Daily Comment (February 3, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with President Trump’s decision over the weekend to impose big, new import tariffs against Canada, Mexico, and China. The move is dominating the financial media this morning, as it has the potential to spark a long, painful trade war and leave the US isolated from its traditional allies. We next review several other international and US developments with the potential to affect the financial markets today, including new revelations on the biased answers that can be generated by China’s DeepSeek artificial-intelligence platform and news that Elon Musk has gained access to the US Treasury Department’s sensitive payments platform.

United States-Canada-Mexico-China: The Trump administration on Saturday imposed 25% import tariffs on most goods from Canada and Mexico, 10% tariffs on Canadian energy imports, and additional 10% tariffs on all imports from China, effective Tuesday. For legal basis, the White House cited emergency economic authority based on fentanyl trafficking from the countries. The administration said the tariffs will have no exemptions and will be in place until officials are satisfied that illicit fentanyl trafficking across the US border has ceased.

- The new tariffs on Canada, Mexico, and China would affect imports with a total value of about $1.3 trillion in 2023, making them much more significant than the tariffs against China in Trump’s first term. Those tariffs applied to about $360 billion of Chinese imports at the time.

- President Trump indicated on Friday that any tariffs against Canada, Mexico, and China would only be the first of many. He vowed to also slap broad tariffs on semiconductors, pharmaceuticals, steel, aluminum, copper, oil and gas imports as soon as mid-February.

- Beijing said it would file a WTO action against the tariffs and take retaliatory measures. Canadian Prime Minister Trudeau called the new US tariffs a “betrayal” and imposed 25% tariffs on $107 billion of US-made products going to Canada, the first phase of which will affect products including motorcycles, cosmetics, wine, and orange juice.

- In addition, the imposition of the tariffs will now likely accelerate efforts to get around them. For example, Chinese electric-vehicle battery maker CNGR Advanced Material last week opened a new battery materials plant in Morrocco to take advantage of that country’s free-trade agreements with the European Union and the US.

- Even though the members of the United Steelworkers broadly supported President Trump in his 2024 election campaign, the union criticized the new tariffs as overly broad. However, the union’s opposition was not enough to derail the tariffs.

- For US consumers, the big tariff hikes could well result in higher prices for automobiles, electronics, winter produce, and many other products in the coming weeks and months.

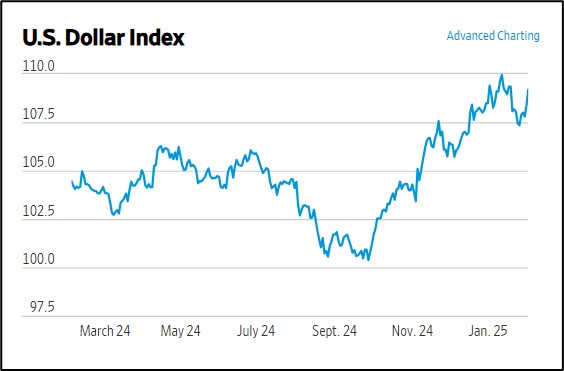

- Finally, the tariffs have rippled through all major markets today, sending US stock futures down, upending many foreign stocks, and especially weighing on global auto makers. The dollar has also appreciated, with the US Dollar Index currently at 109.19, up 0.8% on the day. The VIX has also spiked above 20, and cryptocurrency prices have fallen sharply.

US-China Artificial Intelligence: As investors continue to digest last week’s news that Chinese firm DeepSeek has built a cheap, powerful AI model, a study by a disinformation watchdog has found that DeepSeek’s model often spouts the Chinese Communist Party’s line when queried about international controversies. The slanted results appear when the model is accessed from China-based servers. Other reports say US firms such as Nvidia, Microsoft, and Amazon are supporting uncensored versions of the DeepSeek model for customers outside of China.

- While it’s tempting to think that DeepSeek’s censored output would be a liability, that may not necessarily be the case. Other Chinese tech products, such as Huawei telecom equipment and the TikTok social media app, also present surveillance or propaganda risks, but many Westerners still covet them because of their low cost and ease of use.

- The decision by Nvidia, Microsoft, and other US firms to support the DeepSeek model likely reflects their realization that its low cost and ease of use stand to greatly expand the use of AI, boosting demand for their products.

- A key question going forward is whether Western governments will eventually try to restrict or ban the use of Chinese models on national security concerns.

