Daily Comment (February 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are reacting to the latest inflation figures this morning. On the sports front, Real Madrid narrowly defeated Manchester City in the first leg of their highly anticipated playoff series. Today’s Comment will cover the increasing influence of AI, Fed Chairman Powell’s testimony before Congress, and other key market developments. We’ll also provide our regular roundup of the latest international and domestic economic data releases.

US AI vs Everyone Else: Vice President JD Vance declined to sign a declaration aimed at ensuring AI remains “safe, secure, and trustworthy.” Instead, he asserted that the United States is committed to leading AI development and governance, and aims to set global standards and rules. While acknowledging the importance of international collaboration, Vance emphasized the US’s ambition to become the global hub for AI manufacturing and innovation.

- Vance’s emphasis on the US taking the lead in shaping AI rules seems to be a deliberate response to the EU’s Digital Markets Act and Digital Services Act, which aim to create a more balanced competitive landscape between EU and US tech companies. The administration has made it clear that it will aggressively oppose any measures perceived as discriminatory against US firms operating abroad.

- Furthermore, his remarks suggest that the EU should take a subordinate role to the US in the global technology landscape — a stance that risks deepening tensions and complicating transatlantic cooperation. This approach appears to directly conflict with the EU’s ambitions to cultivate and strengthen its own domestic tech industry.

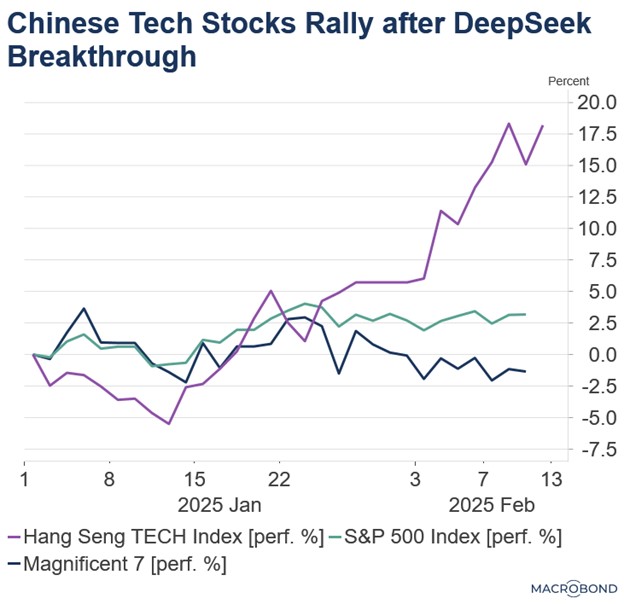

- Vance’s message comes at a pivotal moment as China continues to demonstrate its rising competitiveness in the AI sector. The recent breakthrough by DeepSeek, reportedly achieved with just $6 million and less sophisticated chips, has sent shockwaves through financial markets. This has prompted investors to increasingly turn their attention to Chinese tech companies, while casting doubt on the ability of their US counterparts to meet lofty valuations.

- Since the release of DeepSeek, Chinese stocks have surged, as investors view the breakthrough as a catalyst for revitalizing the sector and injecting new energy into the country’s equity markets. While the Magnificent 7 stocks are trading below their year-start levels, the Hang Seng TECH Index, which tracks leading Chinese tech companies, has climbed nearly 20% year-to-date, underscoring the shifting momentum in global markets.

- The recent rally in Chinese tech stocks faces significant headwinds. China’s economic challenges, often summarized as the five Ds — weak consumer demand, excess capacity and high debt, unfavorable demographics, economic disincentives stemming from Communist Party market interventions, and Western decoupling — pose substantial risks.

- Moreover, the US’s ability to sustain its relationship with Western allies will likely play a pivotal role in preserving its dominance in the tech sector as it looks to counter China. However, it is increasingly evident that the EU and the US could emerge as competitors in this space in the near future, potentially reshaping the dynamics of global technological leadership.

Powell Goes to Washington: Fed Chair Jerome Powell held the first of his two meetings with Congress on Wednesday. Markets showed little reaction to his testimony, as he provided no new insights into the future path of monetary policy. However, the hearing underscored the growing tension between the two parties as they continued to clash over the Department of Government Efficiency (DOGE) and how to address the budget.

