Daily Comment (April 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Investors are closely tracking the president’s latest remarks on trade policy and a flurry of earnings reports. In sports, the Lakers evened their playoff series with a decisive win over the Timberwolves. Today’s Comment will examine softening trade tensions, renewed debates about Fed independence, and other market-moving developments, along with our regular roundup of international and domestic economic data.

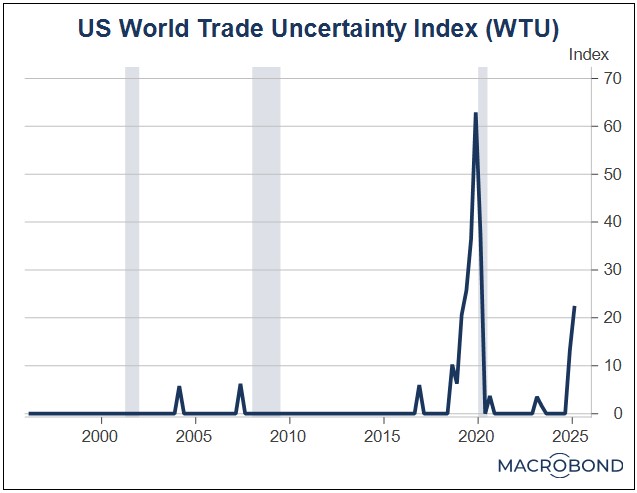

Ease in Trade Tensions: Growing hopes that the US will secure trade agreements with key partners have boosted market optimism, but businesses increasingly worry about rising costs.

- Speaking at a JP Morgan investor conference, Treasury Secretary Scott Bessent predicted that the US and China will ultimately settle their trade standoff, citing the punishing tariffs — as high as 145% on Chinese imports and 125% on American goods — that now function as de facto trade barriers. He warned that sustaining such extreme measures would harm both economies, making their rollback not just likely but inevitable. Despite his confidence, he admitted that there were no talks between the two sides at the moment.

- Bessent’s openness to trade talks with China was warmly received by markets, offering hope after fears that the world’s two largest economies were headed for a prolonged standoff. Later in the day, President Trump echoed a conciliatory tone, stating he does not intend to “play hardball” with China and expects tariff rates to drop significantly from their current highs to more sustainable levels.

- Prospects of de-escalating trade tensions could provide a much-needed boost to market optimism, following growing alarm from corporate America about tariff impacts. US aerospace and defense manufacturers have warned that tariffs would significantly increase production costs. Meanwhile, electric vehicle pioneer Tesla, while relatively insulated from the broader tariff effects, expressed particular concern about potential changes to import duties on Chinese-sourced lithium iron phosphate (LFP) batteries.

- While the potential easing of trade tensions may provide support for equities, significant uncertainty remains about how existing tariffs will affect corporate performance moving forward. Consequently, we will be closely monitoring upcoming earnings reports for insights into how companies are adapting to these pricing pressures. In the interim, it may be prudent to maintain a defensive portfolio stance until markets gain clearer visibility on what constitutes the “new normal” in this trade environment.

Fed Independence Stays: President Trump has retreated from his earlier suggestion to dismiss Fed Chair Jerome Powell, though he maintains his position that interest rates should be reduced.

- The president reversed course Tuesday on his threats to fire Federal Reserve Chair Jerome Powell. Powell had previously warned that rising tariffs could fuel inflation, even as he resisted pressure to cut interest rates amid economic concerns. The apparent shift reflects mounting administration fears that undermining the Fed’s independence could further destabilize financial markets, which are already shaken by ongoing trade tensions.

- The president’s reversal follows increasing calls from Fed officials advocating patience as tariffs ripple through the economy. On Tuesday, Richmond Fed President Thomas Barkin struck an optimistic tone about economic growth while warning of potential stagflation risks — a key reason he supports maintaining current interest rates. Meanwhile, Fed Governor Adriana Kugler echoed similar concerns about the inflationary impact of tariffs during her public remarks.

