Asset Allocation Quarterly (Second Quarter 2025)

by the Asset Allocation Committee | PDF

- Our three-year forecast includes an economic slowdown in the near term and potential recovery later in the period.

- As the recession likelihood has increased significantly, we are reducing risk across the portfolios.

- Trade and fiscal policy uncertainty will continue to dampen business investment as well as consumer and investor sentiment.

- Monetary policy is likely to ease modestly in response to recessionary conditions; however, the degree of easing may be restrained due to inflation concerns.

- Domestic equity exposure includes large and mid-caps, but we exit small caps this quarter.

- International developed equities are attractive given a weakening US dollar, favorable valuations, and the repatriation of foreign investment in the US.

- Gold and long-term Treasurys remain in the portfolios to curb volatility.

ECONOMIC VIEWPOINTS

Uncertainty surrounding trade policy is a key driver of our forecast this quarter, which includes an increased probability of a recession. At the time of this writing, the latest US trade policy includes the implementation of a 10% universal minimum tariff on goods from most countries, with higher, reciprocal rates applied to imports from countries that impose their own barriers on US exports, namely China. These tariffs are designed to shift global trade relationships through a mix of protectionism and leverage for future negotiations. Crucially, the on-again, off-again tariff policy, including shifting exemptions and the prospect of bilateral negotiations, has added to business uncertainty.

The lack of clarity in the magnitude, scope, and duration of trade measures is expected to have tangible economic effects, particularly on business, consumer, and investor activities. Surveys indicate that small business owners are increasingly doubtful about whether now is a good time to expand. Consequently, potential delays in capital expenditures could hamper long-term growth. US manufacturing construction spending has more than doubled since 2022, driven by reshoring efforts and policy incentives like the CHIPS Act. The rapid rise reflects major investment in sectors such as semiconductors and clean energy. As of 2024, spending has plateaued, suggesting a pause amid growing policy and cost-related uncertainties.

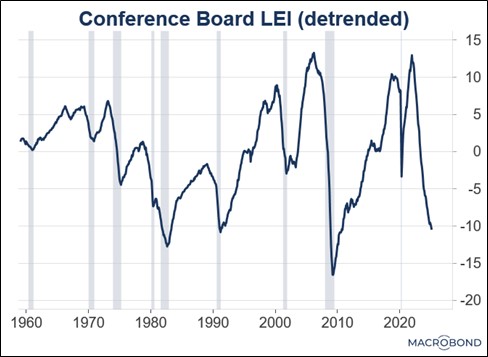

The economy was already losing momentum prior to the new tariffs, which when implemented could further exacerbate recessionary pressures. The Leading Economic Index (LEI) serves as a predictive tool, anticipating turning points in the business cycle. The most recent detrended LEI reading has fallen to levels last seen during the Great Financial Crisis (recessions marked by gray shading in the chart). A recession has been avoided mostly due to expansive fiscal policy, but the combination of tariffs and the lack of additional fiscal stimulus (extending the current tax rates avoids hikes but has little additional fiscal impact) means the recessionary signal offered by the LEI may become relevant. The downturn reflects a sharp deterioration in consumer expectations and a pullback in manufacturing new orders, both key components of the index.

Amid heightened policy uncertainty, the slowdown in business investment may result in an unwinding of labor hoarding, a key factor that has supported employment metrics despite moderating growth. While aging demographics and unresolved immigration policy provide structural support to the labor market over the long-term, near-term pressure may intensify the slowdown. Plunging consumer sentiment, driven by rising costs and the turbulent trade policy environment, is expected to weigh on consumption. Should labor markets deteriorate further, the US economy’s primary growth engine, consumer spending, could lose momentum. At the same time, frictional costs from tariffs, supply chain realignment, and elevated input costs are likely to sustain inflation above the Federal Reserve’s 2% target, even as growth moderates. These mixed signals will make it harder for the Fed to appropriately react to underlying economic conditions. We expect the federal funds rate to decline gradually in response to recessionary conditions; however, rates are unlikely to fall as low as they did during the last bear market. In this environment of elevated volatility and shifting policy dynamics, assessing the underlying strength of the economy remains increasingly complex for both investors and policymakers.

