Daily Comment (November 23, 2016)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] U.S. stock futures moved mostly sideways after reaching a record high over the past two days. There was little additive news to the macro and political news that have carried the U.S. reflation trade recently. President-elect Trump gave an interview to the NYT yesterday and commentators generally agreed that his tone has softened from the harsher campaign rhetoric. A WSJ article suggested that Romney is Trump’s top pick for Secretary of State. Markets rallied modestly on the news as his policies are expected to be market-friendly. Two other major personnel decisions are still undecided, although Steven Mnuchin is seen as the most likely candidate for Treasury Secretary and James Mattis for Defense Secretary.

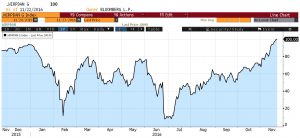

The probability of a December Fed hike was around 85% after the election, but has crept up slowly and has now reached 100% (the likelihood is actually 100.2%). The chart below shows the level of market expectations for a hike next month. The market is expecting a 25 bps move, with a very small likelihood that it might move even more (represented by the 100.2% probability). These expectations follow the strong market rally and comments from several Fed officials indicating their openness to a December hike, including Chairwoman Yellen, who acknowledged that a rate hike may be coming “relatively soon.”

Oil moved lower this morning as participation from Iraq and Iran in an OPEC production cut was left unresolved. Although Saudi Arabia is still the largest producer in the bloc, pumping 31% of OPEC output, Iraq and Iran have gained market share following the end of sanctions and war. Iraq is currently the second largest producer of the bloc, pumping 13.5% of the group’s output, while Iran is third with 10.8% of production. Both countries would also like to expand production. Their reluctance to cut production means Saudi Arabia would have to shoulder a larger portion of the quota.