Daily Comment (April 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the very latest on the Trump administration’s new tariff policies. We next review several other international and US developments with the potential to affect the financial markets today, including potential policy responses to the tariffs from countries such Japan and Germany, and news that the administration is considering a massive cut in the US Army’s active-duty troop count.

US Tariff Policy: President Trump’s baseline 10% tariff on most US imports went into effect over the weekend, and Treasury Secretary Bessent and Commerce Secretary Lutnick said in press interviews that the additional “reciprocal” tariffs on dozens of countries will start as planned on Wednesday. They also warned that even if foreign countries offer concessions to reduce their tariff rates, any negotiations will take time, and the maximum tariffs would be in place until then.

- Bessent also downplayed the drop in the value of risk assets because of last week’s tariff announcement, saying, “Americans who want to retire right now, Americans who have put away for years in their savings accounts, I think they don’t look at the day-to-day fluctuations of what’s happening.”

- Bessent’s statement is further evidence that the administration intends to stick by its economic policies even if economic activity weakens or risk assets continue to lose value. That raises a risk that any needed course correction may not come until it’s too late to avoid a recession or an even steeper market downturn.

- In a continuing response to the tariffs, stock prices in Asia and Europe plunged overnight, and US stock futures are signaling another sharp drop at market open. Oil prices also continue their sharp drop, while investors are bidding up bonds, which is driving down yields.

- Just as concerning, we have noted that gold, cryptocurrencies, European defense stocks, and other assets that had recently been appreciating are now turning downward as well. That suggests that at least some investors are now facing margin calls and are selling what they can, not what they want to. That creates a risk of the financial markets entering into a self-reinforcing downward spiral that causes lasting economic damage.

- Of course, US investors have a very high level of cash “on the sidelines” in money market funds, which could theoretically be used to buy stocks once they look like a good value. However, the administration’s promise to stay the course with its aggressive policies and its past backtracking have created so much uncertainty that investors may be unusually wary about buying the market’s current decline.

Eurozone: Greek central bank chief Yannis Stournaras, who sits on the policymaking board of the European Central Bank, warned in an interview today that the Trump administration’s new tariffs would create an unexpected demand shock for the eurozone, potentially pushing down consumer price inflation below the ECB’s target. The statement signals that some of the region’s policymakers may want to keep cutting interest rates at the ECB’s policy meeting next week, despite ECB President Lagarde’s recent hints of a pause in rate cuts.

Germany: Friedrich Merz, who is negotiating to form the country’s next government and is likely to become its chancellor, warned today that the economic and financial market turbulence from the US’s new tariffs mean that Germany must regain economic competitiveness as quickly as possible. Indeed, Merz said that strategies to deal with the US tariffs will now be a key focus for his center-right CDU party and the center-left SPD as they continue talks to form a coalition. That raises the prospect for big economic reforms in Germany once the government is formed.

United Kingdom: According to lender Halifax, the average price of a home in March was up just 2.8% year-over-year, matching the increase in the year to February but coming in short of the expected increase of 3.5%. On a month-over-month basis, UK home prices fell in each of the last two months, adding to the evidence that the rapid home price appreciation of 2024 has come to an end.

Japan: With the Japanese economy facing both brutal import tariffs in the US and fast-rising prices for food and other basics at home, some politicians in the ruling Liberal Democratic Party are pushing for a cut in the country’s consumption tax. Top LDP leaders are still reluctant to go that far, fearing wider budget deficits and increased debt, but rank-and-file party members are pushing to put such a tax cut in the LDP’s platform for this summer’s Upper House elections.

- The rising calls for consumption tax cuts in Japan illustrate how countries around the world will feel pressure for stimulus programs as their exports run up against the Trump administration’s new tariffs.

- As the debate in Japan shows, any such stimulus programs could lead to bigger fiscal problems and exacerbate the economic disruptions from the new US trade policies.

- Separately, press reports say Chinese officials are also mulling significant economic stimulus measures, including a devaluation of the renminbi, to cushion the blow of the tariffs.