STOCK MARKET OUTLOOK

The introduction of sweeping tariffs and the resulting uncertainty around international trade relationships carry meaningful implications for equity markets. The shift in global trade policy represents more than just a near-term market disruption; it marks a potential paradigm shift in global investing. As the US becomes entangled in potential trade wars, creating heightened geopolitical risk and policy unpredictability, the US equity markets’ traditional status as a global safe haven may be challenged, potentially leading to slower capital inflows and elevated volatility. While near-term impacts are uncertain, tariffs tend to constrain supply, raise costs, and weaken profitability, especially in sectors reliant on global trade.

We have moved to a more defensive posture in our equity allocations, including a 40/60 weight on the growth/value style bias to reflect the increased recession likelihood. Large cap equities should continue to benefit from passive flows, while mid-cap equities offer valuation expansion potential. We added dividend-focused ETFs to the large and mid-cap allocations as dividends may become more important as volatility rises. Given our heightened recession outlook, we exited small cap equities. Small caps historically underperform in downturns due to their higher sensitivity to economic cycles, particularly when financial conditions tighten and market volatility increases. This move reflects a shift toward more defensively positioned assets with greater liquidity.

In sector weights, we maintain the exposure to advanced military technologies given rising geopolitical tensions. Potentially challenging conditions for US defense spending has led us to exit our cybersecurity position. We added Consumer Staples sector exposure as a defensive position amid economic uncertainty. Lastly, we exited the uranium position as this commodity isn’t expected to perform well during downturns.

We initiated an allocation to international developed markets. We expect the US dollar to weaken due to a combination of policy and macroeconomic factors, which could support foreign investment returns for dollar-based investors. Additionally, international developed equity valuations remain compelling. Europe, in particular, is well-positioned to benefit from improving growth outlooks due to eased regulations surrounding fiscal stimulus. In a sense, the pressure on European policymakers is encouraging fiscal adjustments that previously seemed unfeasible.

Our foreign developed market exposure also includes a position in a Swiss franc currency ETF. The franc has historically appreciated during periods of global monetary uncertainty and dollar softness, and it provides regional exposure to Europe without the political and fiscal risks embedded in the eurozone. Switzerland’s strong current account surplus, low debt levels, and independent monetary policy enhance its appeal as a safe, high-quality European-linked currency. This position allows the portfolios to benefit from foreign exposure with less overall equity market risk. The heightened uncertainty around a potential trade war with China keeps us out of emerging markets.

BOND MARKET OUTLOOK

The mercurial approach by the US to both trade and geopolitical events will lead to uneven inflation prints through the course of our three-year forecast. Although we expect the general level of inflation to remain well below levels recorded at the height of the post-COVID regime, we remain doubtful that the Fed will be able to engineer a return to its oft-cited 2% target. Rather, trade policies and economic responses are likely to lead to CPI prints averaging closer to a 3% level, especially if the Fed responds to economic weakness with a series of rate cuts over the next year or two. Given our expectations for heightened inflation volatility, our forecast is for a modestly sloped normal yield curve to prevail over the next three years. A smaller number of Fed rate cuts may limit long-term interest rate declines and reduce the likelihood of a yield curve inversion. Nevertheless, real returns above the rate of inflation will continue to reward savers. Although we extended duration slightly, the preponderance of the bond exposure in the strategies with an income component remains in the intermediate maturity segment.

Among sectors, we continue to emphasize Treasurys and mortgage-backed securities (MBS). Regarding the latter, the high level of refinancings several years ago in the ultra-low-rate environment continues to suppress prepayment speeds and limits duration extension in seasoned MBS. In addition, discounted prices on these securities offer a cushion with volatile rates and the potential for upside performance should we experience a lower rate environment. In contrast, we hold a less than sanguine outlook regarding intermediate to long-term investment-grade corporates. In a challenged economy, their current tight spreads to Treasurys are expected to widen and return to historic levels. Similarly, speculative grade bonds are trading at option-adjusted spreads well below where they trade in an economically challenged and uncertain market. Accordingly, we significantly reduced the speculative grade exposure, with the small positions remaining solely in higher-rated BB credits.

OTHER MARKETS

We maintain gold exposure across all strategies and have selectively increased our allocation in certain portfolios. Gold continues to serve its intended role in the portfolios, offering stability during periods of elevated uncertainty. Persistent central bank demand underscores its importance as a reserve asset and inflation hedge. With rising geopolitical tensions and a push to diversify away from the US dollar, we expect this trend to continue, reinforcing gold’s strategic role in portfolio construction.