Daily Comment (February 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is processing the latest developments in Ukraine. In sports news, Canada was able to defeat Sweden in the NHL 4 Nations Face-Off. Today’s Comment will take a deeper dive into the CPI report, discuss the latest developments in the Ukraine-Russia talks, and provide updates on US congressional budget talks as well as other market news. As usual, it will include a roundup of international and domestic data releases.

CPI Fails First Test: The January CPI report surprised markets with a stronger-than-expected acceleration. Headline inflation rose to 3.0% from 2.9% year-over-year, and core inflation edged up to 3.3% from 3.2%. This higher reading led traders to scale back their forecasts for rate cuts this year from two to one and drove the 10-year Treasury yield upward.

- The good news is that despite the rise in the inflation report many of the sharp increases appear to be temporary. For instance, financial insurance was one of the primary drivers of inflation, and the increase is likely tied to the adjustment of premiums for the costs associated with the natural disasters that occurred toward the end of the year. Additionally, owners’ equivalent rent and rent for primary residences, which are heavily weighted in the index, remained relatively subdued.

- The bad news is that the disinflationary pressure from new and used car prices, which had been a significant drag on the index, seems to be fading. This could mean that services, lately a persistent source of inflationary stickiness, will need to bear a greater burden in reducing overall inflation. Moreover, this development raises the risk of a resurgence in goods inflation, particularly if tariffs are implemented.

- The ugly news is that the window for making substantial progress toward the Fed’s 2% inflation target is narrowing. As highlighted in earlier reports, the first few months of the year typically offer the best opportunity for the Fed to make meaningful strides in lowering inflation. This is because the high readings from early 2024 are more likely to be replaced by figures that align with the long-run average as the year progresses.

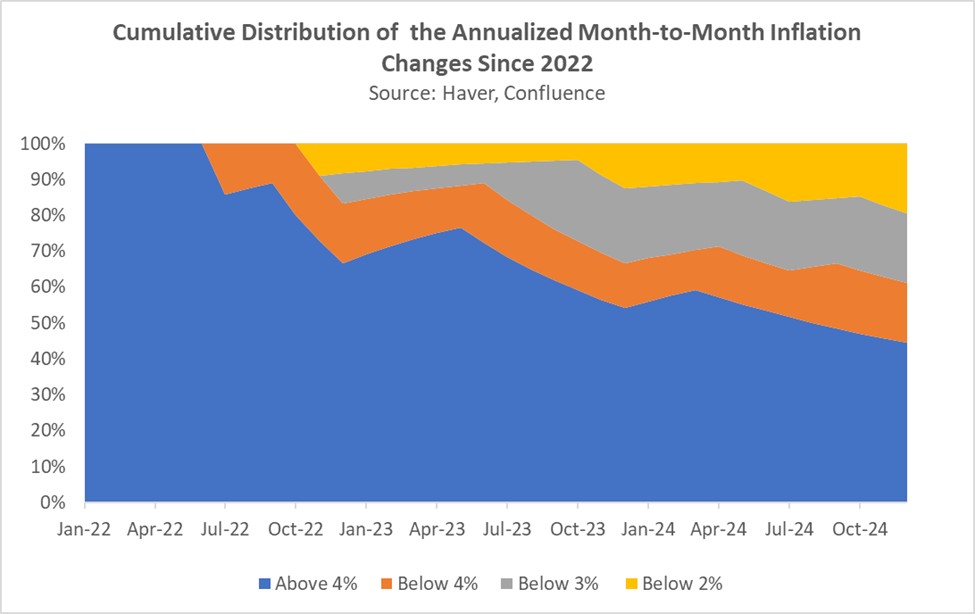

- While the January inflation report was disappointing, with Fed Chair Powell noting that “more work needs to be done,” Fed officials remain confident that inflation could fall to 2% by early 2026. This optimism is rooted in the growing frequency of inflation reports showing that inflationary momentum continues to trend downward.

- As illustrated in the chart above, the number of annualized monthly inflation reports exceeding 4% has dropped significantly and now represents less than half of the reports since 2022. This marks a sharp decline from the first few months of that period, when all reports exceeded this threshold. Furthermore, a growing share of reports now show inflation below 3% and even at 2%, reinforcing the downward trajectory.

Ukraine War Talks: President Trump announced plans to hold talks with Russian President Vladimir Putin in an effort to help resolve the ongoing conflict in Ukraine. While no concrete plans to end the war have been proposed so far, it appears that Ukraine may need to make concessions and could increasingly rely on the European Union for additional support.

- Prior to the announcement, Defense Secretary Pete Hegseth stated that Ukraine’s expectation of regaining its pre-2014 borders was unrealistic. He also expressed skepticism about the possibility of Ukraine joining NATO if a deal to resolve the conflict were to be reached.

- Hegseth emphasized that the US would not deploy troops on the ground to ensure Ukraine’s security, adding that Europe would need to bolster its own presence to protect its borders as the US shifts more of its strategic focus toward countering China.

- The decision to push for concessions from Ukraine and Europe underscores the Trump administration’s view of the EU as a junior partner in the relationship. While this approach is likely to raise tensions between Washington and Brussels, it could also facilitate a resolution to the conflict — a prospect that has already strengthened European equities and boosted the euro.

Budget Breakthrough: Senate Republicans advanced their budget resolution out of committee on Wednesday, moving closer to meeting the president’s goal of securing funding for energy, defense, and border security. The measure establishes a fiscal framework that paves the way for conservative lawmakers to advance the Trump administration’s agenda through the budget reconciliation process.

- Despite progress in the Senate, House Republicans have struggled to gain momentum as they work to fulfill President Trump’s vision of a single “big, beautiful bill” that incorporates key elements of the Senate’s proposal, including the highly touted tax cuts. However, their efforts are being hampered by fiscal hawks, who are demanding deeper budget cuts before they agree to support the deal.

- The latest proposal from House Republicans has sparked significant controversy, as it seeks to identify $2 trillion in budget cuts, raising concerns that they may consider reductions to social programs like Medicaid and food assistance for low-income households.

- Lawmakers in both chambers of Congress are expected to vote along party lines on any portion of President Trump’s bill that includes tax cuts, making it increasingly likely that two separate bills will be passed rather than one. That said, any progress toward enacting tax cuts would likely be welcomed by equity markets, while proposed budget cuts could be favorable for bonds.

Reciprocal Tariffs: President Trump has vowed to impose tariffs on any country that levies duties on US goods. While the president has not specified which countries could be targeted, the timing of this announcement — coming just ahead of his scheduled meeting with Indian Prime Minister Narendra Modi — suggests it may serve as a negotiating tactic.

- The move is part of the president’s three three-prong approach to tariffs, known as the three Rs (Restriction, Revenue, and Reciprocity), which come from former President William McKinley.

- Restrictions involve leveraging trade policies to boost domestic manufacturing by limiting imports. Revenue tariffs impose taxes on imported goods, creating an additional income stream for the government. Reciprocal tariffs, on the other hand, are used as a tool to pressure other countries into lowering their own tariffs.

- While William McKinley achieved some success in advancing his trade goals, President Trump may face a more daunting challenge. The key difference lies in the two approaches — Trump is attempting to implement all three Rs simultaneously, whereas McKinley applied them in combination over time.

- Trump’s widespread use of tariffs to achieve multiple objectives may weigh on economic growth by making the investment environment less predictable. However, in the long run, these measures could potentially benefit exporters.