Asset Allocation Weekly (October 13, 2017)

by Asset Allocation Committee

With the S&P making new highs almost daily, it is probably a good time to look at long-term trends to build some parameters.

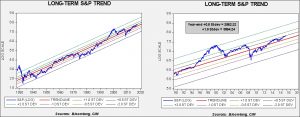

This is a simple trend chart of the S&P 500 Index. We have log-transformed the weekly Friday closes of the index data and regressed it against a time trend. The chart on the left shows the index from 1929 while the chart on the right shows the index from 1990 (same regression trend lines for both charts).

Equities clearly trend higher over time. The yearly trend shows an average return for the S&P 500 Index of just over 6%. However, as the charts show, there is a fair degree of variation over time. The trend data shows that two standard errors above the trend is a dangerous area. One standard error above the trend is a concern. We are currently just below one-half standard error above the trend. That level by itself isn’t a big worry. In the 1950s into the early 1970s, we saw the index vacillate between the trend and one standard error above trend. These are not inconsequential market moves; in the current context, the trend line for the S&P 500 Index is 2090.26, meaning a pullback from current levels to the trend line would be a decline of about 17.6%.

Simply put, barring a recession or geopolitical event, equities are not seriously extended on a trend basis. We also note that the last two bear markets dropped a full two standard errors from peak to trough. The bear market that began in 2000 fell from two standard errors above the trend to the trend line (the bold red line on the chart), and the 2008 bear market ran from one standard error above the trend to one standard error below. Thus, a recession-triggered bear market would be a significant market event.

So, what does this tell us? Although there is a rather elevated sense of concern among investors, overall, the path of least resistance is to grind higher. Equities are not cheap but alternatives are even more expensive. The other insight this research offers is that a “melt-up” would take us well above 3000. If investors were to become “irrationally exuberant” we would expect a move to this level. At this point, there appears to be enough caution to prevent that from occurring. However, if a dovish Fed chair is nominated or a major tax cut appears likely to pass, a rise to these levels might be triggered. A recession is a clear worry; falling to one standard error below the trend line, which would be a drop of lesser magnitude than normal, would be to 1454.81 by year’s end. Obviously, because the trend line moves higher over time, the longer it takes to have a correction, the higher the expected bottom. For now, equities, based on this analysis, are not at levels that would usually signal a major bear market. At the same time, this doesn’t mean that there are no risks. It just means that, in terms of trend, we are not at extremes.