Asset Allocation Weekly (November 17, 2017)

by Asset Allocation Committee

[Ed note: We will not publish an Asset Allocation Weekly Comment the week of November 24. The next comment will be published December 1.]

Over the past three weeks, we have seen a rise in the yields on high-yield bonds. The Merrill Lynch High Yield bond effective index is up 40 bps since late October.[1] There are a number of reasons for the sudden weakness. They are:

- The tax bills in Congress may limit the deductibility of interest for corporations. Since many high-yield issuers are dependent on debt to fund their operations, a tax change could have an adverse effect on these companies and their high-yield issuance. At the same time, we remain pessimistic that major tax reform is likely and so the final version of any tax changes will likely be limited.

- Telecom and health care sectors have suffered some weaker earnings growth. The failed merger talks between Sprint (S, $6.21) and T-Mobile (TMUS, $56.52) also dampened sentiment in the telecom sector. Since these sectors are important issuers of high-yield debt, their problems have raised concerns.

- Spreads have narrowed significantly.

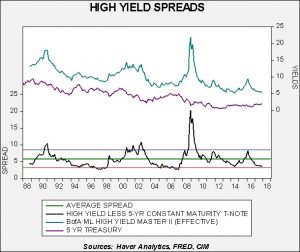

This chart shows the Merrill Lynch High Yield Master effective yield and the five-year T-note yield. The lower lines on the chart show the average spread and the standard deviation lines. The narrowing spread, by itself, doesn’t necessarily signal an imminent problem. As the above chart shows, spreads can remain at the lower deviation for an extended period of time. However, a spread at the lower deviation also suggests a market that is richly valued.

- The relationship of high yield to monetary policy suggests that major reversals in the high-yield spread tend to occur well into a tightening cycle.

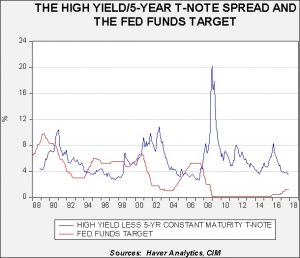

This chart shows the high-yield spread and the fed funds target. Major spikes in the spread are more likely after policy has already been tightened. In addition, the spread often continues to widen after policy easing has commenced. This pattern indicates that the spread is very sensitive to financial stress; in fact, most financial stress indices include both high-yield bonds and high-yield spreads in their construction.

Although there has been much press in the financial media on the recent backup in yields, the most recent change is barely visible on the spread. There isn’t any obvious increase in financial stress, and monetary policy, while tightening, is not at a level that indicates it is near the end of the cycle nor is it at a level that should be causing stress. In our Asset Allocation portfolios, we have been reducing our exposure to high-yield bonds in the income-oriented programs due to high-yield spreads falling to the lower deviation. However, we don’t expect that the recent rise in yields signifies the onset of a financial crisis. Obviously, we will continue to monitor the situation but, for now, we are comfortable with our current allocations to this asset class.