Daily Comment (April 17, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning. Global monetary policy concerns are currently a key focus for the market. In sports, reigning Champions League titleholders Real Madrid were eliminated by Arsenal. Today’s Comment will address recession fears in Canada, the Federal Reserve’s policy stance amid tariff uncertainty, and other market-moving developments. As always, this report will include domestic and international data releases.

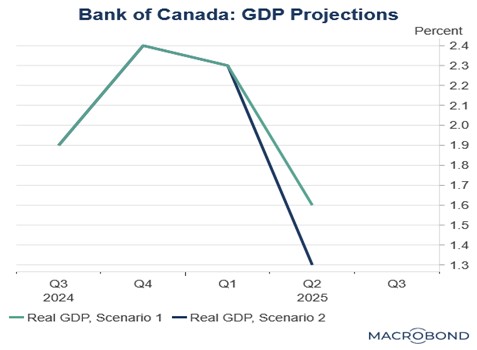

Trouble Up North? The Bank of Canada became the first G-7 central bank to flag a trade war as a potential recession trigger.

- BOC Governor Tiff Macklem delivered a sobering warning about Canada facing a potential once-in-a-generation economic crisis. While the economy showed resilience through late 2024, recent developments have revealed a dramatic deterioration fueled by growing trade policy uncertainty, particularly from aggressive US tariff measures. Macklem expressed concerns that escalating trade tensions could push Canada into a prolonged recession, potentially creating rising inflation and increasing unemployment.

- The grim economic outlook reflects growing concerns that Canada may struggle to maintain growth amid escalating trade tensions with its southern neighbor. The auto sector (a key pillar of the economy) has already shown signs of strain: Stellantis has temporarily idled a factory, General Motors is planning months-long plant shutdowns, and Honda is rumored to be considering a relocation of 90% of its Canadian and Mexican production to the US to prioritize local sales.

- Economic anxieties have surged to the forefront of Canada’s election campaign, now just 11 days away. Prime Minister Mark Carney, leading the Liberals, and Conservative challenger Pierre Poilievre are locked in a high-stakes battle to prove their ability to navigate relations with US President Donald Trump. Wednesday’s inaugural televised debate revealed stark contrasts as Carney positioned himself as the steady crisis manager, while Poilievre embraced the mantle of radical change.

- Canada’s economic vulnerability and heavy reliance on US trade have elevated this election to historic importance, with the outcome likely shaping how the nation weathers a potential trade conflict with its southern neighbor. The Conservative candidate previously enjoyed what seemed to be an insurmountable advantage just months ago, but the political landscape has shifted decisively as voters perceive PM Mark Carney as being best equipped to counter President Trump’s assertive approach toward trade talks.

- As the global order fragments into economic blocs, stronger US-Canada alignment could foster coordinated policy responses to address shared concerns about China’s economic and geopolitical ambitions. We believe that Carney’s pragmatic stance positions him favorably for negotiations with the Trump administration. His recognition of Canada’s limited retaliatory capacity in trade disputes underscores his unwillingness for an out all out back and forth between the two countries.

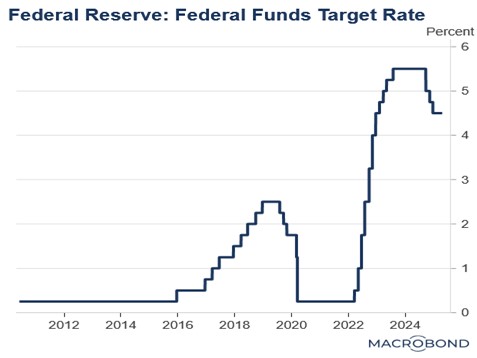

Fed Concerns? Federal Reserve Chair Jerome Powell hinted that tariff uncertainty may lead the Fed to hold rates unchanged for the rest of the year.

- During a speech at the Economic Club of Chicago, Powell warned that trade uncertainty has complicated the Federal Reserve’s efforts to fulfill its dual mandate of maximum employment and price stability. He noted that the current tariff levels far exceed the Fed’s worst-case projections, potentially forcing the central bank to adopt a more cautious, wait-and-see approach to interest rate policy. With Fed officials still uncertain about whether to prioritize inflation control or unemployment, the path forward remains unclear.

- Powell’s lack of explicit guidance has raised market concerns that the Fed may deliver fewer rate cuts than anticipated. According to the CME FedWatch Tool, investors currently assign a 64% probability to three or four rate cuts this year. This uncertainty triggered a mild equities sell-off, as traders grew skeptical that the central bank would intervene to cushion a sharp market downturn — a phenomenon known as the Fed put.

- While the Fed and the market are concerned about rising inflation and slowing GDP growth (aka stagflation), it’s important to note that true stagflation is exceptionally rare. The last significant occurrence in the US was in the 1970s and was driven by the Arab oil embargo. Given that oil prices have declined and broader economic data remains relatively stable, we believe it’s too early to determine the economy’s true trajectory.

- Despite concerns over trade policy, we believe the Fed is likely to keep its policy tools available to address economic risks. While Chair Powell has signaled hesitation about easing policy amid elevated inflation risks, we expect the central bank’s stance could shift swiftly in the event of a severe disruption, such as a sudden spike in defaults or emerging liquidity strains. Barring such shocks, however, the Fed will probably remain on hold and allow developments to unfold.

Trade Talks Progress: Giorgia Meloni, Italy’s Prime Minister, aims to strengthen US-EU ties, while Japan and the US maintain ongoing discussions.

- Prime Minister Meloni is scheduled to meet with President Trump on Thursday, following the breakdown of recent EU-US trade negotiations. Her shared populist background with the US president has positioned her as a potential mediator. The visit occurs amidst EU accusations that the US failed to articulate its specific demands for a trade agreement. During those negotiations, the EU offered to eliminate all tariffs if the US reciprocated. The White House rejected this proposal, insisting on a 10% baseline tariff.

- Despite the lack of progress in EU negotiations, the Trump administration has made headway in discussions with Japan. While specific details remain undisclosed, a second round of negotiations is anticipated later this month. It is expected that both sides will seek agreements on trade and defense.

- US discussions with the EU and Japan are expected to be intense as they aim to establish a framework for an agreement before the 90-day exemption period expires. Given that the deadline is anticipated to near the Fourth of July holiday, we believe an arrangement will likely be finalized in time for the president to potentially use it as a marketing tool.

US-Iran Talks: The two sides have agreed to hold talks in Rome about Iran’s nuclear program this weekend.

- US officials met with their Iranian counterparts last Saturday in Oman for the first round of discussions. The two sides are currently working to define their ultimate objectives regarding Iran’s nuclear capabilities. Complicating matters, Iran has accused the US of moving the goal post from first aiming to limit its nuclear capability to now wanting to shut it down completely.

- The disagreement over what the US aims to achieve in talks with Iran appears to be driven by internal divisions within his inner circle. President Trump has made it clear that he would like to prevent Iran from weaponizing its program and creating a nuclear bomb. This comes after he refused to support Israel’s desire to strike Iran’s nuclear sites as soon as next month.

- Ongoing discussions are likely a positive for the market as they reduce the likelihood of conflict. Trump appears unwilling to pursue military action if a deal can be reached, potentially paving the way for an agreement between the two sides in the coming months.

Note: There will be no Daily Comment published tomorrow due to the holiday.