Daily Comment (February 5, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Investors will be closely watching tech earnings reports today. In sports, Atlético Madrid secured a resounding victory over Getafe and advanced to the Copa del Rey semi-finals. Today’s comment will analyze the president’s Gaza plan, explore why weakening labor demand keeps rate-cut hopes alive, and cover other key market developments. The report will also include a summary of domestic and international data releases.

Gaza Take Over? President Trump has suggested that Palestinians should be resettled in other Middle Eastern countries. This proposal represents a significant departure from longstanding US support for a two-state solution to the Israeli-Palestinian conflict. His remarks risk escalating tensions throughout the Arab world and further complicating regional diplomacy.

- His plan proposes that the US would assume full control of Gaza as it is being rebuilt following the extensive damage resulting from Israel’s response to the Hamas attack of October 7. Additionally, the more than 2.2 million Palestinians living in the region would be relocated to other countries, notably Egypt and Jordan, in exchange for US aid.

- The feasibility of this plan remains unclear, given the lack of precedent. However, the proposal reflects the president’s apparent interest in expanding US influence. In recent weeks, he has also expressed interest in acquiring Greenland and parts of Canada, as well as reasserting US control over the Panama Canal. These overtures have been met with resistance, but the president appears undeterred.

- Middle Eastern countries have largely rejected his proposal, drawing comparisons to the 1948 Nakba, or “catastrophe,” when hundreds of thousands of Palestinians were displaced following the establishment of Israel. Although President Trump had claimed to have secured agreements with Egypt and Jordan, Egypt has publicly denied supporting the plan. Meanwhile, Jordan’s King Abdullah is expected to meet with US officials in Washington to discuss the matter further.

- The president’s emphasis on territorial expansion arguably reflects an ambition to establish the United States as a dominant force. This approach finds historical precedent in the policies of President William McKinley, whose expansionist agenda was similarly motivated by a desire to enhance international standing and strengthen the domestic economy.

- The primary distinction between Trump and McKinley lies in their approach to international influence. While McKinley favored military intervention to achieve his objectives, Trump is more likely to rely on diplomatic pressure, including strategic use of US aid and tariffs. This method is anticipated to be less destabilizing and, over time, could be advantageous for American companies.

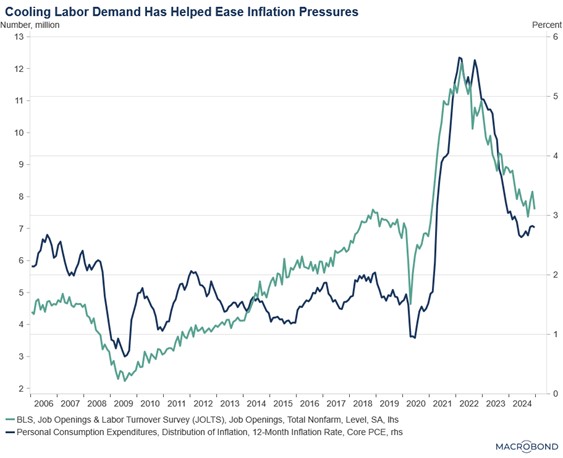

Job Openings Drop: The number of job openings fell to a three-month low in December, which is a sign that firms are starting to slow hiring. US job listings fell to 7.6 million from a revised 8.2 million in November. US Treasurys rallied following the report as it likely leaves the door open for a rate cut this year.

- Despite the drop in the number of available jobs, several other indicators within the JOLTS report remained relatively unchanged. The hiring rate held steady at 3.4%, the lowest in over a decade, while the layoff rate remained at 1.1%, consistent with its long-term norm. The quits rate also remained unchanged at 2.0%, slightly below its pre-pandemic rate. Additionally, the ratio of openings to employment, which is closely watched by the Fed, was unchanged at 1.1, down from its peak of 2.

- The weak jobs report likely reinforces the Fed’s view that it should hold policy steady for now, as data suggests a relatively balanced outlook for inflation and unemployment. This tame inflation and employment data has prompted several Fed officials to signal that the central bank is in no rush to cut rates.

- The Fed’s hesitancy also stems from a desire to assess the impact of previous rate cuts and potential policy changes. Atlanta Fed President Raphael Bostic noted on Tuesday that he wants to see the effects of last year’s 100 basis-point reduction. Concerns about a labor shortage due to immigration restrictions and potential tariffs have also led several Fed officials to raise the possibility of renewed inflation.

- Cooling labor markets had been a key driver of disinflation in 2024. For the Federal Reserve to continue its easing cycle, this trend likely needs to persist. The next few jobs reports will be crucial in determining the policy path for the remainder of the year. Currently, given prevailing economic conditions, we anticipate the Fed will cut rates by a maximum of 50 basis points this year.

Maximum Pressure: During his meeting with Israeli Prime Minister Benjamin Netanyahu, President Trump signed a memorandum directing the US government to use its resources to pressure Iran back to the negotiating table for nuclear talks. The potential for the loss of Iranian oil supply caused a temporary spike in crude oil prices.

- This memorandum comes as the United States pursues a strategy of using sanctions to compel Iran to abandon its nuclear weapons program. Although details regarding the mechanisms for future discussions have not been released, the US has indicated its intention to block the export of Iranian crude oil, a tactic previously employed against Russia.

- Iran’s willingness to engage in discussions for sanctions relief contrasts with its recent displays of military strength. These include the unveiling of a new ballistic missile with the range to reach Israel, as well as large-scale military exercises and the showcasing of underground military installations.

- Heightened tensions between the US and Iran continue to pose a substantial risk to commodity markets. Reports of an alleged Iranian assassination plot against the US president, which Iran has denied, have further exacerbated these tensions. Therefore, we will be monitoring conversations between the two sides closely.

Government Shutdown Looming? Congress is preparing for budget negotiations to avert a government shutdown in mid-March. The primary obstacles are disagreements over spending freezes and the extent of potential cuts.

- Citing a lack of transparency from the new administration, Democrats have been hesitant to engage with their counterparts. Democrats point to developments such as Elon Musk’s access to Treasury data related to the Department of Government Efficiency and the proposed termination of funding for programs benefiting USAID and Lutheran Social Services as examples of this lack of clarity.

- The budget impasse has led Republicans to pivot away from Trump’s wish for a single “big, beautiful bill,” in favor of a two-part strategy. While tax cuts remain a priority, the party recognizes the challenges involved and, due to the December 31 deadline to extend the tax cuts, is proceeding deliberately.