Daily Comment (May 2, 2017)

by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EDT] May Day is over and markets have reopened. There wasn’t any market-moving news overnight, although there were some interesting items that provide some background for issues that will concern us in the coming months. Here is a roundup:

China’s credit slowdown: Yesterday, we noted that China was lifting interest rates. The rise in rates is part of a pattern we have seen since the Great Financial Crisis. In this week’s WGR, we began a series on trade and introduced the balance identity, which is that the private investment/savings balance (I-S) plus the government balance (G-Tx) equals the trade balance (X-M). The formal equation is as follows:

(I-S) + (G-Tx) = (M-X)

China’s development suppresses consumption. This builds saving which is used to create productive capacity through investment. Much of the saving went to boosting investment but China ran a trade surplus when I<S, as the above identity would suggest. After the Great Financial Crisis, global demand wasn’t strong enough to maintain China’s policy structure. To compensate, China boosted investment further and increased borrowing to pay for it. We believe China has a serious problem with malinvestment and the cure is to reduce S by boosting consumption. However, that would require a change in the structure of the economy that would harm the currently rich and powerful in China. So, in the short term, China is simply recycling the excess saving at home by boosting capacity and likely creating unnecessary investment.[1] In the longer run, the Asian Infrastructure Investment Bank and the “one belt, one road” expansion plan that Chairman Xi is promoting are likely attempts to create neo-colonial economic conditions in Asia that would allow China’s current development model to continue. The simple fact is that China can have any growth level it likes as long as it has debt capacity. The problem with debt capacity is that it is virtually impossible to determine in advance. In other words, when creditors won’t accept your debt at any price, you have achieved debt capacity. On occasion, we see Chinese leaders recoil from the rising debt levels and try to curtail borrowing. This leads to slower growth, which is also unacceptable, and thus borrowing resumes.

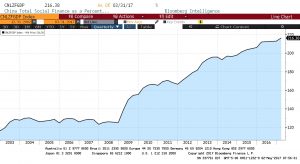

This chart shows total social financing as a percentage of GDP; this debt is private sector only (household and corporate). It is currently 216.4% of GDP. Although U.S. debt is larger, at 232.5%, the growth rate is far less. Since 2008, private sector debt/GDP is up 72.8% in China, while U.S. private sector debt/GDP has fallen 20.8% over the same time frame. For safety, China should curtail its debt growth; however, it has to be willing to accept slower growth, which is clearly unpopular.

The two Trumps: We have argued that the president has two parts of the GOP coalition he needs to address. The populist faction, represented by Steve Bannon, wants immigration restrictions, trade impediments, job support and regulatory protection. The establishment wing, represented currently by Gary Cohn,[2] wants traditional GOP goals such as open trade and borders, smaller government and less regulation. Clearly, the goals of these two groups are not compatible. The president has been managing these two factions by vacillating policy “balloons” between the two groups. So, yesterday, the president suggested he might support a large bank breakup proposal, perhaps a return of Glass-Steagall. This would be something of an anathema to much of the establishment GOP. He also floated a gasoline tax hike to pay for infrastructure, which might find support among the establishment but is opposed by the populists. We do think that the president is mostly non-ideological. He wants to “get things done” and be considered a “winner” and thus he is willing to support different policies to achieve his goals. It’s unclear how this will work out, but investors should remember that this is a president who doesn’t appear to value consistency.

The Greeks get a deal: Greece’s creditors and the government reached a preliminary deal today that will allow the disbursement of €7.0 bn in funds to Athens. In return, Greece will make further reforms to its labor and energy markets, along with pension cuts and tax increases. It isn’t obvious to us that the Tsipras government can survive getting these changes through the Greek parliament. However, there are vague promises that creditors may consider debt relief if Greece accepts the deal. The IMF wants to see debt forgiven, arguing that Greece won’t be able to pay back its current burden. Germany is willing to “extend and pretend” for longer. We doubt any debt relief comes until after the German elections in September. The good news for investors is that Greece won’t trigger a Eurozone crisis.

________________________________________

[1] This article highlights the issue. See: https://www.wsj.com/articles/china-looks-to-export-auto-overcapacity-on-slow-growth-world-1493627132.

[2] Although many others could fit this characterization, including Speaker Ryan.