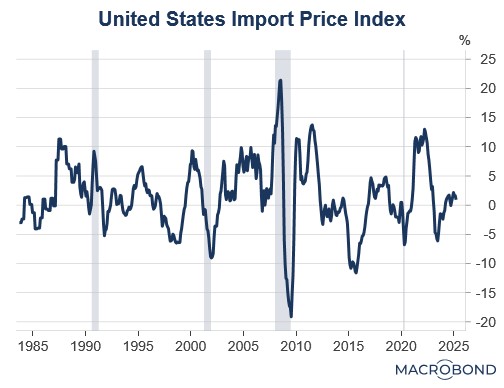

- Understanding the inflationary impact of tariffs requires monitoring the import price index, which reveals the cost of imports before tariffs are levied. Therefore, a continuous decrease in import prices would imply that foreign sellers are absorbing the tariff costs, which should soften the impact of the levies for their respective US buyers. However, if the index remains stable or rises, it could mean that US firms may be forced to push tariff costs on to consumers or accept lower profit margins.

- Growing confidence that the White House will respect Federal Reserve independence is expected to bolster demand for US Treasurys, which would be a timely development as the government seeks to finance widening fiscal deficits. This renewed appetite should prove particularly valuable for today’s five-year note auction, where foreign investors typically account for roughly 60% of total demand. A strong auction result would be viewed as favorable by the market.

Ukraine-Russia Progress: The White House has delivered its “final” peace proposal to Moscow and Kyiv as both sides weigh concessions to end the war.

- The White House’s new peace proposal includes several significant concessions to Russia including formal US recognition of Crimea as Russian territory, de facto acceptance of Russian-controlled territories seized since 2022, and a complete lifting of sanctions imposed since 2014. The deal would also guarantee Ukraine’s exclusion from NATO membership while establishing a new US-Russia economic partnerships in energy and industrial sectors.

- Under the proposed arrangement, Ukraine would receive robust security guarantees featuring peacekeeping forces from European and allied nations, along with the return of Russian-occupied territories in Kharkiv Oblast. The deal ensures free navigation rights along the Dnieper River and includes comprehensive reconstruction assistance, combining international funding with compensation mechanisms.

- Following the latest proposals — and amid reports that the US could withdraw from negotiations — both sides have made concessions to salvage a potential deal. Russian President Vladimir Putin has signaled his willingness to halt military operations along the current frontlines, while Ukrainian President Volodymyr Zelensky has shown new openness to talks, marking a significant shift in posture after signs of deadlock.

- While an immediate agreement remains unlikely, recent developments suggest a peace deal could materialize in the coming weeks. European equities stand to benefit most from a resolution, as an end to hostilities, coupled with the potential return of Russian energy supplies to global markets, would alleviate key economic pressures across the region.

Global Response to Tariffs: As nations engage in trade negotiations with the United States, growing uncertainty threatens to dampen global economic growth.

- New Delhi is showing a renewed flexibility in its ongoing trade negotiations with the US. A notable concession under consideration by the world’s most populous nation involves the elimination of tariffs on luxury vehicles and auto components, a move intended to strengthen bilateral trade ties. This development is unfolding alongside persistent US pressure on India to lower e-commerce barriers that currently impede market access for American retail leaders such as Amazon and Walmart.

- Recent PMI data reveals growing concern among business leaders about US tariffs, with the latest index reading hovering just above 50.1, barely surpassing the threshold for economic expansion. This persistent lack of confidence suggests that the region remains wary about future growth prospects as trade tensions escalate.

- Despite escalating trade tensions and protracted negotiations, the IMF maintains its forecast that the global economy will avoid recession. While the institution has downgraded its worldwide growth projections — including a significant reduction in its US outlook from 2.8% to 1.8% — it remains cautiously optimistic about continued expansion. If this outlook holds, it could foster increased risk appetite in financial markets heading into year-end.