Daily Comment (January 2, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] Welcome, 2018! Back to the salt mines. Here is what we are watching this morning:

Iranian unrest: Civil unrest broke out in the major urban areas of Iran. The protests were widespread and have led to at least 22 fatalities so far. Iranians are angry about weak economic growth; hopes were raised that the nuclear deal would lead to a general reduction in sanctions. Although a large number of restrictions were lifted, the U.S. has maintained a significant number of unilateral sanctions and these have been enough to keep foreign investment below expectations. Social media reports suggest that many of the protestors come from the lower economic classes and the chants indicate calls for more focus on the domestic economy and less on expanding Iran’s geopolitical footprint (populism isn’t only occurring in the West). Another factor to consider is that the Iranian leadership was always able to blame the weak economy on international sanctions. The goal of the nuclear deal was to end the sanctions and thus the ordinary Iranian assumed that the end of sanctions would lead to a much better economy. As we noted above, most U.S. sanctions remain in place but that fact probably got lost in the narrative President Rouhani was selling.

We expect Iran’s security forces to maintain security; after all, the unrest after the 2009 elections was widespread but failed to bring regime change. At the same time, the rather reserved response from the security forces thus far does add credence to the notion that the protestors are not the sophisticated children of the elite but the natural allies of the regime, the conservative lower classes. If the protests continue, at some point, we would look for the security services to become more aggressive. If unrest does threaten the regime, it would likely be bullish for crude oil.

Italian elections: Although we have been anticipating elections in Italy for some time, the government set a date for the actual vote of March 4, 2018. The single currency has the lowest popularity rating in Italy among the major Eurozone countries, although most polls still show the majority favor remaining in the Eurozone. There are parties that not only want to leave the Eurozone but also question EU membership. Current polls suggest the election won’t yield a definitive outcome and may lead to months of wrangling to try to form a government. Any election sentiment that appears to support an Italian exit from the Eurozone will be bearish for the single currency.

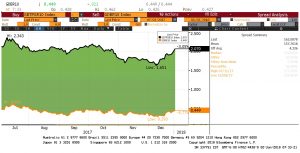

Eurozone PMIs: The final readings for December manufacturing PMIs are shown in the PMI table below, but the numbers continue to show impressive strength. The dollar is falling this morning on the back of Eurozone economic strength. We also saw weaker European equities due to rising interest rates. The chart below shows 10-year yields for Italy and Germany. Although European interest rates remain remarkably low, we have seen rates in both these nations rise rather significantly since mid-December. The rise in German rates reflects stronger growth, while the rise in Italian rates is likely due to a combination of political uncertainty and economic expansion. In any case, rising European yields does have a similar effect on U.S. yields. Our 10-year T-note model suggests that for every rise in German yields of 100 bps, U.S. yields rise 15 bps (all else held equal).

North Korea: There were several news items that emerged from the Hermit Kingdom over the past few days. Kim Jong-un claims he now has a “nuclear button” on his desk, indicating his nation is a fully nuclear power. We have serious doubts that North Korea’s weapons can be launched immediately, but the “button” is highly symbolic. The U.S. and South Korea released evidence of fuel oil smuggling; initially, it was first thought that Chinese vessels were involved but later it appeared that Russian ships were actually helping North Korea evade sanctions. Kim Jong-un also made overtures to South Korea with regard to the Winter Olympics. Finally, former Joint Chief of Staff Adm. Mike Mullen said over the weekend that nuclear war with North Korea is “closer than ever.” He blamed President Trump’s rhetoric for increasing tensions.