Daily Comment (January 4, 2017)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] It was mostly quiet overnight. Perhaps the most interesting news came from National Front Leader Marine Le Pen, who indicated that she would want a single currency in Europe to continue even if France leaves the Eurozone. Le Pen has said before that if she wins the presidency she will hold a referendum on exiting the Eurozone and returning to the franc. However, today she seemed to indicate that she really wants a return to the old European Monetary System (EMS), which was a series of exchange rate pegs with some degree of flexibility. We suspect she is trying to soften her currency position in front of the spring elections. Polls suggest most voters in France would prefer to stay in the Eurozone and our research suggests that there is little need for France to leave the single currency. Simply put, in terms of relative inflation, there are no serious valuation problems in France. By harkening back to the pre-Eurozone era, Le Pen is, it seems, looking to “make France great again.” Of course, the EMS also existed when there were two Germanys.

Britain’s ambassador to the EU resigned in frustration with the May government. Sir Ivan Rogers was one of the country’s most experienced diplomats. He has consistently indicated that Brexit would be messy and difficult and that the EU is likely to make the process onerous, simply as a warning to other members that leaving is costly. According to the FT, members of the May administration were tired of Roger’s pessimism; sadly, he is probably giving the prime minister an accurate picture of Britain’s future outside the EU.

According to Bloomberg, Chinese officials are looking at a number of measures to curb capital flight. China allows households to move $50k each year offshore; this year, reports suggest the paperwork has expanded to discourage such actions. As we have documented over the past year, China has been spending part of its foreign exchange reserves to slow the CNY’s weakness. According to reports, China is “encouraging” state owned firms to bring offshore funds back to China and may require them to convert these offshore holds to CNY.

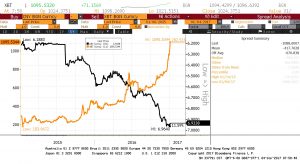

One of the indicators we monitor is bitcoin.

This chart shows the CNY against the XBT/USD relationship over the past two years; we have seen the two exchange rates steadily diverge. This may be due to Chinese investors using the anonymous bitcoin architecture as a conduit to push money out of China. If this is the case, and Chinese authorities can’t find a way to close this portal, bitcoin could continue to rise and China will be forced to use more of its reserves to prevent the CNY from weakening further and faster.