Asset Allocation Weekly (March 10, 2017)

by Asset Allocation Committee

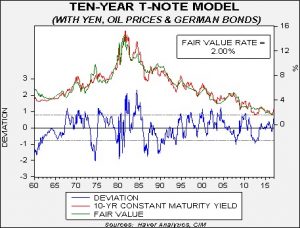

As the FOMC prepares to raise interest rates, it’s a good time to update our views on long-term interest rates. The chart below shows our current estimate of fair value for the 10-year Treasury.

The model uses fed funds, the 15-year moving average of CPI (an inflation expectations proxy), the yen/dollar exchange rate, oil prices and German bond yields. The current yield is about 42 bps above fair value; we move above one standard error of fair value at a 10-year yield of 2.70%. Assuming the other variables remain steady, the current yield on the 10-year T-note has discounted fed funds of 1.80%, suggesting that a series of rate hikes is already in the market.

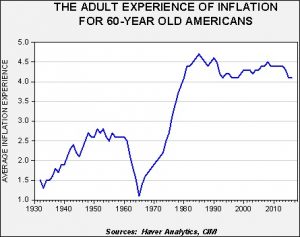

The factor that could lead to a bigger bear market in long-duration fixed income would be a change in inflation expectations. Our inflation proxy estimates inflation expectations of 2.1%, which is roughly in line with the implied 10-year inflation rate from the TIPS spread. Our worry about inflation expectations is that older investors could ratchet higher if the new administration’s policies raise inflation concerns.

This chart shows the average adult (ages 16 to 60) experience of inflation for 60-year-olds. It’s currently 4.2%. It should be noted that younger Americans have, on average, experienced lower levels of inflation; the inflation experience of the current 50-year-old cohort is only 2.8%. We expect older investors to favor fixed income to preserve capital and replace wages in retirement. We also assume that fixed income investors are sensitive to inflation and base their inflation expectations on long-run inflation experiences. Thus, if new government policies on trade and infrastructure spending raise fears of inflation, older Americans may be more prone to “inflation panic” and demand higher rates. Over the next 18 months, that is probably the greatest risk to long-duration fixed income.

For now, we remain cautious on long rates and have tended to favor credit risk over duration risk in fixed income. However, if inflation expectations remain anchored (and tighter monetary policy should assist in this effort), then long-duration fixed income assets could become more attractive as the Fed’s tightening cycle continues.