Asset Allocation Weekly (December 22, 2017)

by Asset Allocation Committee

(N.B. This will be the last Asset Allocation Weekly for 2017. We thank our readers and wish them a Merry Christmas and Happy New Year. The next report will be published on January 5, 2018.)

As equity markets continue to trend higher, there are always worries about how long the bull market can last. In general, bull markets over the past three decades have tended to end with recessions, triggered either by a policy mistake or a geopolitical event. Unfortunately, the latter are binary events and difficult to predict. We do pay close attention to such events in our Weekly Geopolitical Reports.

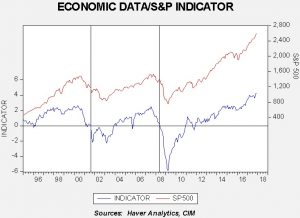

Due to its importance to financial asset performance, we also closely monitor the economy. One of our more simple indicators is constructed with commodity prices, initial claims and consumer confidence. We standardize the data and combine it into a single indicator. The thesis behind this indicator is that these three components should offer clear signals on the economy; in other words, rising initial claims coupled with falling commodity prices and consumer confidence is a warning that a downturn may be imminent. The opposite condition should support further economic recovery.

The above chart shows the results of the indicator and the S&P 500 since 1995. We have placed vertical lines when the indicator falls below zero. Although it works fairly well as a signal that equities are turning lower, it is a bit slow.

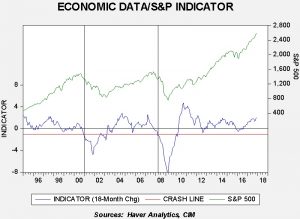

To make a more sensitive indicator, we took the 18-month change and put the signal at -1.0. This triggers a more useful sell signal and also eliminates the false positives that setting it at zero would generate. However, we do pay close attention when the 18-month change falls under zero.

What does the indicator say now? Clearly, if we are going to have a pullback, it won’t be from the economy. The economy is healthy and will be supportive for equity markets. That doesn’t mean that valuation doesn’t matter, but it does suggest that the economy shouldn’t cause a bear market in the near term.