Daily Comment (February 6, 2017)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] It was a mostly quiet weekend, at least quiet based on the standards of the new administration. Super Bowl weekend has become something of a national holiday in the U.S. and last night’s game was one for the ages. So, even with injunctions and tweets, most of the focus was on the game and the caloric treats that accompany.[1]

Still, there were some articles of interest. One of the key political battles we have been watching is what we have framed as the “Ryan v. Bannon” match. Ryan represents the traditional GOP positions favoring low tax rates, balanced budgets (which, by arithmetic, require cuts in government spending), free trade, globalization and deregulation. Bannon represents the right-wing populists who favor deglobalization, including immigration and trade restrictions, along with defense and infrastructure spending, with little to no regard for deficits.

This battle will have numerous iterations, one of which surrounds corporate tax reform. The Ryan wing wants to cut the highest marginal rate and allow for all investment to be deducted from taxable revenue (ending depreciation) and expand the base of the tax by ending the deduction on interest payments. However, the key revenue offset comes from a “border adjustment,” which would tax imports but leave export revenue untaxed.

This border adjustment is complicated and fraught with uncertainty. If it works as planned, the obvious lift in import prices would be offset by a stronger dollar. Over time, the adjustment would give an incentive for firms (foreign and domestic) to source investment and production in the U.S., which would boost U.S. employment but also likely lead to retaliation from foreign nations. The Tax Policy Center estimates that by 2026 the net effect of corporate tax reform will reduce tax revenue by $890.7 bn; if the border adjustment isn’t included, this number rises to $2.07 trillion.[2] For establishment members of the GOP, the rise in deficits is unacceptable.

However, President Trump has already indicated he is less concerned about the deficit, suggesting that defense spending alone should rise regardless of tax revenue. He has also vacillated about the border adjustment; on the one hand, if it brings investment into the U.S., it would be favorable. On the other, it does reduce his flexibility to unilaterally impose trade barriers on nations he feels aren’t fairly trading with the U.S. We note Reuters is reporting that Kevin Brady, the head of the House Ways and Means Committee, is suggesting he is willing to make adjustments to the program. Once this horse trading starts, the whole purpose of the tax reform, which is to lower the rate and broaden the base, becomes a mere tax cut, which would lower the rate as exceptions are made to the border adjustment.

Our base expectation is that President Trump will need to placate both the GOP establishment and the populists to succeed. This involves doing two things, finding common ground between the factions and figuring out the priorities of each side. Thus, a trade of immigration reform for corporate tax reform that is less revenue-negative might work. How Trump manages these competing interests will, to some extent, define his administration. One thing we do expect, however, is that deficits will likely rise. We still expect both defense and infrastructure spending to increase over the next four years.

Other interesting news…Germany’s Finance Minister Wolfgang Schäuble indicated that the EUR is too weak for the German economy and blamed the ECB for this weakness. As we have noted recently, we would tend to agree with this assessment. However, Schäuble’s complaints are a bit disingenuous. It’s true that Germany doesn’t control forex policy; that mandate does reside with the ECB. However, Germany’s saving and investment policies lead to large trade surpluses and low inflation, which would lead to a stronger currency if the D-mark still existed. One way Germany could address the overly weak EUR would be to boost its fiscal spending and raise inflation, addressing the currency distortion.

PM May of the U.K. may be facing a revolt within her own party as a group of Tory MPs broke rank and criticized her strategy before parliamentary votes for Brexit. It is still unlikely that Parliament will reverse Brexit but, without solid support from her party, her bill to exit the EU might become larded with amendments and could lead to a hard Brexit without any trade deal.

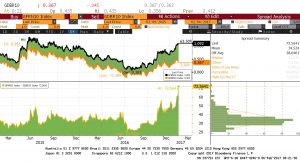

Marine Le Pen has launched her campaign for president. According to reports, she is following the Trump model, suggesting the nation is under attack from the EU and foreign influences that aim to undermine the French system and its economy. Current polls suggest she will reach the runoff stage (the French electoral system requires a majority; if one does not emerge in the first round, a second round is held between the top two vote winners from the first round). Due to scandal and disarray, the conservatives are falling in the polls and thus a populist win in France is a growing possibility. The chart below shows the German and French 10-year sovereigns. Note the spread is widening as French yields rise relative to Germany on worries about a populist president in France.

______________________________________

[1] At the O’Grady household, it was flatiron steak tacos with red mole sauce; white chocolate cake for dessert.

[2] http://www.taxpolicycenter.org/sites/default/files/alfresco/publication-pdfs/2000923-An-%20Analysis-of-the-House-GOP-Tax-Plan.pdf