Daily Comment (February 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely watching the latest developments from the Trump administration. In sports news, the Golden State Warriors made headlines by acquiring Miami Heat guard Jimmy Butler in a major trade. Today’s commentary will focus on the Trump administration’s shift toward targeting longer-term interest rates, Canada’s planned response to new US tariffs, and other market-moving headlines. As always, we’ll also provide a roundup of key domestic and international data releases.

Ten-Year Yield Rates Take Center Stage: US Treasury Secretary Scott Bessent reaffirmed his support for the Federal Reserve’s independence on Wednesday, stating that the current administration has no intention of interfering with Fed policy. Instead, the Treasury plans to leverage its issuance strategy to target long-term interest rates, which play a more direct role in shaping borrowing costs for American households.

- His announcement comes amid growing concerns from several Federal Reserve officials about the potential inflationary impact of tariffs. Chicago Fed President Austan Goolsbee recently added his voice to the debate, cautioning that the risks to supply chains from trade policy should not be overlooked. His hesitation is particularly noteworthy given his past support for the Fed’s easing measures, signaling a shift in perspective as policymakers weigh the broader economic implications of trade restrictions.

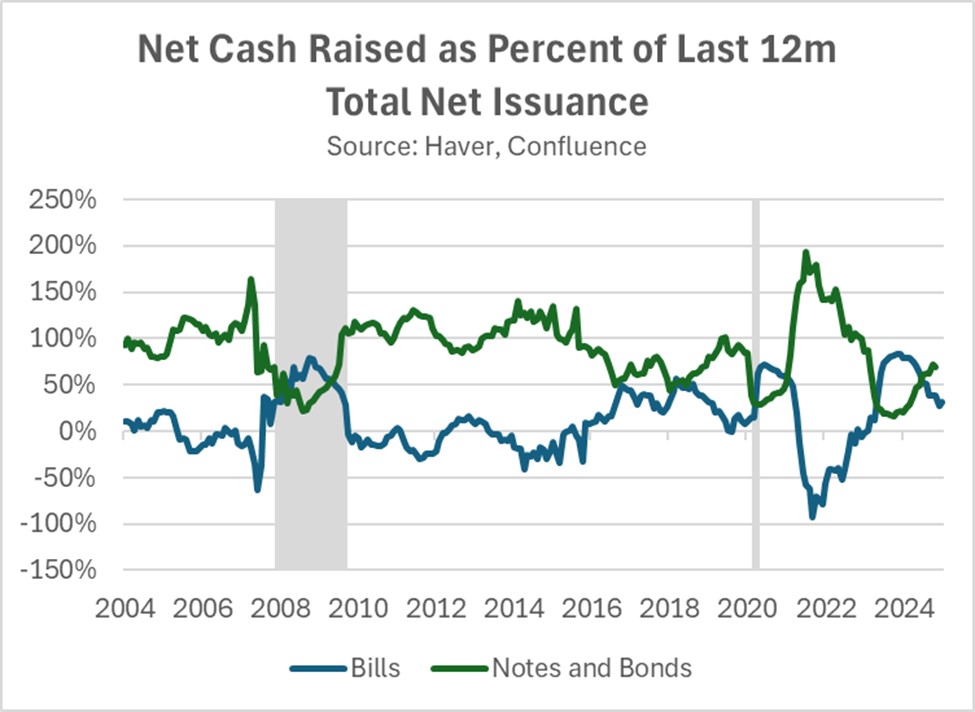

- Prior to Secretary Bessent’s remarks, the Treasury Department unveiled its quarterly refunding plans, revealing that it would maintain the debt management strategy established by its predecessor, Janet Yellen. The Treasury confirmed it will continue shifting issuance away from longer-term securities, a move expected to alleviate upward pressure on 10- and 30-year Treasury yields.

- Over the next three months, the Treasury plans to utilize Treasury bills to manage fluctuations in its borrowing needs. This decision marks a notable shift for Secretary Scott Bessent, who had previously criticized the strategy, warning that it could undermine the Federal Reserve’s efforts to curb inflation.

