Daily Comment (February 4, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest on President Trump’s tariff program, including a one-month delay in the tariffs against Canada and Mexico, while China has launched a series of its own tariffs, export curbs, and other measures against the US. We next review several other international and US developments with the potential to affect the financial markets today, including a plan by the European Union to begin enforcing its new artificial-intelligence regulations and a Trump executive order to set up a US sovereign wealth fund.

US Tariff Policy: Yesterday, President Trump said he had extracted sufficient concessions from the leaders of Canada and Mexico on illegal immigration and drug trafficking that he would postpone his big import tariffs on the countries until early March. For example, Canadian Prime Minister Trudeau and Mexican President Sheinbaum both agreed to deploy about 10,000 troops to their US borders to clamp down on fentanyl trafficking. In contrast, China retaliated today with a series of tariffs on US products and export curbs on some Chinese goods.

- In reality, the Canadian and Mexican concessions are less than meets the eye. For example, Mexico has previously surged troops to the border to meet US concerns, and almost no fentanyl enters the US from Canada.

- Canadian and Mexican officials have also complained that different high-ranking officials in the Trump administration have given them different stories on what Trump is aiming for with his trade policies. The statements suggest Trump is making the decisions largely on his own, perhaps more tactically than strategically. That underscores how US trade policy in the new administration will remain unpredictable and volatile.

- In any case, we continue to believe that Trump’s aggressive, bullying tactics may well yield progress on issues such as illegal immigration, drug trafficking, economic resiliency, and the US balance of trade, but at the risk of unnecessarily alienating important US allies and undermining economic efficiency. Based on China’s greater economic heft and strong rivalry with the US, there is also a possibility that it will be harder for Washington and Beijing to reach a lasting deal.

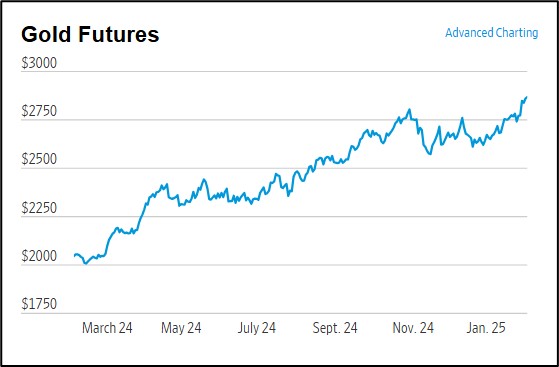

- In terms of market responses, we note that global equity prices have held up relatively well to the tariff kerfuffle, suggesting that stock investors expect the tariffs to be minimized, temporary, or otherwise not overly economically damaging. However, investors have also bid gold prices up to record levels, suggesting more substantial concerns. So far today, near gold futures are pricing at $2,866.50/oz, up 0.3% from yesterday and up more than 40% from one year ago.

(Source: The Wall Street Journal)

(Source: The Wall Street Journal)

European Union-United States: The European Commission today will release its implementing rules for the EU’s 2023 Artificial Intelligence Act. The Commission plans to release the regulations despite President Trump’s threat of retaliation for any moves that affect US technology firms, which have become a key part of his governing coalition. The new rules are the world’s most comprehensive set of AI regulations, affecting activities such as model development and data privacy.

United Kingdom: For the first time, a YouGov opinion poll shows the right-wing populist Reform Party with more public support than either the governing Labour Party or the Conservative Party. The poll puts support for Reform at 25%, versus 24% for Labour (within the poll’s margin of error) and 21% for the Conservatives. The data illustrates how European politics continue to move toward the right, potentially setting the stage for more tax cuts, deregulation, curbs on immigration, and isolationist foreign policies.

United States-Ukraine: President Trump yesterday said he was looking for a deal under which Ukraine would provide the US with rare-earth mineral resources in return for continued military aid. According to Trump, the Ukrainian government is open to the deal. Nevertheless, it isn’t clear whether Kyiv can keep fighting off the Russian invasion force until such a deal is in place. New reports suggest the Ukrainian military could be starting to buckle because of the recent slowdown in Western support and its own manpower shortfalls.

US Rule of Law: In recent days, Secretary of State Rubio has said President Trump named him as acting director of the US Agency for International Development, which by statute is set up to administer foreign aid programs to build goodwill toward the US. Trump, Elon Musk, and Rubio then largely shuttered the agency. Similarly, Trump named Treasury Secretary Bessent as acting chief of the Consumer Financial Protection Bureau, after which Bessent essentially ordered a freeze on the agency’s activities.

- The Trump administration’s moves with USAID and the CFPB aim to cut what the president sees as wasteful spending and excessive regulation.

- Nevertheless, both agencies are overseen by Congress, so the moves by Trump could well set up a constitutional crisis. If the judicial system allows Trump’s moves to stand, Congress could conceivably be neutered, and the president could be left with relatively unfettered power to implement whatever policies he wants.

- Shutting down or severely reducing USAID’s foreign aid programs also presents an opening for China and the key member of its geopolitical bloc to step into the breach and replace the US’s funding. Doing so would allow Beijing to capture the goodwill previously earned by the US and further enhance Chinese diplomatic power.

US Sovereign Wealth Fund: President Trump yesterday signed an executive order for the US to create a sovereign wealth fund to facilitate public investments in long-term assets. The fund, which would presumably require Congressional approval and appropriations, is to be up and running within one year. Although Trump didn’t provide specifics on his goal for the fund, he did suggest that it could be of use in taking over the US operations of Chinese social media app TikTok.

- Countries ranging from Norway to Saudi Arabia have sovereign wealth funds, some of which are enormous.

- Today’s sovereign wealth funds not only operate in arms-length asset purchases, but they are sometimes used to provide strategic, long-term capital to favored sectors or companies. Therefore, the risk is that a US fund could be deployed for uneconomic projects or to support politically favored firms.