Daily Comment (January 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new, market-driving statements by President Trump regarding global energy supplies and US tariff policy. We next review several other international and US developments with the potential to affect the financial markets today, including new signs that Europe is taking steps to protect itself from China’s predatory economic policy and new pressure on the Federal Reserve from Trump to cut US interest rates.

United States-World Economic Forum: Yesterday, in his video speech to the WEF in Davos, Switzerland, President Trump urged Saudi Arabia and the other members of the Organization of the Oil Exporting Countries to boost oil production and bring down prices, claiming the price cuts would reduce consumer price inflation and allow interest rates to fall. He also reiterated his invitation for foreign firms to invest in the US and take advantage of its low tax rates, but he warned that foreign manufacturers would be subject to import tariffs.

- Taken together, Trump’s statements on oil prices, inflation, and import tariffs help confirm that he is looking for lower energy prices to offset some of the inflationary impact of some of his other policies, such as higher tariffs.

- Even if that is Trump’s strategy, however, it’s important to remember that the plan may not work. Given that so many of Trump’s policies run the risk of higher price pressures, any lowering of energy prices may merely slow the resulting price inflation, rather than bringing overall prices down.

United States-China: Despite reiterating his willingness to hike tariffs in his WEF speech, President Trump said in an interview released last night that he would “rather not” have to impose them against China. Coupled with the lack of any specific new tariffs imposed since Trump was inaugurated on Monday, the statement has increased the market’s uncertainty regarding tariff policy, pushing the dollar lower against most major currencies today and giving a boost to some foreign stock markets.

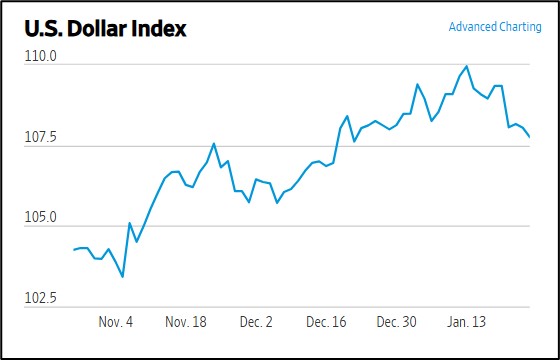

- As of this writing, the US Dollar Index is down approximately 0.3% to 107.71.

- The index is now down 2.1% from mid-January.

European Union-China: Teresa Ribera, executive vice president of the European Commission, has revealed to the Financial Times that Brussels is considering an EU-wide subsidy for consumers to buy electric vehicles. The subsidy would aim to help EU automakers survive the onslaught of super-cheap EV imports from China. If it is ultimately approved and implemented, the subsidy program would be yet another sign of the protectionism and industrial policy being implemented around the world.

Germany-China: Friedrich Merz, chief of the center-right Christian Democratic Union and leading candidate for chancellor in February’s elections, warned that German firms investing in China shouldn’t expect government help if those investments go sour. The warning comes as German manufacturers desperate for growth are increasingly building factories in China, even though China’s predatory industrial policies are essentially aimed at putting them out of business on their home turf.

- The statement by Merz suggests that he would support further economic decoupling from China if he becomes chancellor as expected.

- The statement therefore signals that the potential policies of Europe’s rising right-wing leaders will likely lead to more global fracturing going forward, which we think will tend to boost consumer price inflation and interest rates in the future.

Eurozone: On a panel during the last day of the WEF in Davos, European Central Bank Chief Lagarde said Europeans are too pessimistic and should be more confident about their economic prospects. According to Lagarde, one thing that would help boost the European economy would be to keep more of its highly skilled workers and capital from going abroad. On the same panel, BlackRock CEO Larry Fink said there is not only too much pessimism in Europe, but that it was also probably time to be investing back into the Continent.

- In our view, Lagarde and Fink probably have a point regarding the extreme pessimism that many investors feel toward Europe these days. The Continent retains an enormous amount of wealth, income, human capital, and economic potential. The question is whether the European economy is finally turning the corner to a new round of strong growth, which may be a necessary catalyst for renewed investor optimism.

