Asset Allocation Weekly (May 5, 2017)

by Asset Allocation Committee

In our most recent quarterly asset allocation meetings, our analysis determined that emerging markets would not be added to the portfolios. Since this asset class has been this year’s best performer, some explanation is in order. One of the primary reasons we have refrained from adding emerging markets is the dollar’s strength.

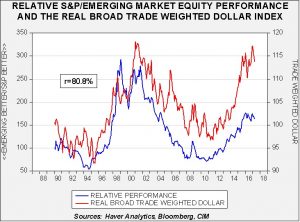

The blue line on this chart looks at the relative performance of emerging markets to the S&P 500. When the line is rising, the S&P is outperforming emerging markets. The red line is the JPM real dollar index. The two series are positively correlated at 80.8%, meaning that a stronger dollar tends to reflect the S&P 500 outperforming the emerging markets. This correlation has weakened modestly recently, but is still quite elevated.

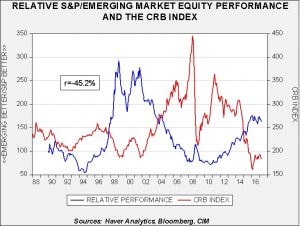

The second reason we have been reluctant to add emerging markets is because the relative outperformance is occurring with weaker commodity prices.

Although the correlation isn’t as strong as with the dollar, rising commodity prices tends to coincide with stronger relative emerging market performance. Although commodities are off their lows, they remain depressed. Thus, the current level of commodity prices seems to support weaker relative emerging market equities.

This chart shows a model of the emerging market/S&P 500 relative performance regressed against the JPM dollar index, the CRB index and fed funds (advanced six months). Currently, the model is suggesting that emerging market equities are overvalued relative to the S&P against these three independent variables.

Despite this overvaluation, it is possible that the strong relative performance of emerging markets is anticipating a recovery in commodities, a slowing of monetary policy tightening or a weaker dollar. The dollar lifted on expectations of tighter policy and if the FOMC does not raise rates as much as expected or if foreign central banks reverse their current easy policy stances, then the dollar could weaken. However, this model suggests that emerging market equities have already discounted that outcome. Thus, we are concerned that emerging market equities may be ahead of the fundamentals. If this is true, the current strong performance of emerging markets could stall even with dollar weakness, rising commodities or a stall in Fed tightening. And, if the dollar rises, commodities fall further or the FOMC raises rates according to the “dots plot,” emerging markets could be quite vulnerable. For now, we believe the risks exceed the potential return from these levels.