- On monetary policy, Fed Chair Powell largely echoed the sentiment of his fellow colleagues stating the Fed is in no rush to cut interest rates but warned that the neutral rate was likely meaningfully higher than it was prior to the pandemic. When pushed to give his thoughts on the inflationary impact of tariffs, he resisted, and only stated that a rise in inflation was a possible outcome of new trade restrictions.

- Fiscal policy was also a key topic of discussion. Fed Chair Powell urged lawmakers to rein in spending, emphasizing that current levels are on an unsustainable trajectory. Additionally, he addressed Elon Musk’s recent cost-cutting efforts at DOGE, noting that the Treasury system remains secure from any breaches and clarifying that the group has no access to its systems. Furthermore, Powell suggested that the Fed may not require staff reductions but rather hires to effectively fulfill its responsibilities.

- Investors have driven up 10-year yields in recent weeks as they react to the ongoing debate over fiscal and monetary policy. The market is increasingly pricing in the risks of higher debt and inflation, which could limit the Federal Reserve’s policy options down the road. A continued rise in the yield is likely to raise borrowing costs for households and firms as well as be a source of headwinds for equities.

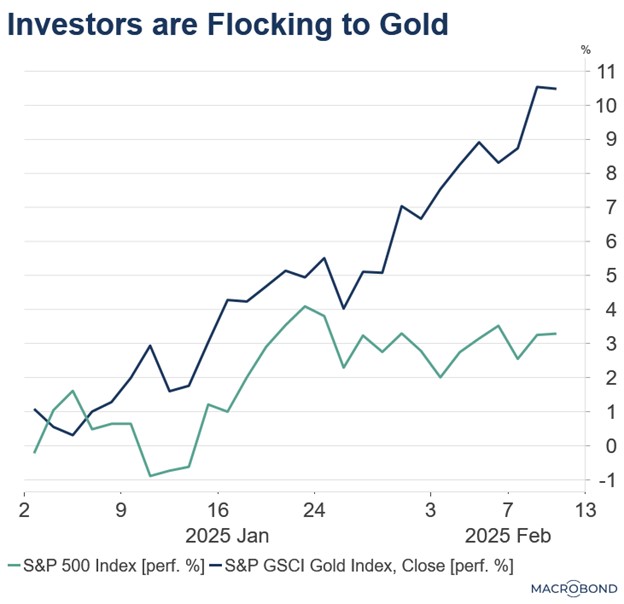

- Precious metals may offer a hedge against current economic uncertainty. Gold has seen a strong start to the year, rising 11.0% year-to-date and outpacing the S&P 500’s 3.0% gain over the same period. This preference for gold comes as investors and institutions become skeptical of the dollar’s use as a reserve asset. This trend could be further fueled by escalating trade tensions, which could weaken the dollar’s position as a reserve currency.

UK Growth Concerns: British Chancellor Rachel Reeves is facing mounting pressure after a watchdog downgraded its UK GDP growth forecast. Reeves had previously cited strong economic growth as a key rationale for avoiding harsh budget cuts, but the revised outlook has cast doubt on that justification.

- Reeves is scheduled to deliver her update on the budget on March 26. If growth does not meet the fiscal rules, she will be forced to make spending cuts to public services or welfare in order to balance the books.

- Thursday’s monthly UK GDP report is expected to offer valuable insights into the trajectory of the economy. If the data reveals strong growth in December, we anticipate a rally in UK bonds and equities, reflecting renewed investor confidence.

Ukraine War Update: While details of the negotiations between the US, Russia, and Ukraine to end the war remain undisclosed, it is evident that discussions are ongoing. In a recent development, a wrongfully detained teacher has been released from Russia, marking a potentially significant step amid the broader diplomatic efforts.

- Russia has intensified its attacks on Kyiv even as negotiations continue, signaling a dual strategy of military pressure and diplomacy. However, signs of economic fragility are emerging, particularly as borrowing costs rise and financial strain deepens. Meanwhile, Ukraine remains steadfast in the holding of its occupied territories, aiming to leverage them for potential negotiation swaps in the ongoing conflict.

- The likelihood of a ceasefire in the conflict has grown, but its impact on markets will largely hinge on whether Russia receives sanctions relief. This remains an open question, particularly given the Trump administration’s focus on bolstering US energy companies, which could complicate any decision to ease economic pressure on Moscow.