Daily Comment (March 26, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Investors are closely tracking the latest tariff developments. Meanwhile, in a historic NHL moment, Alex Ovechkin netted his 889th career goal, placing him just six away from eclipsing Wayne Gretzky’s all-time record. Today’s Comment will analyze the latest consumer confidence data, explore the implications of new semiconductor restrictions, and break down other key financial stories driving the markets. As always, we’ll also provide a roundup of domestic and international economic releases.

Soft vs. Hard Data: Recent tariffs and government workforce reductions have significantly dampened consumer confidence, as reported by The Conference Board. However, the economy continues to show signs of growth.

- US consumer confidence plummeted to a three-year low in March, with The Conference Board’s index dropping sharply to 92.9 from February’s revised 100.1. The decline was driven primarily by collapsing future expectations, as the six-month outlook plunged to 65.2 (down from 74.8), marking its weakest reading in over a decade. Even surveys on present situation conditions have deteriorated, falling from 138.1 to 134.5, suggesting broadening economic concerns among households.

- Tariff-related uncertainty and macroeconomic concerns drove the sentiment shift. Key indicators flashed warning signs, such as inflation expectations breaching 6% (first since 2023) and employment outlooks hitting 12-year lows. The confidence gap between demographics was striking — respondents 55+ showed the most pronounced pessimism, contrasting with modest optimism in the under-35 cohort, which saw a slight uptick.

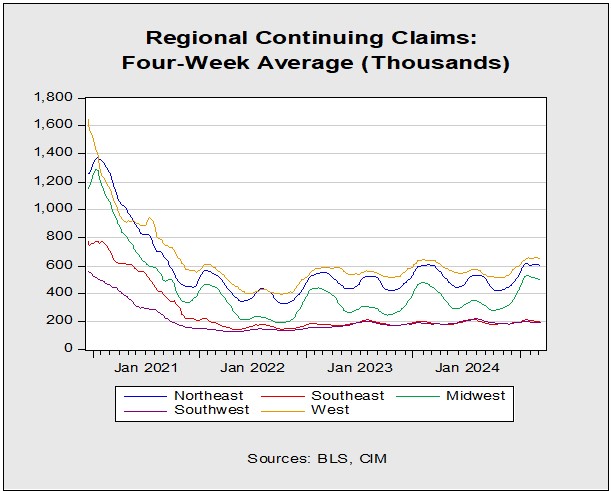

- While depressed consumer confidence suggests growing economic anxiety, key indicators confirm the underlying economy remains robust. The unemployment rate continues to hold below 5%, with initial jobless claims staying at historically manageable levels. Recent inflation data has also provided encouraging signs of moderation. In essence, despite public pessimism, fundamental economic conditions still point to sustained expansion.

- The recent dip in consumer confidence warrants close monitoring, as it signals growing household concerns about economic conditions. However, the labor market’s resilience and robust consumer spending during the significant Conference Board confidence drop in 2022 suggest that confidence surveys may not provide a complete picture of economic performance. In summary, while current trade tensions could create modest headwinds for growth, we find no definitive evidence that the economy has entered a recession.

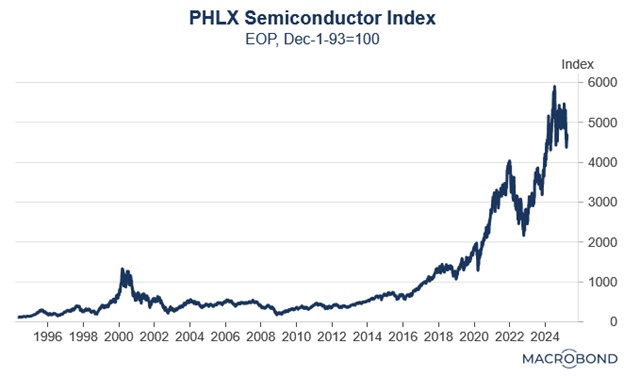

Chipmaker Ultimatum: Foreign governments and tech firms are pushing for relaxed US semiconductor export controls ahead of the May 15 sanctions deadline, reflecting the mounting challenges of operating in today’s geopolitically divided marketplace.

- The “AI Diffusion Rule,” a late-term Biden administration regulation restricting the sale of high-performance computing technology to specific nations, has sent shockwaves through the semiconductor industry. This framework aims to safeguard advanced US technology and maintain America’s competitive edge by compelling other countries to adhere to US standards. This move appears to be a strategic effort by the US to ensure its continued leadership in the AI space.

