Daily Comment (March 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a few words about yesterday’s steep sell-off in the US stock market. We next review several other international and US developments with the potential to affect the financial markets today, including increased investment in the European and Australian defense industries and the latest on the US stopgap spending bill to avoid a partial government shutdown starting at the weekend.

US Financial Markets: Futures trading so far today suggests that stock prices could stabilize or even rebound modestly after their steep declines yesterday, when the S&P 500 index fell 2.7%, and other indexes fell even more. Yesterday’s plunge appeared to stem largely from statements by President Trump and his administration suggesting that they are willing to tolerate short-term economic disruptions or even a recession for their longer-term goal of economic restructuring. Investors today will continue to digest those concerns.

- As we noted in our Bi-Weekly Geopolitical Report from January 27, the evolving Trump economic strategy is probably more consistent and coordinated than many observers realize. Many of the strategy’s components are classic pro-growth measures that investors should like. We think the key risks are in the administration’s effort to suddenly and sharply cut spending and push many of the costs of economic adjustment onto other countries, potentially sparking a trade war and shattering the US alliance system.

- Investors are likely to keep focusing on those risks in the coming days and weeks, especially if incoming economic data continues to soften. For example, since market close yesterday, both Delta Airlines and American Airlines have reported softening consumer and business demand. Similar reports could push stock prices lower again.

- From a technical perspective, we note that yesterday’s plunge pushed the S&P 500 below its 200-day simple moving average for the first time since October 2023. The share of the S&P 500 stocks trading above their 200-day SMA is now down to 46.8%, coming closer to the 30% or so that many traders consider a weak market. If the S&P 500 continues to fall, its next major support level is probably at about 5,433, at which point it would be in correction territory.

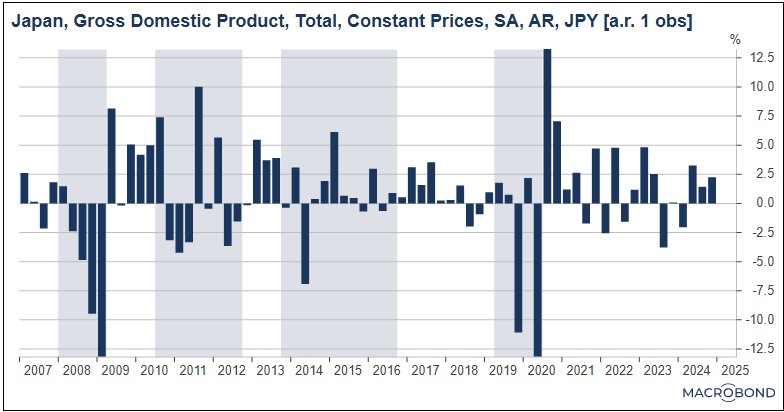

Japan: Revised figures showed that fourth-quarter gross domestic product expanded at an annualized rate of just 2.2%, far below the initial estimate of 2.8%. Nevertheless, the growth in the fourth quarter was an acceleration from the 0.6% rate in the previous quarter, and it marked the third straight period of expansion. The data will probably help prompt the Bank of Japan to keep raising interest rates after boosting its benchmark rate to 0.5% in January.

Australia: The government has unveiled a roughly $19-billion investment plan to upgrade the country’s defense industrial base so it can support future nuclear-powered submarines built through the AUKUS security pact with the US and the United Kingdom. The new investments in Australia’s industrial plant and workforce, coupled with regulatory reforms, show how rising defense spending around the world is likely to spur broader economic development and boost economic growth in the coming years.

North Korea: For the first time, state media over the weekend showed images of what it called “a nuclear-powered strategic guided missile submarine” under construction. South Korean analysts believe the sub would be able to carry about 10 nuclear missiles, potentially threatening the US mainland. The development has the potential to reignite tensions between Pyongyang and the governments of the US, Japan, and South Korea.

European Union: At the European Parliament today, European Commission President von der Leyen said the EU’s new 150-billion EUR ($164 billion) loan program for member states to boost their armed forces can only be used for purchases from European producers, including those in the UK, Norway, and Switzerland. According to von der Leyen, the rule aims to not only help EU nations rebuild their militaries, but also to strengthen Europe’s defense industry. The rule is likely to add even more fuel to European defense stocks and help boost Europe’s economy.

Denmark-Greenland-United States: Greenland today is holding parliamentary elections, the outcome of which could determine whether and when the territory will hold a referendum on independence and whether the US can acquire it, as President Trump wants. According to a January poll, about 85% of Greenlanders don’t want to be taken over by the US. In addition, the legislature has passed laws clamping down on foreign governments attempting to influence the island’s elections.

US Fiscal Policy: As the Friday deadline approaches for Congress to pass a stopgap spending bill to avoid a partial government shutdown, 21 House Republicans have signed a letter to their leadership opposing the elimination of clean-energy tax benefits in the Biden administration’s Inflation Reduction Act. The signatories have threatened to vote against any spending package that eliminates the IRA funding to help pay for President Trump’s tax-cut extension.

- As we’ve noted before, Biden’s signature IRA programs have ironically channeled billions of dollars of manufacturing subsidies and other funds into districts dominated by Republicans. The signatories to the letter all represent districts that have received significant funding from the IRA.

- The letter illustrates how the IRA has created a constituency for green-energy facilities even in Republican-dominated areas. Nevertheless, it isn’t clear whether their resistance will prevent planned cuts to the IRA funding or disrupt passage of the stopgap bill.

US Military: Even as the US Army appears to be reversing its recent recruitment crisis, new data shows that almost 25% of enlistees are washing out and leaving the service before their initial two-year contract is up. Army officials suggest much of the problem stems from a poor recruiting pool, with few young Americans able to meet the service’s stringent physical and educational standards. Today’s healthy labor market and rising civilian wages could also be pulling new recruits away. The data points to potential problems in US military readiness.