Daily Comment (April 3, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are analyzing the implications of the latest tariff measures, while in sports news, Shohei Ohtani’s powerful home run last night propelled the LA Dodgers to their eighth consecutive victory. Today’s Comment will focus on the economic impact of the newly announced tariffs, the EU’s cautious approach toward including US suppliers in its military procurement strategy, and other market-moving events. As always, we’ll also provide a roundup of today’s international economic data releases and indicators.

Liberation Day: The president’s unveiling of targeted tariff measures triggered a market sell-off. The dollar and equity markets declined sharply, and US Treasurys rose.

- On Wednesday, President Trump announced reciprocal tariffs targeting nations he accused of unfair trade practices. To substantiate his position, he presented a chart comparing existing foreign tariff rates on US imports to his proposed reciprocal rates, demonstrating that current charges were approximately double his recommended levels. The new tariffs would be added on top of previously announced taxes on US imports.

- Under the new tariff structure, China faces the highest rate at 54%, while several Southeast Asian nations — particularly Vietnam — confront steep increases exceeding 45%. The EU received a 20% tariff, while countries maintaining trade deficits with the US were subject to a comparatively lower 10% rate. Key takeaways:

- The Good: The administration would like these tariffs to be the worst of it. Treasury Secretary Scott Bessent has stated that if other nations refrain from retaliation, the tariffs will be capped at their current rates, with the possibility of future negotiations to reduce them. Additionally, the US spared its largest trading partners, Mexico and Canada, from additional tariffs. Similar exemptions were granted for commodities such as oil, gold, copper, and products affected by Section 232 tariffs, including steel, aluminum, and lumber.

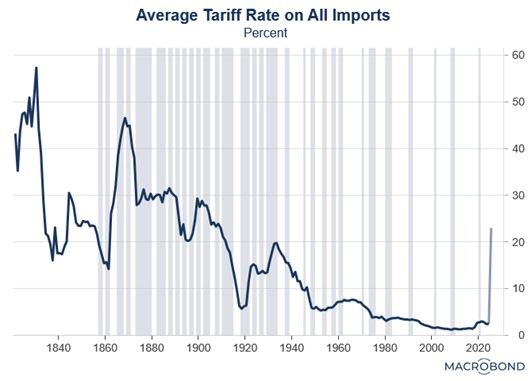

- The Bad: The tariffs were significantly higher than market expectations. According to Bloomberg, the effective tax rate on imports (projected to be around 23%) now rivals levels seen during the protectionist 1930s. Meanwhile, signs of retaliation are emerging as Canada is set to announce countermeasures on Thursday, and the EU has vowed a unified response to the new tariffs.

- The Ugly: The apparent calculation methodology behind these reciprocal tariffs raises significant concerns about how the administration defines unfair trade practices. The formula divides a country’s trade surplus with the US by the value of its exports to America. While not perfect (for example, the EU’s 37% rate falls slightly below the administration’s 39% benchmark), the calculation aligns with projections for Japan (46%) and produces similarly elevated figures for China (67%) and Indonesia (64%).

- The administration appears to have adopted a de facto stance that any country running a trade surplus with the US is engaging in unfair tariff practices. Given this position, these reciprocal tariffs are likely to remain in effect and may even be adjusted in coming months, particularly if affected nations implement retaliatory measures. We will be paying close attention to the dollar as a persistent drop could have spill-over effects.

Political Fractions Emerging: A rare bipartisan coalition opposed the president’s trade war immediately before he announced new tariffs.

- On Wednesday, Senate Democrats introduced a bill to repeal tariffs on select Canadian imports. The measure passed 51-48, with four Republican senators joining Democrats to advance the legislation. While the bill is unlikely to clear the House, the vote served as both a rebuke of the president’s aggressive tariff policies and a broader test of congressional sentiment on executive trade authority.

- While Democratic support for the bill was expected, the Republican backing represents an unwelcome surprise for a president who prizes loyalty above all. This rare defiance signals growing congressional unease with how the president has used his ability to impose tariffs unilaterally. Should the administration’s trade levies not achieve their intended goals, lawmakers may consider reasserting their constitutional authority over tariff policy, which would address the perceived expansion of executive power.

- Although the US’s economic dominance is often cited as its key advantage in a trade war, public sentiment remains a decisive factor. Recent special elections in Florida, Wisconsin, and Pennsylvania suggest growing opposition to Trump’s agenda, although much of it may have to do with his government spending cuts. Should this trend continue, lawmakers may be forced into a politically difficult reversal.

- We still believe the president’s core base will largely support his trade policy shift — after all, his tough stance on trade helped get him elected. Once the tax bill passes, it should generate enough goodwill to offset some backlash. The key challenge now is minimizing the economic pain from tariffs to avoid a financial crisis. Difficult, but possible.

Europe Defense Build Up: NATO allies continue to prepare to operate independently of the US. However, American officials have requested that Europe still buy American weapons.

- Secretary of State Marco Rubio cautioned Baltic EU leaders that excluding the US from defense procurement initiatives would trigger a strong backlash from Washington. He is set to reiterate this stance later this week at the NATO Foreign Ministers’ meeting. His remarks come amid a broader EU push to bolster its domestic defense industry and reduce reliance on American military supplies.

- The move comes as European countries begin developing a joint plan to fund military purchases. The UK has expressed interest in joining the EU-led initiative, which aims to establish a collective fund for stockpiling weapons amid growing concerns over Russian aggression. There has been notable support — particularly from France — for restricting the fund to purchases of weapons manufactured within the EU.

- Europe would like to change how it buys weapons for two main reasons: trade disputes with the US and a fading trust in American security promises. While Europe can’t yet match US weapons technology in terms of scale or sophistication, it would like to invest heavily in its own arms industry. The goal is to rely less on American suppliers and eventually compete in the global weapons market. These moves could seriously change how Europe and the US work together on defense.

Musk Exit? There are conflicting reports that the Tesla CEO and leader of the DOGE taskforce is rumored to be stepping down from his position within the Trump administration.

- According to Politico, President Trump informed cabinet members that Elon Musk would step down from his advisory role in the administration. While White House spokesperson Karoline Leavitt and other officials later denied the report, it suggests Musk’s temporary position — which by statute lasts only 130 days — will not be extended beyond its original term.

- Elon Musk’s expanding influence has made him an increasingly polarizing figure, raising concerns among observers. Recent reports suggest he may now be marginalized within Trump’s core advisors, signaling a potential decline in his political sway.

- Musk’s departure could mean many of the proposed spending cuts may not be as deep as initially hoped. Without him, the administration will need to either find another leader capable of driving the mission or develop alternative strategies — such as efficiency-based deficit reduction — to avoid politically risky spending cuts while maintaining fiscal discipline.