Daily Comment (April 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely tracking the latest trade developments. In sports, Alex Ovechkin has cemented his legacy as the NHL’s all-time leading goal scorer. Today’s Comment will explore why the bond market continues to shrug off inflation data, provide an update on the Trump tax bill, and discuss the EU’s escalating regulatory push against Big Tech. We’ll also cover other market-moving news and, as always, provide a roundup of key international and domestic data releases.

Bond Market Turmoil: In a telling sign of shifting market priorities, bond investors largely dismissed the better-than-expected inflation data.

- The Consumer Price Index (CPI) fell in March for the first time in nearly five years, suggesting that recent tariffs have not yet translated into higher consumer prices. The index dipped 0.1% month-over-month, defying economists’ expectations of a 0.1% increase. Even the core CPI, which excludes volatile food and energy costs, inched up just 0.1%, well below the projected 0.3% rise. The moderation in inflation was driven largely by falling gasoline and used car prices.

- While the slowdown in the CPI report was welcomed, the exact drivers of the decline remain unclear. Weak demand — likely tied to broader economic concerns — appears to have weighed heavily on gasoline prices and airline fares, which fell 6.3% and 5.3%, respectively. Meanwhile, shelter cost, the index’s largest component, grew at its slowest pace since June of last year. The moderation in shelter costs suggests that the post-pandemic price distortions are gradually working their way through the economy.

- While cooling inflation has traditionally been welcomed by markets, investors are growing increasingly concerned about persistent price pressures due to tariffs. Retailers are now warning of potential price hikes as rising costs and lower inventories squeeze margins. These increases could emerge across various sectors, from imported fruits (with the US importing roughly 65% of its supply) to bicycles (which rely heavily on foreign components).

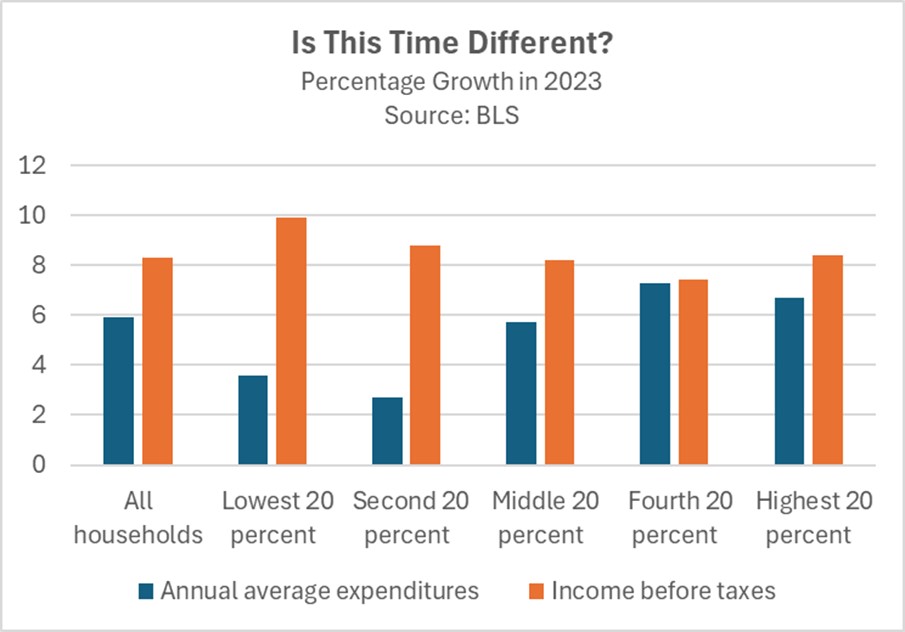

- Corporations appear to be ready to test their pricing power, with firms passing input costs on to consumers. While this worked early in the business cycle, it is unclear if it will be effective in the current environment. Lower-income households, while initially protected by pandemic-era savings and wage growth, now face diminishing financial cushions. Simultaneously, equity market declines threaten to suppress consumption via the wealth effect among affluent demographics. As a result, firms may face resistance.

- While stagflation cannot be ruled out entirely, it’s important to note this phenomenon typically occurs during severe energy shocks. In fact, before the 1970s, most economists considered stagflation theoretically impossible. That said, given the unexpected resilience of households in weathering inflation so far, we can’t dismiss the possibility completely. Currently, the bond market appears to be establishing a new equilibrium, a process that may temporarily impair its traditional role as an economic indicator.

