Asset Allocation Bi-Weekly – Magnificent 7 to the Rescue! (January 21, 2025)

by the Asset Allocation Committee | PDF

The traditional role of Treasurys as a safe-haven asset has eroded. For example, Treasury prices fell in the last quarter of 2024 despite escalating geopolitical tensions in the Middle East, concerns about global economic growth, and heightened political uncertainty in developed nations. This weakening in the demand for Treasurys was largely driven by investor anxieties over the future rate of inflation and the widening budget deficit. For many market participants, concerns about the outlook for Treasurys have fueled a resurgence of interest in the Magnificent 7 as a target for safe-haven flows.

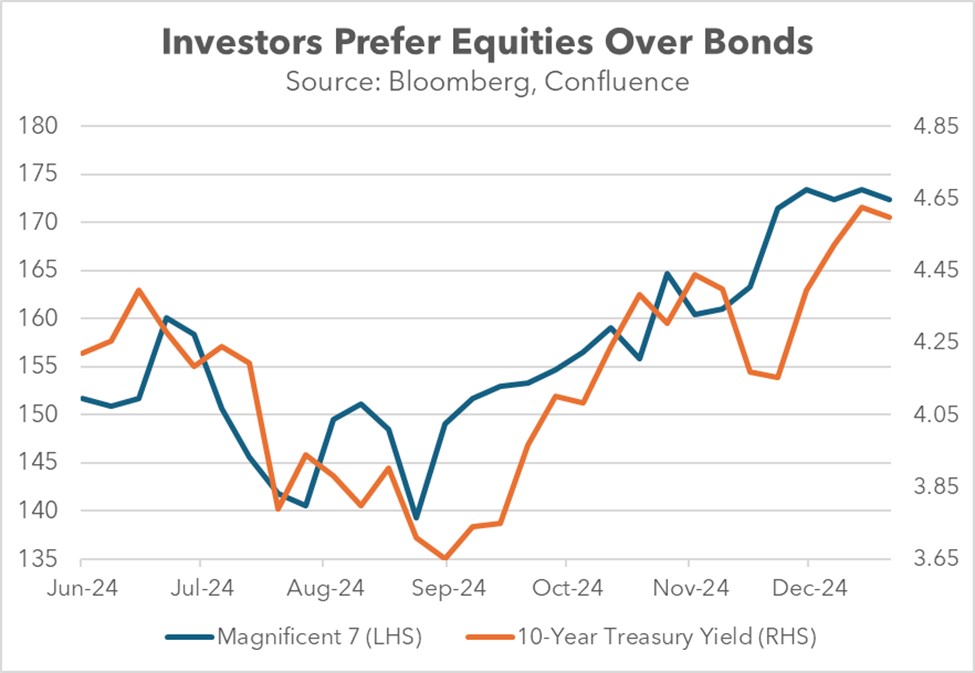

This shift in preference was partly driven by expectations surrounding the incoming administration. Leading up to the election, investors began divesting from US government bonds and purchasing mega-cap tech stocks. This shift reflected growing optimism for a pickup in economic growth and declining confidence in the Federal Reserve’s ability to cut interest rates. Consequently, from September to December, the yield on the 10-year Treasury note surged nearly 100 basis points, while the Magnificent 7 stocks surged almost 24%.

The unraveling began when the Federal Reserve initiated a series of rate cuts last fall. Despite the Fed lowering interest rates by 100 basis points across its final three meetings, the 10-year Treasury yield surged by a comparable amount instead of declining. This divergence stemmed from policymakers’ reluctance to commit to further monetary easing, particularly as the economy showed signs of accelerating. The presence of two dissenting votes during these meetings further reinforced concerns that the central bank may be hesitant to loosen policy.

The Fed’s unwillingness to commit to aggressive rate cuts has led investors to turn to equities. Growing optimism about economic growth propelled the S&P 500 above 6,000 for the first time ever. The change in investor sentiment was further reinforced by growing confidence from the outcome of the November election, which is widely expected to favor policies that will bolster corporate earnings and consumer demand.

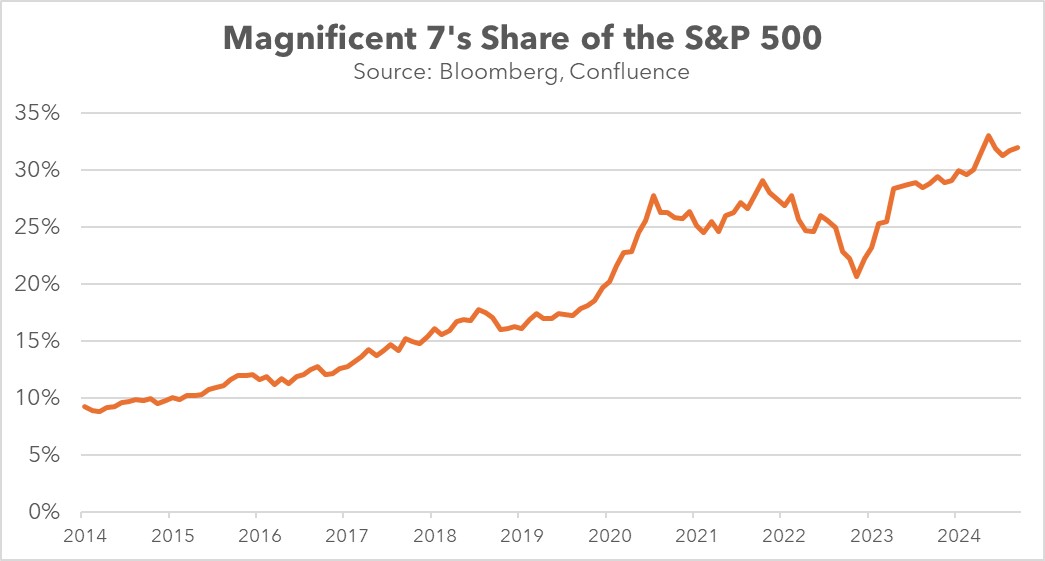

Specifically, investors gravitated toward the Magnificent 7, a cohort of tech giants perceived as capable of generating robust earnings and rewarding shareholders even in a high interest rate environment. This group, which makes up more than a third of the S&P 500’s market capitalization, is projected to significantly outperform the broader index in Q4 earnings, with an estimated 20.7% growth compared to the S&P 500’s overall projected growth of 11.9%.

While stock-price appreciation has been a strong motivator, investor preference for the Magnificent 7 has been further solidified by the companies’ intent to increase shareholder returns. Last year witnessed some notable examples, including Meta and Alphabet issuing their first dividends, Apple executing a massive $110 billion stock buyback, and Nvidia announcing a stock split. The potential for these companies to produce robust earnings growth, coupled with the prospect of lower corporate tax rates, would further enhance their ability to return capital to shareholders.

Looking forward over the coming year and beyond, uncertainty about the future trajectory of interest rates and the fiscal outlook will likely continue to weigh on bond values. Some safe-haven buying may therefore shift to gold and other precious metals, while others could shift to large, stable, dividend-paying value stocks. Still, it wouldn’t be a surprise if many investors favor large cap growth companies because of their strong track record of consistent earnings growth and demonstrated commitment to shareholder returns. However, we think that investors trying to use large cap growth stocks as a safe haven should remember that they are currently very richly valued and could be at risk for correction at some point. Investors should remain mindful of their true risk tolerance before using growth stocks like the Magnificent 7 for safe-haven purposes.