- In any case, even though Europe continues to face challenges ranging from disrupted energy supplies and high energy prices to a fractured financial system, high regulation, and poor demographics, we think opportunistic investors can still find attractive opportunities in certain sectors and among the Continent’s many well-run, innovative firms with strong world market shares.

Italy: Monte dei Paschi di Siena, widely recognized as the world’s oldest bank, has announced an unsolicited bid worth nearly $14 billion for fellow Italian lender Mediobanca. The combined firms would make up Italy’s third-largest bank by assets. Along with recent takeover bids by Italian lender UniCredit, the proposed takeover has once again raised investor hopes for a consolidation of the fractured banking system in Italy, and in the broader European Union.

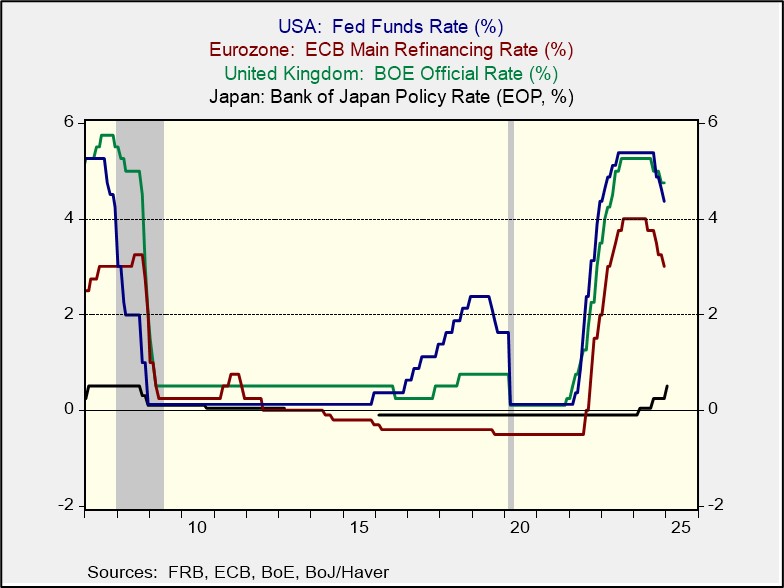

Japan: The Bank of Japan today hiked its benchmark short-term interest rate to 0.50%, boosting it from 0.25% previously and marking the third rate hike in less than a year. In a post-decision press conference, BOJ Governor Ueda said his policymakers had become more confident that a rate hike would help them keep consumer price inflation to their target of 2.0% over the medium term, while they saw no unexpected developments from the new Trump administration that would make them change their tightening course.

- Despite the rate hike and the dollar’s pullback against many other currencies so far today, the yen (JPY) has weakened about 0.2% to 156.32 per dollar ($0.0064).

- Even though the BOJ’s recent hikes have helped close the rate gap with other central banks, the yen today remains near its weakest level since 1990.

US Monetary Policy: With the Fed widely expected to hold its benchmark interest rate at a relatively high 4.25% to 4.50% next week, President Trump yesterday claimed he understands interest rates “much better” than the central bankers and would pressure them to cut interest rates “a lot.” The statement confirms that Trump is ready to strongarm Fed Chair Powell into cutting rates and trample on the Fed’s traditional independence, even if the policymakers think Trump’s policies will push up consumer price inflation.

- Trump’s rhetoric illustrates why many investors have been wary of the increasingly powerful right-wing populist politicians in the US and Europe.

- Some investors worry that right-wing populist politicians will cut taxes and hike outlays on workers, expanding national budget deficits. However, they are also concerned that these politicians will push for excessively loose monetary policy, which will raise the risk of resurgent inflation.

US Fires: Even as firefighters were finally making progress on the major blazes elsewhere in Los Angeles County, new fires have broken out in the northern part of the jurisdiction and are now being fanned by strong winds. The Hughes fire near Santa Clarita has exploded to almost 10,400 acres, sparking thousands more evacuation orders. The new Sepulveda fire has broken out just two miles from the perimeter of the Palisades fire that has already destroyed some 23,000 acres and thousands of structures.