Japan-China: Following on US efforts to curb Chinese access to advanced technologies, Japan is reportedly preparing to tighten its export controls on advanced semiconductors, chipmaking equipment, and quantum-computing technology. It is also preparing to put dozens more Chinese firms on its “entity list,” which names companies restricted from receiving certain Japanese exports that have both civilian and military uses.

- In some respects, Japanese Prime Minister Ishiba in recent months has seemed eager for warmer ties with China, sparking worries about the strength of the US-Japanese security alliance. The tougher curbs on Japanese exports to China could help ease those concerns.

- Of course, the flip side is that Beijing will certainly be perturbed by the new Japanese rules. The move therefore could worsen Japan-China relations again and potentially prompt China to impose retaliatory trade barriers against Japan.

China-Philippines: Late last week, Manila arrested five more Chinese nationals on suspicion of spying, after arresting the group’s apparent ringleader in mid-January. Among other activities, the spies had allegedly set up cameras and other surveillance equipment to monitor Philippine coast guard ships en route to resupply marines on the Second Thomas Shoal, a disputed outcrop in the South China Sea. The shoal is claimed by both Beijing and Manila.

- The spies’ activities help explain how the Chinese navy and coast guard have been so successful in intercepting Philippine vessels trying to resupply the marines and assert Manila’s territorial claims in the South China Sea.

- More broadly, the arrests suggest that the Philippines has become a hotbed of espionage activity as China tries to take control of Philippine territory and the US deploys more military assets to the region.

Germany: Friedrich Merz, the center-right Christian Democratic Union’s (CDU) candidate for chancellor in this month’s election and the current leader in opinion polls, suffered a humiliating defeat in parliament for his tough anti-immigration bill on Friday, as his controversial reliance on the far-right Alternative for Germany (AfD) party for an earlier procedural vote backfired spectacularly.

- It’s now clear that Merz’s flirtation with the AfD has irritated many legislators and citizens from the center-left to the center-right.

- Even if Merz remains the frontrunner and wins the election, there is now an increased chance that he may turn to the AfD to form a government. That would give the far-right its strongest position in German politics since World War II.

United States-Denmark-Greenland: After a poll last week showed that 85% of Greenland’s residents reject President Trump’s plan for the US to take over the autonomous Danish island, a new poll shows 78% of Danish citizens also oppose selling to the US. The new poll also found that 46% of Danes now see the US as a “very big threat” or “fairly big threat” to Denmark, exceeding the share who say the same about Iran or North Korea.

- If foreign citizens increasingly see the US as a threatening country, foreign political leaders may come under pressure to reduce their cooperation or support for Washington.

- As we discussed in our Bi-Weekly Geopolitical Report from January 27, such a development could potentially undermine the US alliance structure and weaken the country’s security position against China, Russia, Iran, and North Korea.

United States-Panama: Secretary of State Rubio visited Panama over the weekend to talk with Panamanian President José Raúl Mulino about US concerns over Chinese involvement with the Panama Canal. Mulino reportedly offered several concessions, such as ending a 2017 deal for Chinese infrastructure funding, but he insisted Panama would not return the facility to the US. In response, President Trump reiterated that if Panama does not return the canal, “something very powerful is going to happen.”

US Politics: The Democratic National Committee has selected Ken Martin to be its new party chairman, charged with making the party competitive again after its broad losses in the 2024 election. Martin is the long-time chair of Minnesota’s Democratic-Farmer-Labor Party and has said he wants to push the party back toward a focus on helping working class voters.

US Fiscal Policy: Despite resistance from career employees, Treasury Secretary Bessent on Friday gave associates of Elon Musk and the so-called Department of Government Efficiency access to the Treasury Department’s electronic payments system, which handles most federal payments to individuals, businesses, educational and medical agencies, and states. The move is quickly becoming controversial because it could theoretically allow Musk and his team to stop federal spending even if it has been appropriated by Congress.

- Allowing Musk’s team into the payments system will also likely rekindle concerns that he and many of his Silicon Valley recruits to the DOGE have conflicts of interest.

- For example, companies that serve as contractors for the federal government and compete against Musk’s businesses could theoretically see their payments shut off. The payment system also carries a lot of sensitive information on companies and individuals, which helps explain why access to it has been closely restricted until now.