Daily Comment (February 28, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are reacting to the latest inflation data. In sports, Steph Curry joined Wilt Chamberlain and Elgin Baylor as the only players with 45+ point games on the same date. Today’s Comment explores the factors behind the Fed’s aggressive policy shift, the strategic importance of a US-UK trade agreement, and other market-moving events. Plus, we’ll provide a comprehensive overview of today’s key economic data releases.

Close to Neutral? On Thursday, two Federal Reserve officials offered contrasting perspectives on the tightness of monetary policy, underscoring the persistent uncertainty surrounding the path to the neutral interest rate. Despite their differing views, both officials agreed that the Fed should maintain current interest rates for the time being.

- Cleveland Fed President Beth Hammack has indicated that the Fed’s policy rate is no longer meaningfully “restrictive,” suggesting that the central bank may be approaching its neutral rate — the level at which monetary policy neither stimulates nor constrains economic growth. Her comments mark one of the first signals that some Fed officials are growing comfortable with the idea of concluding the current easing cycle by the end of the year.

- On the same day, Philadelphia Fed President Patrick Harker noted that he believes the current policy rate remains sufficiently restrictive to maintain downward pressure on inflation over the long term. While these remarks do not indicate how many rate cuts he expects for the year, it does suggest that he may not agree that the Fed is close to finishing its easing cycle.

- Although both officials still support keeping rates steady at the upcoming meeting and neither has pushed for a near-term rate hike, the widening divergence in their views highlights a growing hawkish tilt among committee members in recent months. This shift signals that the Fed may be closer to ending its easing cycle than markets initially expected at the start of the year.

- Market expectations have shifted significantly. Before the latest inflation data, Fed futures contracts showed that many participants had largely dismissed the possibility of 50 bps of rate cuts this year. As of now, the likelihood of a rate hike has surpassed that of a cut. Current pricing suggests a 35% probability that rates will remain unchanged by the end of 2025, a 25.2% chance of a 25 bps increase, and a 23.1% chance of a 25 bps cut.

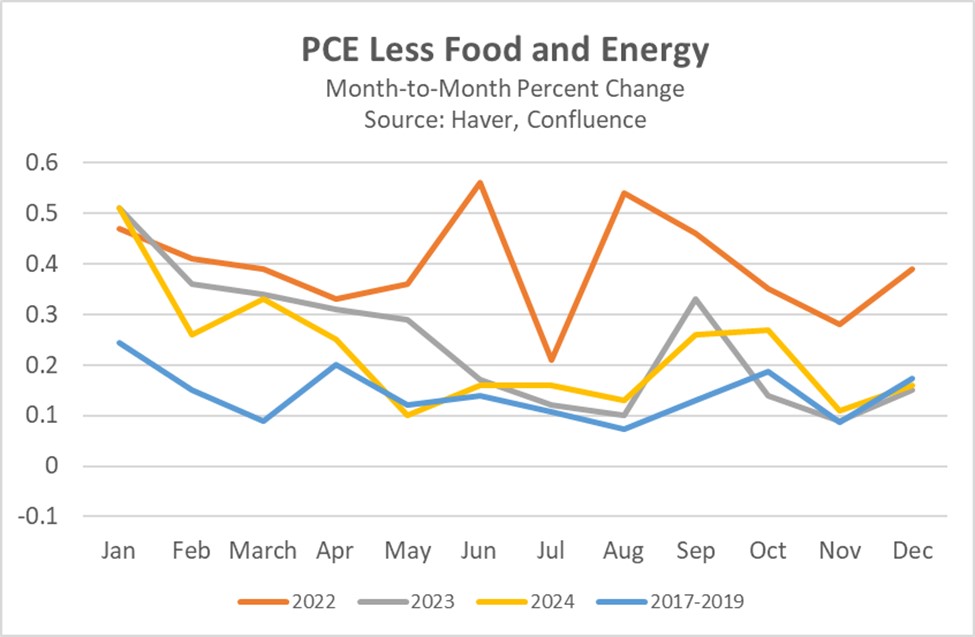

- As we have emphasized over the past few months, the Fed will be closely monitoring inflation data early in the year. The first few months present the best opportunity for the Fed to make progress toward its 2% target, given that inflation readings during this period have historically been elevated compared to their long-term average. While a sudden rate hike is not currently the base case scenario, it remains a potential unexpected headwind for risk assets.

