Daily Comment (November 20, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] Happy Monday and Happy Thanksgiving week! We want to pass along a heads up that the Daily Comment will not be published this Friday, November 24. Here’s what’s going on this morning:

Coalition talks collapse: Chancellor Merkel has been unable to pull together a coalition consisting of her CDU/CSU party, the Free Democrats (FDP) and the Greens, announcing this morning that talks have broken down after the FDP walked out of negotiations. Apparently, the three sides (and, perhaps, four because the CDU and CSU have differences as well) could not agree on a number of issues, the primary one being immigration. There are four possible outcomes: (1) Merkel can’t form a government and new elections are called. This action would be unprecedented in German postwar history and the process is remarkably clumsy. The Bundestag would need to elect a new Chancellor (most likely Merkel), who would then need to lose a no-confidence measure, leading President Steinmeier to call a new election. Losing the no-confidence vote would further weaken Merkel and new elections would raise the chances that the populist AfD would get even more support. Thus, we expect the German political establishment to work furiously to avoid this outcome. (2) The Social Democrats (SDP) join Merkel in another “grand coalition.” The SDP remains adamant against this outcome as its coalition with the CDU/CSU in the last government undermined the party. And, if the SDP joined the government, the AfD would become the official opposition, furthering its political fortunes. (3) Merkel goes with a minority government with either the Greens or FDP, also unprecedented and likely unstable. (4) The FDP walkout was a bargain ploy and they return at the 11th hour to form a government and get more power. In rank order of most market-friendly to least, we would say #2, #4, #3, #1. At this point, we think #4 is the most likely, although the FDP must move quickly if this is going to occur.

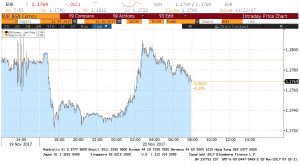

The EUR fell sharply on news of the failure of the talks but has recovered on hopes that the FDP is bluffing. The chart below shows the overnight trade of the Eurozone currency. Initially, the EUR fell sharply, then recovered and has since given up some of its gains.

Geopolitical updates: We begin a three-part WGR series on the recent purge/missile attack/ouster of Lebanon’s PM involving Saudi Arabia this week. We note this morning that Reuters is reporting there have been backchannel discussions between Israel and the Kingdom of Saudi Arabia. Although we have suspected as much for some time, the fact that it is being reported suggests both nations are sending signals to Iran that it faces a potentially broader front opposing the Mullah’s actions to control the region.[1]

The Straits Times is reporting that authorities in Malaysia revealed they discovered a makeshift laboratory where it is believed North Korean operatives made the VX that assassinated Kim Jong-un’s oldest brother, Kim Jong-nam. It is widely believed that North Korea was behind the assassination, despite its denial, and this evidence bolsters that argument.[2]

Spain’s attorney general, José Manuel Maza, died suddenly on Saturday while attending a conference.[3] He was the lead prosecutor on the case against Catalan separatist leaders. It remains to be seen how his death will affect the prosecution.

Trade issues: Jonathan Swan of Axios[4] published what could be a blockbuster analysis of the Trump administration’s trade policy by detailing the influence of U.S. Trade Representative Robert Lighthizer. Lighthizer has a long history in government, working as Chief of Staff for Sen. Robert Dole (R-KS) and as Deputy Trade Representative during the Reagan administration. He has also practiced as a private attorney specializing in international trade law. Swan reports that Lighthizer’s mercantilist positions are gaining currency within the administration. He is recommending very aggressive trade positions against China and has been spearheading the NAFTA negotiations, which appear headed for a rupture. According to Swan, his presentations on trade have been accepted by the free trade establishment figures in the White House (Mnuchin, Cohn), suggesting that trade conflicts may increase once the tax issue is put to rest. This is an issue we watch very carefully because it affects markets on various fronts. First, trade impediments that lead to a narrower trade deficit will have the same effect as a global contraction of the money supply given the dollar’s reserve currency role. Although our position on the dollar is bearish due to valuation levels, widespread trade restrictions would lead us to reconsider that position. Dollar scarcity would be bullish for the greenback. Second, trade impediments, all else held equal, will reduce supply to the American economy and lead to higher inflation. If it affects inflation expectations, it would be quite bearish for long-duration assets. Third, higher inflation would lead to faster policy tightening, increasing the odds of a recession. And fourth, if tax cuts are implemented along with trade restrictions, it would force up private saving and likely slow economic growth. So far, trade actions have been more bark than bite but that may change next year if Swan’s assessment is correct.

[1]https://af.reuters.com/article/worldNews/idAFKBN1DJ0R3?utm_source=Sailthru&utm_medium=email&utm_campaign=New%20Campaign&utm_term=%2ASituation%20Report

[2] https://www.nst.com.my/news/crime-courts/2017/11/301375/condo-unit-used-process-vx-nerve-agent-which-killed-north-korean?utm_source=Sailthru&utm_medium=email&utm_campaign=New%20Campaign&utm_term=%2ASituation%20Report

[3] https://www.nytimes.com/2017/11/19/world/europe/spain-attorney-general.html?emc=edit_mbe_20171120&nl=morning-briefing-europe&nlid=5677267&te=1

[4] https://www.axios.com/lighthizer-increasingly-influential-in-white-house-2510871315.html