Daily Comment (November 16, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] After a day of profit taking, the previous trends have returned; the dollar is up as are Treasury yields. Gold prices are lower. Oil prices are giving back some of their large gains from yesterday as the API data showed a larger than expected build in stockpiles. The official DOE data is out at 10:30 EST.

The media remains focused on President-elect Trump’s transition. We are watching this too but with some degree of restraint because, at this juncture, it’s a bit like what’s going on in baseball. In the latter, this is “hot stove” season, where trades are made and free agents are soon to follow. Baseball writers are floating all sorts of trade packages and tracking down rumors of deals. Although it’s great sport, it will be a bit of time before actual transactions occur. The same is true for the new administration. Names are being floated about; a great deal of electronic ink is being deployed in commentary. But, the “decider,” Trump, has been rather quiet about his choices. Until people are actually named to positions, we are not going to comment about his choices and the impact on policy.

It appears we are seeing a battle within the transition team between the populists and the establishment. The latter does seem to be trying to sway the new president into a traditional center-right package of tax cuts and hard money. For example, David Malpass, an economic consultant with supply side leanings to the Trump campaign, is on the tape this morning calling for the Fed to create a plan to shrink its balance sheet. We suspect this would lift long-term interest rates; how much rates would rise depends on a number of factors but, barring a recession, it is difficult to see how this would lower rates. Similar talk has emerged about appointing hawks to the two open Fed governor positions. The establishment wants the new administration to focus on tax cuts and deregulation. Fiscal spending, trade restrictions and immigration curtailment would be, at best, back burner concerns for the establishment and probably not enacted. The populists could probably live without hard money and tax cuts but really want to see infrastructure spending, immigration control and trade impediments. Our read is that if the establishment wins, Trump will likely face a primary challenge by a populist in 2020, and the Democrats won’t make the same 2016 mistake and will run a candidate from the Warren/Sanders wing of the party.

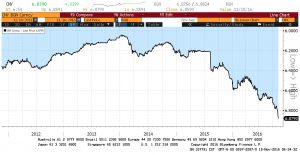

Meanwhile, we are seeing the dollar strengthen. What is occurring in China is especially notable.

This chart shows the CNY/USD exchange rate (inverted scale). The Chinese yuan is making new lows this morning. Such weakness will likely trigger Trump’s campaign promise to declare China a “currency manipulator.”

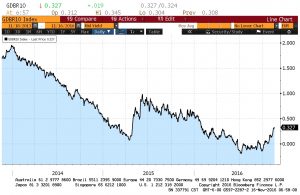

We are also seeing rising rates abroad.

This chart shows the yield on the 10-year German sovereign. After falling into negative territory for the first three-quarters of the year, we are seeing a sharp rise in rates. In our standard bond model, a 100 bps change in this yield adds 23 bps to the U.S. 10-year T-note.