UK Trade Deal: UK Prime Minister Keir Starmer visited Washington this week to discuss strengthening trade ties between the two nations. While no final agreement was announced, both sides expressed a commitment to maintaining positive relations. The potential US-UK trade deal is expected to serve as a benchmark for what allies can achieve when they align closely with US interests.

- Following the discussion, President Trump announced that his administration had begun working on a deal with the UK, which could help both nations avoid being swept into a trade war. The deal was a welcome development for Starmer, as his country has been seeking a breakthrough amid recent budget cuts and unpopular tax reforms. However, it appears that Trump may have a broader strategy in mind.

- The president’s decision to pursue a trade deal with the UK may signal to other countries considering breaking away from the EU that they, too, could negotiate their own agreements with the US. Under current EU rules, individual member states are not permitted to negotiate independent trade deals. Additionally, the president has mentioned that he prefers bilateral trade deals with countries as opposed to multilateral agreements.

- That said, this is not the first time the president has expressed interest in working on a trade deal with the UK. In 2019, his administration was actively negotiating an agreement, but progress stalled due to the pandemic. This time may differ slightly, as the administration appears to have a clearer vision of its objectives. However, it’s important to note that trade agreements typically require years of negotiation to finalize.

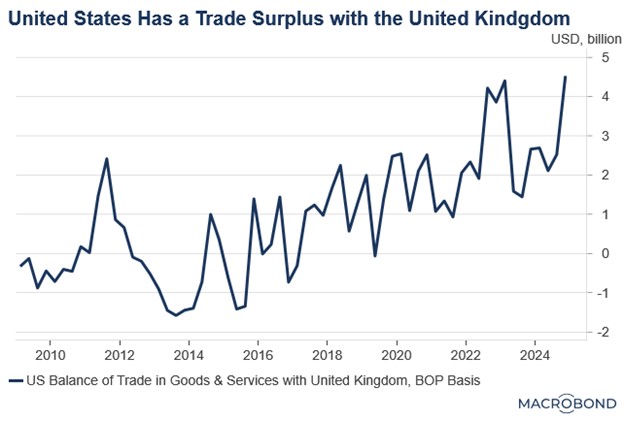

- One advantage the UK holds is that it currently runs a trade deficit with the US, meaning — by the President Trump’s metric — it is not exploiting the system. As a result, the UK may become an attractive destination for those seeking to avoid countries that could be negatively impacted by a trade war with the US.

Open AI Strikes Back: The latest version of Open AI’s model has been released, aiming to reassure investors that it remains on track following DeepSeek’s recent breakthrough. This new technology marks a significant shift for the company as it moves away from language learning models (LLMs) that rely on chain-of-reasoning approaches.

- The new GPT-4.5 is different from its predecessor models in that it is able to engage with users more naturally, therefore creating a more improved customer experience. The update is unlikely to create the same level of buzz as GPT-4 did when it was released in 2022, but it does show the focus of AI research has started to shift.

- When the technology was first introduced, it faced criticism for its capability to solve only straightforward problems while struggling with more complex ones. As a result, generative AI models have proven to be valuable tools for experts with a strong grasp of a subject, aiding them in completing tasks more efficiently. However, their unreliability in handling nuanced or intricate challenges has made them less suitable for beginners or those starting from scratch.

- Improvements in these models are expected to enhance AI’s ability to tackle more complex tasks, potentially boosting overall economic productivity. However, this advancement could, over time, undermine worker bargaining power as AI becomes increasingly capable of performing roles traditionally held by humans. Consequently, while the technology holds immense promise, it may also face significant political resistance as its broader societal and economic implications come to the forefront.

China Vows Response: Beijing has responded to President Trump’s threat to raise tariffs on Chinese goods, stating that it will take necessary measures if additional tariffs are imposed. This follows Trump’s announcement of a planned 10% tariff increase on Chinese imports, set to take effect on March 4.

- While Beijing has avoided detailing specific measures, its response signals a readiness to counter US threats. Export growth has been a bright spot for the Chinese economy, providing momentum as it seeks to break out of its current slowdown.

- That said, any response is likely to be measured, as both leaders are expected to meet soon to negotiate a trade agreement, making an aggressive reaction improbable.