European Union-United States: European Commission Vice-President Séjourné today hinted in an interview that the EU won’t put tariffs on US bourbon as it retaliates for the Trump administration’s new imposts. That suggests that the EU executive has caved to demands from the wine and spirits industries of countries such as France, Italy, and Ireland, which feared the US would impose even higher tariffs on their products if the EU retaliated against US whiskey.

US Military: According to a report late last week, the US Army is “quietly” mulling a cut in its active-duty troop count from about 450,000 now to as little as 360,000 in the coming years. It is unknown whether any cuts are being considered for the Army Reserve or the National Guard. The contemplated cuts reflect a number of pressures, including President Trump’s directive to cut the defense budget by 8% and the administration’s plan to shift military resources away from land maneuver forces in Europe to naval and air forces in the Asia-Pacific region.

- If the US downsizes its ground forces and shifts military assets out of Europe before the Europeans can rebuild their own defense capabilities, Russia would likely be emboldened to assert itself in the region, if not by actual territorial aggression, then perhaps by political pressure.

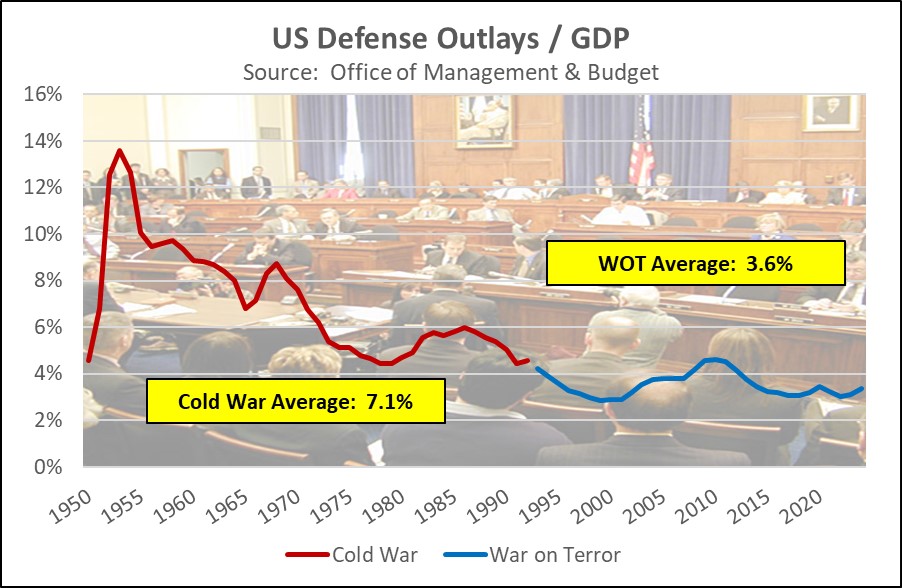

- In any case, the drive to cut defense spending comes even though the US defense burden (military outlays as a share of gross domestic product) is now at a historic low of only about 3.3%, versus an average of 3.6% during the War on Terror and 7.1% during the long Cold War.

US Agriculture Industry: A report on Friday said administration officials and congressional lawmakers are considering new fiscal support for farmers hurt by retaliatory tariffs or other trade barriers imposed by other countries in response to President Trump’s tariffs on US imports. The talks are in the early stages, so it isn’t yet clear how big any such relief program would be. Still, the news suggests that US agribusiness stocks may hold up better than expected amid the evolving global trade war.

- On a related note, new analysis shows that the recent retreat in US egg prices likely stemmed from a massive surge of imports. According to the data, February egg imports from Mexico and Turkey were about four times higher than they were in the same month one year earlier.

- As avian influenza decimated US flocks earlier this year, prompting egg shortages and driving prices higher, Mexican and Turkish producers evidently responded to the price signal by shipping more to the US, exactly as economic theory would suggest. One key question now is whether the administration’s new tariffs will push those egg imports down again, creating another fowl price experience for US egg buyers.