Daily Comment (February 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is digesting the president’s recent tariff announcements. In sports news, Real Madrid secured a victory against Real Sociedad in the first leg of their Copa del Rey semifinal clash. Today’s Comment will explore why the trade deficit may not be the Trump administration’s sole concern, analyze the Magnificent 7’s weak start to the year, and cover other market-related developments. As usual, the report will also include a roundup of key international and domestic data releases.

Trump Tariffs: President Trump has pledged to proceed with tariffs on Mexico, Canada, and the European Union starting next week, though he left room for a potential extension that could delay them until April. The announcement sent shockwaves through markets, as uncertainty grows over how far his administration will escalate this global trade war.

- Originally, Trump planned to impose these levies on March 4, proposing a 25% tariff on goods from Mexico and Canada due to concerns that the countries were not taking sufficient actions to curb the flow of fentanyl into the United States. Simultaneously, the EU was targeted over allegations of unfair trade practices, which have placed the US agriculture and automotive industries at a competitive disadvantage.

- That said, his threats have caused some confusion, particularly for Mexico and Canada, as it remains unclear whether they will receive an extension. The president’s team has been evaluating various goods that could potentially be targeted by tariffs, which were also set to take effect on April 2. As a result, the president may consider imposing additional tariffs on Mexican and Canadian goods a month after implementing 25% tariffs, rather than extending the March deadline.

- Regardless of whether tariffs take effect in March or April, the uncertainty surrounding how events will unfold has already contributed to volatile equity markets. The US is expected to start with relatively low tariffs, with the possibility of increasing them if trading partners retaliate. Meanwhile, other countries have been preparing contingency plans in case their goods face tariffs, potentially targeting swing-state economies as part of their response.

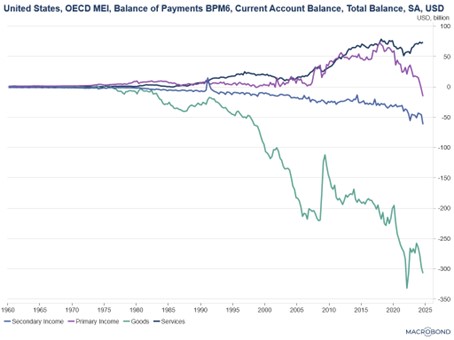

- One key area of focus in analyzing the trade war will be the current account balance. While the US trade deficit has been widely discussed in the media, far less attention has been given to the deficit in primary income. For the first time in recorded history, American residents are earning less on their overseas assets than foreigners are earning on their US assets. This suggests that the US is paying more to the rest of the world in dividend and interest than it is receiving from them in return.

- The concern with having both a trade deficit and a primary income deficit is that it indicates other countries are not only gaining an advantage in trade but also demanding higher returns on their investments. In the long run, this dynamic is unsustainable, as it could lead to a rapid increase in US debt or a currency crisis.

- It is important to note that the president may be using the current account as a scorecard to assess whether the US is being taken advantage of. As a result, the Trump administration’s pressure on the rest of the world could extend beyond trade and potentially into financial flows if these imbalances persist. This could introduce additional uncertainty into equity markets while simultaneously strengthening the case for gold as a safe-haven asset.

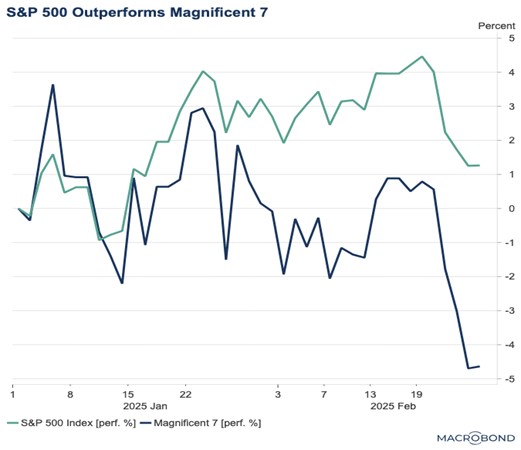

Magnificent 7: Nvidia was unable to provide a boost for the group of seven mega cap tech stocks, which have slipped into correction territory this week. Their collective weak start to the year comes as investors continue to assess the potential of AI and other emerging technologies.

- The chipmaker posted another strong earnings report in the fourth quarter of 2024. The company’s sales surged by 78% in the final three months of the year, reflecting robust demand for its chips. Additionally, it was able to counter concerns that demand for its products was under threat following the release of DeepSeek.

- That said, the strong earnings report failed to excite investors, as the company’s stock price remained relatively flat compared to the previous day, despite rising as much as 3.4% in the lead-up to the announcement. The muted reaction comes as investors have begun rotating away from the Magnificent 7 in favor of other large cap stocks.

- Following two exceptionally strong years in 2023 and 2024, during which the Magnificent 7’s collective stock price nearly tripled the performance of the S&P 500, investors appear to be seeking new leadership. While the Magnificent 7 is down 4.4% year-to-date, the rest of the S&P 500 has gained 4.5% over the same period.

- One of the key uncertainties is whether investors will continue to pressure the companies’ collective capital expenditure (capex) spending, particularly amid growing uncertainty surrounding US policy and geopolitical tensions. As a result, investors may adopt a wait-and-see approach for now, as they assess how these companies navigate emerging challenges.

Taiwan in Danger? Chinese military exercises around Taiwan are growing increasingly assertive, signaling that Beijing may be seriously considering the possibility of an invasion.

- A senior Chinese official responsible for Taiwan relations issued a strong call on Wednesday, urging the island to consider “the inevitable reunification of the motherland.” This bold statement indicates Beijing’s potential for increased action to maintain Taiwan within its orbit.

- This assertive stance, coupled with escalating Chinese military exercises near the island, has fueled concerns of a potential false flag invasion. Furthermore, the severing of undersea cables by Chinese entities has raised fears of hybrid warfare, suggesting a significant escalation in cross-strait tensions.

- While the US has consistently stated its support for Taiwan’s self-governance, President Trump has been reluctant to explicitly promise military defense of the region in the event of an attack by China.

Rubio Russia Pivot: Secretary of State Marco Rubio has warned that the US should not allow Moscow to become a junior partner to China. This strategy, which some have dubbed the “reverse Nixon,” underscores the Trump administration’s willingness to pull Moscow away from Beijing’s influence.

- While the rhetoric may sound appealing, the practicality of this goal appears highly questionable, especially considering Russia’s already heavy economic reliance on China and the growing competition between the US and Moscow over energy markets in Europe.

- That said, the warming of ties between the US and Russia serves as another reminder to the EU that Washington no longer prioritizes its transatlantic relationships. This shift could potentially push Europe to seriously reconsider and accelerate its own defense buildup.