Daily Comment (March 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new indications that the Trump administration’s “reciprocal” tariffs to be announced on April 2 could be narrower than expected. The news is giving a significant boost to US stocks so far this morning. We next review several other international and US developments with the potential to affect the financial markets today, including a snap election called in Canada for April 28 and growing pushback against a US plan to impose big, new fees on Chinese ships calling at US ports.

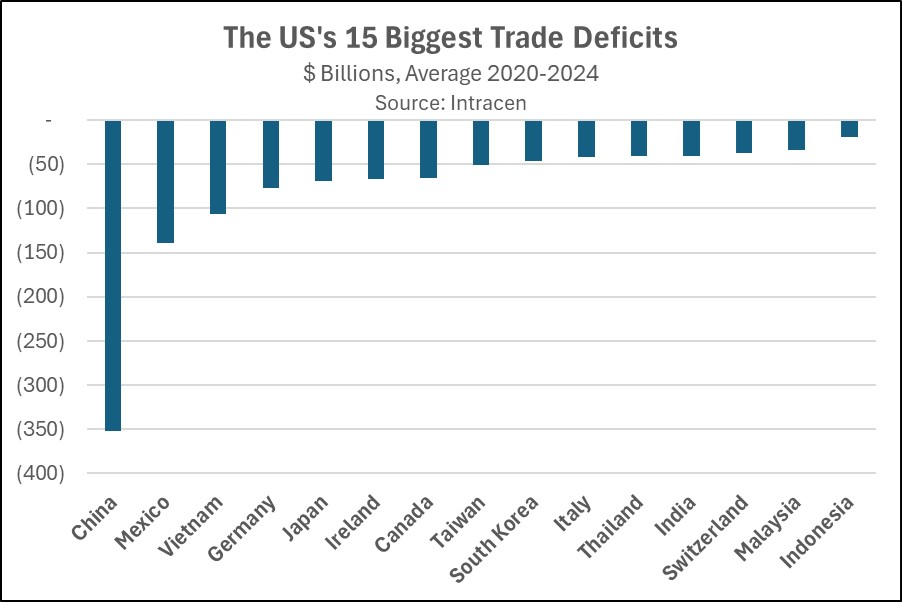

US Tariff Policy: Administration officials over the weekend said the new “reciprocal” tariffs that President Trump plans to announce on April 2 will likely be narrower than expected. It appears that officials are coalescing around a plan to impose big tariffs against just 15 nations that have especially large trade imbalances with the US, although other countries could also be hit with more modest levies. The officials also suggest Trump will hold off on some of the broad sectoral tariffs that he has threatened, such as those on autos and pharmaceuticals.

- News of the narrower tariffs has given a strong boost to US stock futures so far this morning, suggesting that stock prices will jump after the open.

- Nevertheless, we would caution that President Trump could still change his mind and impose broader tariffs than what today’s reports indicate. In addition, whatever tariffs are announced on April 2 could subsequently be modified, and other tariff announcements could come later. In other words, the situation remains fluid, which will probably prompt continued stock market volatility in the coming weeks.

European Stock Market: Now that European stocks have performed so well in the first quarter of 2025, it’s notable that German software firm SAP today has overtaken Danish pharmaceutical giant Novo-Nordisk as the continent’s most valuable company in terms of market cap. SAP’s stock price has surged some 40% over the last year as it successfully migrated its business to the cloud. In contrast, Novo-Nordisk’s stock value has been roughly halved as investors question how it will follow up its recent success with weight-loss drugs.

Eurozone: In a preliminary report, S&P Global and Hamburg Commercial Bank said their March composite purchasing managers’ index rose to 50.4 from 50.2 in February. Like most major PMIs, the one for the eurozone is designed so that readings over 50 indicate expanding activity. At its current level, the data suggests that the eurozone economy is growing, but just barely. The region’s slow growth and susceptibility to new US tariffs will likely be a test for European stocks going forward.

Japan: In an interview with the Financial Times today, Finance Minister Katō warned that Japan hasn’t truly exited its long period of deflation, even though the headline consumer price index has shown annual inflation as high as 4.0% in recent months. According to Katō, inflation in Japan today is largely the “wrong kind,” reflecting the weak yen (JPY) and high commodity prices, rather than strong underlying economic growth. The statement suggests the government will continue looking for ways to boost consumer demand and overall economic growth.

China: Researchers have unveiled a device that can cut through armored subsea communication cables at a depth of up to 4,000 meters — twice the maximum operational depth of today’s subsea telecom infrastructure. The revelation apparently marks the first time any country has officially disclosed that it has such an asset.

- Although ostensibly for civilian salvage and deep-sea mining, the device could be deployed by submarines to cut critical communication lines between Chinese adversaries in time of geopolitical tension or war. For example, the device could be used to cut the telecom cables linking the US to Japan or Taiwan.

- China and Russia have already been linked to multiple cable-cutting incidents in relatively shallow waters around Taiwan and in the Baltic Sea, but the damage in those cases has been from ships dragging their anchors. The new Chinese device, if it’s real, could threaten a much bigger swath of the world’s telecom infrastructure.

Turkey: Mass protests against the detention of Istanbul mayor Ekrem İmamoğlu continued over the weekend, resulting in the arrests of hundreds of demonstrators. President Erdoǧan apparently had the popular İmamoğlu arrested last week to keep him from potentially winning the country’s upcoming elections. The arrest of İmamoğlu has raised concerns about Erdoǧan’s government becoming even more authoritarian, raising the risk of continued political unrest, economic disruptions, and weaker stock prices.

Canada: Yesterday, Prime Minister Carney, who assumed the office from Justin Trudeau just nine days earlier, called snap elections for April 28. The quick election comes as Carney’s Liberal Party has seen a resurgence in support in response to US President Trump’s threat to take control of Canada. If Carney can take advantage of the Liberals’ rebound in the polls, Ottawa’s economic policy would likely see only a limited moderation versus the progressive policies followed by Trudeau.

US Port Fees: The Wall Street Journal today says that hundreds of trade associations, farmers, and other individuals have filed protests or asked to speak at a hearing this week on the Trump administration’s proposal to impose big fees on Chinese ships calling at US ports. The proposed fees have bipartisan support among policymakers, having stemmed from a probe ordered last year by President Biden. However, the groundswell of criticism by shippers concerned about higher costs raises the chance that the fees will be reduced or eliminated.