- Additionally, the Treasury’s forward guidance indicated that borrowing needs would keep auction sizes unchanged for at least the next several quarters. However, this decision has been met with some skepticism, as the Treasury Borrowing Advisory Committee — a group of external advisors including dealers, fund managers, and other market participants — has warned that auction sizes may need to adjust depending on the trajectory of monetary and fiscal policy, and the broader economic outlook.

- With the Treasury now prioritizing the reduction of long-term interest rates, this shift is likely to be bullish not only for fixed-income securities but also for equities, particularly small-cap stocks. Lower long-term rates typically reduce borrowing costs and support higher valuations across asset classes. However, this move also underscores the need for the Treasury to maintain a focus on cost reduction to ensure it can sustainably fund future spending initiatives.

Canada Fights Back? Canadian sentiment toward the US has soured following the imposition of tariffs on Canadian exports and controversial remarks suggesting Canada could become the 51st state. This shift in relations has prompted many Canadians to push for a stronger response from their government.

- Nearly 82% of Canadians support implementing an export tax on oil if the US follows through with its threat to impose tariffs. This measure has gained traction as Canadian lawmakers aim to pressure the US by increasing energy costs for American consumers and businesses. Other goods being considered for export taxes include uranium and potash.

- The threat arises as the US president has opted to exclude oil from the tariffs he plans to impose on Canadian goods. It’s important to note that a tariff is essentially an import tax, typically paid by the consumer, though in some cases, the cost may be shared with the supplier. Conversely, an export tariff is paid by the supplier to ship goods abroad, though this cost can also be passed on to the consumer under certain circumstances.

- The key difference between export and import tariffs lies in their impact on supply and sales. Import tariffs, or taxes, are intended to make foreign goods more expensive compared to their American counterparts, thereby reducing their sales. This, in turn, typically leads to higher prices for consumers. On the other hand, export tariffs discourage the sale of domestic goods abroad, increase domestic supply and, as a result, lower prices.

- Export taxes on Canadian goods could provide a modest boost to Canada’s economy but are unlikely to prevent a recession. Conversely, reduced US imports of oil may lead to some price increases domestically, but the effect should be minimal and would not disrupt the overall economic outlook.

End of Ukraine War? The Trump administration is set to unveil its long-awaited plan to resolve the Ukraine war next week at the Munich Security Conference. The announcement will coincide with the three-year anniversary of the conflict’s onset. The plan is expected to facilitate increased access to Russian energy in global markets.

- While specific details of the proposal have not been revealed, it is expected to include a freeze on the conflict, potentially allowing Russian forces to remain in occupied territories. The plan may also provide Ukraine with security guarantees against future Russian aggression, alongside provisions for new elections following a ceasefire.

- That said, there still appears to be room for negotiation between Russia and Ukraine. Moscow believes it holds enough territorial leverage to extract concessions from Kyiv, while Kyiv views its control over parts of the Kursk region as a potential bargaining chip.

- One consistent pattern we’ve observed with this administration is its reluctance to make deals without securing benefits for the United States. President Trump has expressed interest in gaining access to Ukraine’s rare earth minerals and has hinted at ensuring that Europe maintains its energy ties with the US. Consequently, any potential sanctions relief for Russia is likely to come with significant conditions attached.

Bank of England Lowers Rate: The UK central bank lowered its benchmark interest rate for the first time this year, reducing it from 4.75% to 4.50%, amid growing concerns about the economy’s weakening strength. While the decision was widely anticipated, the downgrade in the economic outlook has dampened sentiment toward the British pound (GBP).

- While the Monetary Policy Committee unanimously agreed on the need for a rate cut, two members dissented, pushing for a larger decrease. Interestingly, even Catherine Mann, typically a policy hawk, advocated for a 50 basis point reduction, which would have brought the rate down to 4.25%.

- The committee signaled its openness to further rate cuts to stave off a recession. Despite a recent uptick in inflation, they anticipate it will be transitory. This apparent disregard for rising prices suggests a shift in the central bank’s priority from price stability to economic stabilization.