Daily Comment (January 22, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are paying close attention to the new president. In sports, Ichiro Suzuki, CC Sabathia, and Bill Wagner were inducted into the National Baseball Hall of Fame. Today’s Comment covers Trump’s first few days in office, including his threats of higher taxes on foreign nationals, tariffs on US allies, and the White House’s push for AI. We’ll also review key domestic and international data releases and other market-moving developments.

Trump 2.0 Begins: President Trump has offered more details on his plans to deal with the rest of the world. These proposed changes include potential taxes on foreign multinational corporations and new tariffs. The announcements positively impacted the stock market, notably boosting equities of small and mid-cap companies, and also contributing to a rise in long-term bond prices.

- The 47th US president has criticized other nations for imposing so-called “extraterritorial taxes” on American companies. Trump argues that Western countries are unfairly targeting US businesses and has vowed to retaliate by doubling taxes on foreign nationals and companies. He referenced a 90-year-old provision in Section 831 of the US tax code that permits retaliatory taxes on foreign entities.

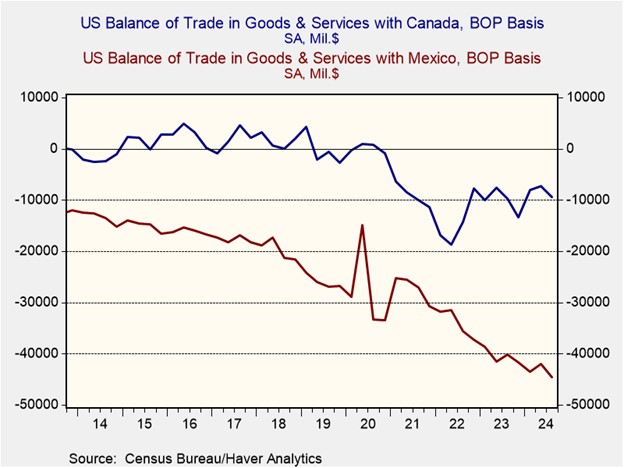

- Regarding tariffs, the president avoided a blanket tax on imports from all nations, instead threatening targeted tariffs specifically against countries involved in the fentanyl trade. He said he would add a 25% tariff to all goods from Mexico and Canada if they don’t take action to stop the flow of illegal immigrants and illicit drugs. Additionally, he also mentioned a modest 10% tariff on Chinese goods for China’s role in the drug trade. This new tariff would start on February 1.

- This shift toward a more assertive stance with US allies likely reflects the president’s efforts to solidify a transition from a benevolent global leader to a more transactional one. Consequently, the US may be less inclined to offer preferential trade terms to its allies and could potentially reassess its security commitments.

- American allies have signaled a willingness to collaborate with the US on certain issues but have also warned of potential pushback. Mexican President Claudia Sheinbaum affirmed her intent to work with the US while emphasizing her commitment to defending Mexico’s sovereignty. Canadian Prime Minister Justin Trudeau stated that Canada would respond decisively to any unfair tariffs.

- The president’s more assertive approach towards US allies may initially have a positive impact on equity and bond yields, provided his rhetoric remains largely posturing and does not provoke significant retaliation. However, in the long term, this isolationist trajectory could negatively impact the US economy. While equities may remain relatively resilient, a prolonged period of increased geopolitical tension and economic decoupling could ultimately trigger a bear market in bonds.

AI Taking Next Steps: The administration’s plans to boost AI infrastructure investment to $500 billion and relax regulations have been met with enthusiasm from the tech industry. However, growing apprehension is evident among other groups concerned about the potential consequences of this rapid advancement.

- On Monday, the president took several actions aimed at accelerating AI development. He signed an executive order that would relax safety and transparency regulations for AI systems. Additionally, he announced a public-private partnership with Softbank, OpenAI, and Oracle Corporation to develop advanced AI technologies. Finally, he signed another executive order authorizing the release of federal land for the construction of data centers.

- Furthermore, the president has expressed a willingness to facilitate increased energy access for these companies to support their growing data center needs. While not explicitly mentioning nuclear power, he indicated an openness to exploring options that allow these firms to generate their own energy solutions.

- NIMBY (not in my backyard) opposition had previously hindered AI development, as several communities have resisted their local governments’ efforts to permit the construction of data centers within their area.

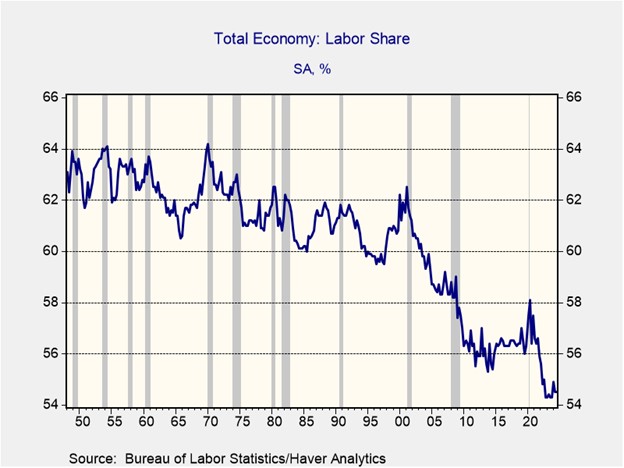

- Additionally, concerns about job displacement due to technological advancements are growing. On Tuesday, Kevin Weil, Chief Product Officer at OpenAI, warned of the imminent arrival of AI agents. These sophisticated AI systems will be capable of performing complex tasks, potentially automating many white-collar jobs.

- While AI is poised to play an increasingly significant role in the economy, its development and deployment are likely to become increasingly politicized in the coming years. Although the president currently appears supportive of the tech industry, we anticipate that the sector is still under threat of higher political scrutiny.

Energy Deregulation Hopes: As anticipated, the president withdrew the United States from the Paris Climate Accords and declared a national energy emergency. This policy shift has fueled optimism among some that increased energy production will lead to lower energy and input costs.

- The president has expressed a desire to increase domestic oil and gas production, aiming to bolster US manufacturing. To this end, he signed an executive order that would ease environmental regulations, facilitating the construction of new energy production facilities and enabling drilling in previously protected areas.

- While the president has prioritized oil and gas production, other sectors also anticipate benefiting from his deregulatory agenda. Rio Tinto, a major copper mining company, has expressed optimism that the administration will approve its plans to expand copper mining operations in Arizona. The company aims to supply 25% of the country’s growing demand for copper.

Panama Canal Takeover: The United States’ desire to reclaim control of the Panama Canal is raising international concerns.

- Earlier today, the Panamanian president dismissed anxieties that the US might attempt a forceful takeover. Additionally, Russia has also publicly stated its interest in ensuring the canal’s continued neutral status.

- The ongoing dispute over the Panama Canal, a vital conduit for global trade, is likely to fuel concerns about potential disruptions to supply chains and an escalation of geopolitical tensions. Therefore, we will be closely monitoring this evolving situation.