Daily Comment (February 9, 2017)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] One of the political factors we watch with a new president is the management of political capital. Political capital is essentially the goodwill, the mandate, which comes from winning an election. Although not a hard and fast figure, it does appear to exist, can be depleted and has a “sell-by date.” In general, by the 18th month of the first term, the capital is exhausted even if it isn’t spent. By that time, Congress is gearing up for the midterm elections and the president’s goals and aspirations become secondary to the desire for reelection.

Essentially, it’s all about first understanding the strength of the mandate and “spending” it wisely. In my recollection, no president is perfect in this area. In the sweep of the moment, it’s easy for a president to think he can do more than he is actually able and to get distracted by side issues that consume more time, effort and political capital than the issues warrant. It’s also critically important for a president to understand the environment. All Democratic Party presidents pine for the expansion of health care; Republicans for entitlement changes. Attempting to achieve these changes tends to consume a lot of political capital and it’s hard to get much else accomplished.

President Trump is something of an enigma. It is difficult to measure how much political capital he has given the size of his popular vote. At the same time, he is so unconventional that he may have more than normal. However, history would suggest his capital isn’t infinite and it probably remains perishable. This means that we have to closely watch the allocation of political capital to policy and personnel.

After the November election, both the right-wing populists and the center-right establishment had their wish lists and both seemed to believe most of their goals would be fulfilled. Financial markets clearly believed that tax reform and rate reductions were coming and regulatory rollbacks were likely. Equity markets rallied, interest rates rose and the dollar jumped. At the same time, the right-wing populists were expecting immigration reform, infrastructure spending and trade restrictions. Trump is clearly trying to satisfy both constituencies while also trying to fill positions to build an administration. Our concern is that he is experiencing a significant “capital burn.” At some point, he is going to have to start choosing his battles more carefully to conserve his political capital and accomplish his goals. We suspect this is going to require some degree of discipline that, at this juncture, seems to be lacking. Without discipline, he stands to disappoint both wings of his constituency due to ineffective management and opposition from Democrats.

Here is an indicator that may offer some insight into the concept of political capital.

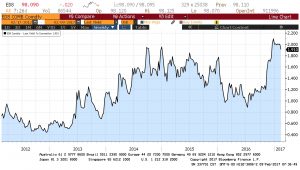

This chart shows the implied yield from the Eurodollar futures contract, two years advanced. Essentially, it’s the market’s estimate of what three-month LIBOR will be in two years. Note that the yield soared after the election, jumping nearly 90 bps in the first few weeks after November 9. We believe the rate jumped on expectations that Trump’s fiscal stimulus would boost the economy and lead to tighter monetary policy. However, we are starting to see the implied rate pull back, suggesting the financial markets are reassessing just how much he will be able to accomplish.

If our analysis is correct, the implied rate should rise if Trump’s policy goals begin to accelerate. This is especially true if tax cuts and fiscal spending are implemented. That would also lift long-duration Treasury yields and the dollar. However, if the implied yield continues to fall, it would suggest the financial markets are discounting less stimulus and slower policy tightening. This could lead to lower long-duration Treasury yields and dollar weakness.