Daily Comment (April 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

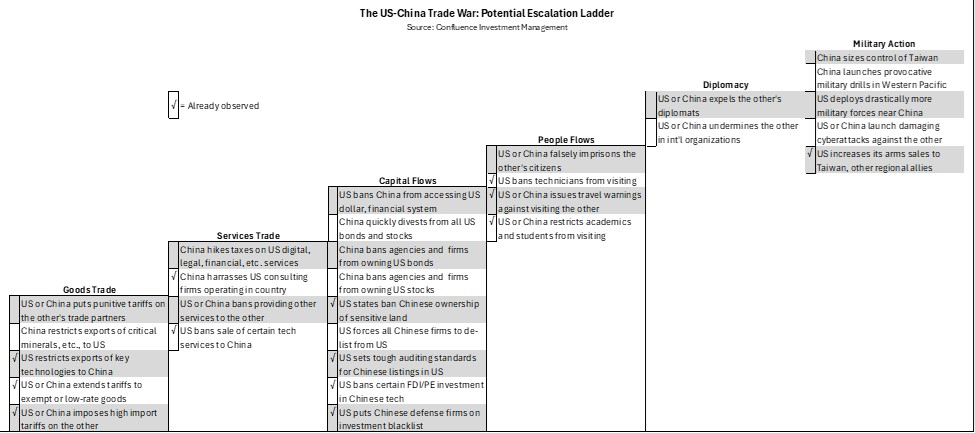

Against the backdrop of President Trump’s on-again/off-again policy moves and mixed messages, we think his 90-day pause on non-China “reciprocal” tariffs last week is confirmation that his top target in the trade war is China, as it likely should be. Since that suggests US-China tensions could keep rising, we start our Comment today with a potential “escalation ladder” of future adversarial steps between the US and China that investors should probably be watching for. We next review several other international and US developments with the potential to affect the financial markets today, including new signs of distrust between the US and Europe and a few words on what appears to be capital flight from the US.

US-China Trade War – Escalation Ladder: As noted above, Trump’s tariff moves last week seem to confirm that China is his top target in the trade war. Trump is trying to walk a fine line between rebalancing the US-China trade relationship while not antagonizing China too much. US-China tensions could therefore keep rising in the coming months, creating further investment risks. To show how US-China relations could evolve, we lay out the following potential “escalation ladder” of future steps that each side could take against the other:

- Restrictions on Goods Trade. Despite China’s statement last week that it won’t match any more US tariff hikes because further hikes would be economically meaningless, the US could keep hiking China’s rates. Both the US and China could also extend their tariffs to currently exempted goods or hike their tariffs on lower-rate products. They could also set non-tariff barriers on imports or exports (such as bans on critical mineral exports). They could even put tariffs on third countries that import from their adversary.

- Restrictions on Services Trade. Since tariffs are taxes on imported goods, the next step in the trade war could be for the US or China to impose onerous taxes on each other’s services, such as legal advice, consulting, or transport. They could also clamp down on the provision of services. For example, China could increase its ongoing harassment of some US firms providing legal, financial, and consulting services in China. The US might also try to ban its firms from providing such services.

- Restrictions on Capital Flows. For investors, an especially harmful escalatory move would be for the US to limit capital flows to or from China, and vice versa. For example, Treasury Secretary Bessent last week hinted that the federal government might force Chinese firms to delist from US stock exchanges. Such a move would add to existing restrictions on US investments in Chinese equities. The US or China could also bar its investors from buying their adversaries’ bonds, including Treasurys.

- Restrictions on Travel and Tourism. Both the US and China have already taken steps to discourage their citizens from visiting their adversary and to harass their adversary’s citizens in country. Further steps could include broadening the US ban on technicians visiting China to service advanced chip-manufacturing equipment. The US or China could also impose outright bans on academic researchers or students visiting one another.

- Diplomatic Maneuvers. One specialized form of travel restriction could be for the US or China to cut their diplomatic representation in each other’s country or demand a cut in their adversary’s diplomatic corps in country. Each side could also step up their efforts to undermine each other in international forums such as the United Nations.

- Military Initiatives. Just as Japanese leaders saw US sanctions and oil embargos as an existential threat in 1941, prompting them to attack Pearl Harbor, Chinese leaders facing the whole array of escalatory steps outlined here could potentially decide they must strike back militarily. For example, they could finally seize control of Taiwan. The US could also launch provocative military moves against China to back up its economic pressure. Clearly, such moves would be a worst-case scenario; they are not necessarily probable.

US-China Trade War – Electronics Exemption: In its latest on-again/off-again move on US trade policy, the Trump administration said late Friday that key electronic products would be exempt from its “reciprocal” 125% tariffs on Chinese imports. The exempted goods include desktop computers, laptops, tablets, smartphones, flat-screen televisions, memory chips, and chip-making equipment. However, Trump and his officials yesterday signaled that new tariffs would still be coming on many of those products in the near future.