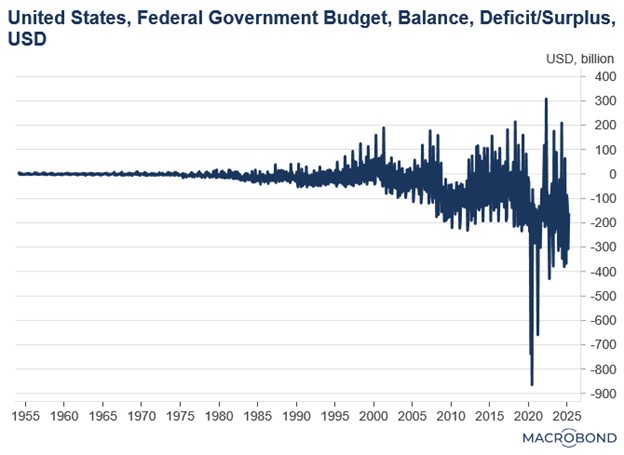

Fiscal Deficit Widens: As Republicans move closer to passing tax cuts, growing concerns emerge that investors may become wary of holding debt due to the rising deficit and uncertainty about future economic growth.

- House Republicans advanced their budget blueprint, 216-214, targeting extensions of Trump-era tax cuts and deeper spending reductions. The close vote, which relied on almost complete GOP support, revealed the party’s narrow majority. Lawmakers touted potential long-term savings of $1.5 trillion, but the bill only specifies $4 billion in cuts over the next decade, demonstrating a substantial discrepancy between their stated fiscal goals and the immediate impact of the legislation.

- Despite some fluctuations, the US deficit remains a significant concern. The federal government reported a $1.307 trillion shortfall for the first half of the fiscal year (October-March), marking the second-largest six-month deficit on record. This figure is close to the unprecedented $1.706 trillion deficit seen during the same period in 2021, when pandemic-related expenditures were at their highest.

- Luckily, investor appetite for long-term bonds in the primary market remains resilient in the face of headwinds. Thursday’s $22 billion, 30-year Treasury auction saw robust demand, with the debt clearing at 4.435%, below the expected yield at the bid deadline. This strong showing follows Wednesday’s solid 10-year Treasury auction, suggesting investor concerns about tariffs dampening demand for US debt may be overstated.

- While concerns persist about the recent rise in 10-year Treasury yields, there are no clear indicators this represents a crisis. The upward movement appears primarily driven by investors raising cash through position liquidations, though market speculation points to possible foreign central bank selling — the People’s Bank of China being the most probable candidate. Should this yield momentum continue, Federal Reserve intervention may become increasingly likely.

EU Prepares for US Talks: The EU is prepared to protect its interests as it seeks to meet the US halfway in some of its demands.

- European Commission President Ursula von der Leyen is set to negotiate with the US during a 90-day window. However, she has warned that the EU is prepared to walk away if talks are not conducted in good faith and potentially retaliate by targeting US trade in services, specifically tech firms, with digital taxes. Her threat follows US efforts to address the EU trade imbalance and scrutinize its tax policies.

- Her remarks follow the Trump administration’s criticism of the EU, targeting not only its trade surplus with the US but also its defense spending, tax policies, and regulatory framework. While the European Union has shown a willingness to discuss military expenditure and trade issues, it has remained silent on addressing other American concerns such as getting rid of VAT or loosening tech regulation.

- The current standoff between the US and EU will likely center on establishing a mutually beneficial framework for cooperation. The most probable outcome would involve creating an economic ecosystem that simultaneously limits China’s influence while advancing Western technological ambitions. Given these strategic imperatives, we believe negotiations could still foster closer transatlantic ties, provided both sides demonstrate a willingness to make concessions for a meaningful agreement.

End to Tariff Madness? China has retaliated against the US decision to impose 145% tariffs on its goods by introducing 125% tariffs on American products. However, Beijing has indicated it does not intend to escalate tariffs further.

- China’s move to raise tariffs on US goods signals its readiness to withstand a prolonged trade conflict with Washington. While Beijing has pledged to avoid further tit-for-tat measures, it has firmly stated it will not back down. These tensions underscore the accelerating economic decoupling between the world’s two largest economies.

- These escalating tariffs have now reached levels that make cross-border commerce commercially unviable for many firms. This development threatens corporate earnings in both nations, as US companies have depended on China’s rapidly growing consumer market for overseas profits, while Chinese firms have relied on access to America’s massive consumer base.