Asset Allocation Weekly (October 27, 2017)

by Asset Allocation Committee

It is expected that over the next two weeks President Trump is going to appoint a new Federal Reserve Open Market Committee (FOMC) chair and vice chair. In this report, we will build scenarios of how policy could change depending upon whom the president appoints.

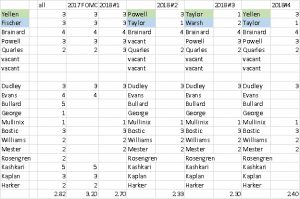

This spreadsheet details our estimate of policy preference, with one being the most hawkish and five the most dovish.

The first column shows the members of the FOMC with the chair in green and vice chair in blue. We have Fischer still on the roster even though he is now leaving. The “all” column lists our estimates of policy bias. The Fed has eight permanent voters—the seven governors and the New York Federal Reserve Bank (FRB) president. The other 11 regional FRB presidents rotate into a voting position roughly every two to three years. The last row shows the average of our hawk/dove rankings. The current voting roster is more dovish than the FOMC as a whole. Scenario #1 assumes no changes to the chair and vice chair roles, although we know that Fischer is leaving so this scenario is purely hypothetical. This is to show that even with no changes at the governor level, next year’s voting roster would have been markedly more hawkish regardless, with an average ranking of 2.70 compared to the current ranking of 3.20.

Scenario #2 assumes Jerome Powell, a current governor, is appointed to chair with John Taylor as vice chair. Powell’s seat is assumed to remain vacant for the foreseeable future, which leads to an even more hawkish FOMC, with an average of 2.33.

Interestingly enough, the FOMC voters are just about as hawkish under the next most likely scenario, with John Taylor as chair and Kevin Warsh as vice chair (Powell remains as a governor). Finally, if Trump re-appoints Yellen but adds Taylor as vice chair, the average is 2.40; again, not a significant change in policy stance.

So, what is the most likely outcome? Currently, Powell is considered the front-runner[1] and would be the safest candidate. He is a moderate like Yellen and would probably maintain the current arc of policy. According to reports, President Trump had a good meeting with John Taylor and he might select him for vice chair. There is no indication at this point who would be selected to fill out the rest of the three open seats if Powell is appointed. It’s possible that Kevin Warsh could be offered one as a consolation prize but, for now, we would not expect the remaining vacancies to be filled until much later in 2018.

The bottom line is that next year’s FOMC will take on a decidedly more hawkish stance due mostly to the hawkish lineup of regional bank presidents. This is a factor that will affect our outlook for next year.

[1] https://www.predictit.org/Market/3306/Who-will-be-Senate-confirmed-Fed-Chair-on-February-4%2c-2018