- The Friday exemptions may constitute a subtle concession by Trump to encourage positive moves by China. After all, electronics make up the biggest category of Chinese goods sent to the US (smartphones alone account for almost one-tenth of US imports from China). The exemptions may also be aimed at helping US firms dependent on selling China-sourced goods, such as Apple. In response, futures trading currently suggests the US stock market will open on a firm note today.

- Nevertheless, the US’s remaining 20% tariffs against China will still be an issue, and the Sunday statements pointing to new electronics tariffs in the future will likely keep US-China tensions high. The risk of new tariffs in the future will probably also short-circuit any relief that US firms felt upon hearing of the Friday exemptions.

US-Japan Tariff Talks: Ahead of Thursday’s US-Japan talks on tariffs and trade relations, the policy chief of Japan’s ruling Liberal Democratic Party has offered assurances that his country would not try to use its massive holdings of US Treasury obligations as leverage. The statement signals that Tokyo will try to keep the talks as amicable as possible, raising the prospects for a quick agreement that isn’t overly disruptive for the Japanese economy and financial markets.

- Despite Tokyo’s assurances about US Treasurys, it is becoming increasingly clear that a key US economic risk from Trump’s trade policy may relate to financial flows rather than trade flows. The evidence in this regard is the fact that the market volatility touched off by the trade war hasn’t spawned the usual safe-haven buying in the US dollar and Treasury securities. Instead, the greenback has depreciated sharply, Treasury prices have fallen, and US bond yields have jumped.

- The decline in the dollar and Treasurys, along with falling values for US stocks and other risk assets, suggests that the dramatic changes in US trade and economic policies and the administration’s adversarial approach to foreign countries have undermined faith in the US as an investment destination. That could merely reflect near-term concerns about a US recession. However, if these trends continue, they could mean that the US has become more fundamentally tarnished and that what we’re seeing is capital flight.

- Capital flight could weigh on the US domestic economy in a couple of important ways. For one thing, Treasury dumping by foreign countries, central banks, or private institutions could push US interest rates so high as to impede investment and economic growth. At the same time, the falling dollar would likely further raise the price of imports, weighing on consumption and pushing up inflation.

Taiwan: The ruling Democratic People’s Party is reportedly mulling the launch of recall campaigns against opposition lawmakers with the relatively China-friendly Kuomintang party. The KMT has only 52 of the 113 seats in the legislature, but with six allies from the Taiwan People’s Party and two independents, it has been able to form an opposing majority to paralyze the DPP’s legislative initiatives. One key risk is that a DPP recall initiative could worsen political polarization on the island and shift support toward the KMT.

Ecuador: In elections yesterday, conservative President Daniel Noboa was re-elected to a new four-year term with approximately 56% of the vote. The loser was Luisa González, a protégé of leftist former President Rafael Correa. Now that he has a full term in office, Noboa is expected to continue his tough crackdown on violent drug gangs and keep building ties with the US.

European Union-United States: In the latest sign of falling trust between the US and the EU, the European Commission has reportedly begun issuing burner phones to US-bound officials to avoid US espionage. The measure replicates steps taken for EU officials traveling to Ukraine and China to avoid Russian or Chinese surveillance. The measure also illustrates the extent to which US-EU trust has fallen, which could derail any future efforts by the two sides to cooperate in security, trade, or finance.

United States-Iran: US envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi met in Oman on Saturday to start talks aimed at preventing Iran from acquiring nuclear weapons. The US and Iran had both insisted that the initial talks were merely aimed at gauging whether the other side was serious about an agreement. Early reports suggest both sides saw the other as serious, so follow-on talks are scheduled for next Saturday.

US Fiscal Policy: “First Buddy” Elon Musk reportedly said in a Cabinet meeting last week that his Department of Government Efficiency would fail to reach its goal of cutting $1 trillion in federal spending in the current fiscal year, which ends September 30. Instead, Musk said DOGE would cut about $150 billion in outlays, and outside analysis suggests even that figure is inflated by errors and miscounts.

- DOGE’s failure to achieve greater spending cuts could make it harder for President Trump to get Congressional approval for the upcoming year’s budget, which includes extensions to his 2017 tax cuts.

- Given the political and administrative challenges to cutting outlays significantly, Trump’s extended tax cuts could well lead to even bigger budget deficits. With global investors now increasingly wary about investing in the US, that could prompt even weaker demand for Treasury securities and a further backup in yields.

US Consumer Spending: In a little-noticed statement in its first-quarter earnings report, JPMorgan said the portion of loans in its credit card business deemed unrecoverable has now risen to a 13-year high. The statement is consistent with other incoming reports that suggest charge-offs in the overall credit card industry are now higher than they were before the coronavirus pandemic. The data adds to the current worries that consumers may be ready to rein in their spending, which would slow economic growth and reduce corporate earnings.

US Commercial Real Estate Industry: According to data provider CoStar, a tentative rebound in office demand that saw leasing activity jump 13% in the first quarter is already cooling in response to the uncertainties of the administration’s trade war. Office-building sales and refinancings have also reportedly slowed after a short-lived rebound. A new downturn in the market would not only weigh on stocks directly related to office buildings, such as real estate investment trusts, but it would also keep alive risks to the broader financial system.