- The restrictions have drawn frustration from both corporations and foreign governments, as they cap potential sales for tech firms while pushing nations to align more closely with US interests. Semiconductor companies fear losing access to lucrative markets like China, which is pouring billions into AI infrastructure. Meanwhile, US allies — including Saudi Arabia, Israel, and Mexico — face new hurdles in developing their own domestic tech industries under the tightened export regime.

- The Trump administration has shown no willingness to relax these restrictions. In fact, it escalated the measures on Tuesday by adding 80 companies and organizations —predominantly Chinese, but also including firms from Iran, South Africa, and Taiwan — to a blacklist barring them access to US semiconductor technology on national security grounds.

- Geopolitical tensions are anticipated to strain chipmakers’ profitability due to the growing bifurcation of supply chains between US-aligned and China-aligned entities. Coupled with the semiconductor industry’s cyclical nature, these factors could generate significant headwinds. Considering these challenges, we believe diversifying investments beyond traditional big tech firms may offer value in optimizing portfolio returns in the current environment.

Growing Trade Volatility: President Trump has signaled an unwavering stance on tariffs, seeking to condition markets to expect — or at least react less sharply to — new trade restrictions.

- On Tuesday, President Trump announced limited tariff exemptions effective April 2, while tempering expectations for widespread relief. He maintained his commitment to the tariffs but hinted at a more nuanced strategy, favoring calibrated adjustments over rigid reciprocal actions. These remarks coincided with reports that his administration is exploring a more targeted implementation of the tariffs due next Wednesday, possibly encouraging last minute deal making with countries before the deadline.

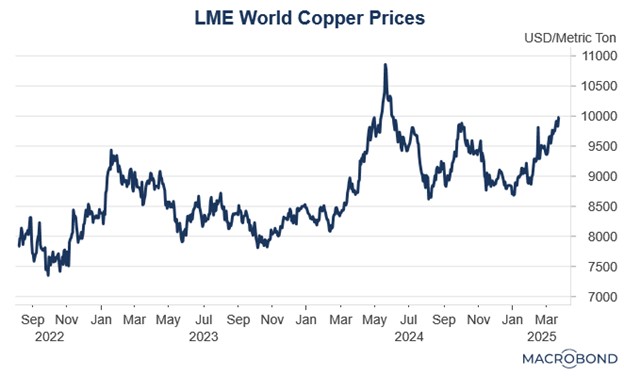

- At the same time, the president has accelerated efforts to impose tariffs on copper, moving ahead of schedule. This follows President Trump’s earlier directive to the US Commerce Department to complete a 270-day investigation into the metal’s trade patterns. However, the review appears to be concluding significantly earlier than planned, with expectations that Trump will soon announce 25% tariffs on copper imports. The announcement has already led to a surge in copper prices.

- A key focus is the market’s reaction to evolving trade dynamics. In recent months, equities have shown significant swings and increased volatility. As these fluctuations become more commonplace, we anticipate investor attention shifting towards economic fundamentals — specifically, tangible evidence of tariff impacts — rather than solely policy announcements. Assuming continued economic resilience, the period of heightened volatility may be receding.

Truce Coming Soon? Ukraine and Russia have agreed to a temporary ceasefire on sea and energy targets. However, significant challenges remain in reaching a comprehensive peace agreement to resolve the broader conflict.

- While the full terms of the agreement remain unclear, the deal represents the first formal accord between the warring parties. US mediators secured Russian participation by offering targeted sanctions relief in exchange for reduced military operations. For its part, Ukraine has demonstrated willingness to follow America’s diplomatic lead in these negotiations.

- However, no clear timeline for resolving the conflict has emerged, particularly from the Russian side. President Trump recently criticized Putin for deliberately stalling peace negotiations, but remains optimistic that a deal can be done. Analysts speculate that Putin, facing mounting war costs, continues to seek tangible justification for the invasion’s “success,” most likely through complete control of the Donbas region.

- A resolution to the Ukraine-Russia conflict would significantly impact global markets, with particularly pronounced effects on European economies and commodity markets, especially oil. While we maintain our base-case expectation for a negotiated settlement before year-end, the bargaining process will likely prove more protracted than Western powers, including the US administration, would prefer.