Daily Comment (March 10, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EST] SUPER MARIO RETURNS! ECB President Draghi, unlike in December, didn’t disappoint. The central bank announced the following:

(1) The interest rate on the main refinancing operations of the Eurosystem will be decreased by 5 basis points to 0.00%, starting once the operation is settled on 16 March 2016.

(2) The interest rate on the marginal lending facility will be decreased by 5 basis points to 0.25%, effective 16 March 2016.

(3) The interest rate on the deposit facility will be decreased by 10 basis points to -0.40%, effective 16 March 2016.

(4) The monthly purchases under the asset purchase program (QE) will be expanded to €80 billion from €60 bn, starting in April.

(5) Investment grade euro-denominated bonds issued by non-bank corporations established in the euro area will be included in the list of assets that are eligible for regular purchases. In other words, corporate bonds will now be eligible for the central bank’s asset purchase program.

(6) A new series of four targeted longer term refinancing operations (TLTRO II), each with a maturity of four years, will be launched starting in June 2016. Borrowing conditions in these operations can be as low as the interest rate on the deposit facility. It appears that this is how banks will be supported in the face of negative interest rate policy (NIRP). Banks will be effectively paid to lend money because the deposit rate is negative. So, when a bank participates in the TLTRO, it borrows at -40 bps; obviously, if it just holds the cash, it earns a positive carry. In the press conference, Draghi suggested that further cuts are not likely and noted that he doesn’t think NIRP can be extended without limit. These comments dampen the impact of the announced policy measures by weakening the stimulative effect of the forward guidance part of policy.

Draghi faced the problem of expectations going into this meeting. After disappointing the market in December, there was great pressure on the ECB to positively surprise the market. At least initially, market expectations were clearly exceeded and market reactions were consistent with these unexpected actions. Equities and related futures rose sharply. The dollar lifted across the board. Commodity prices eased in the face of a stronger dollar. The U.S. Treasury curve is flattening due to expectations that the Fed is probably leaning the other way (more on this below). European bonds rallied, especially corporates. European credit default swaps are narrowing as well. However, the comments suggesting that today’s move is the last and that NIRP cannot be extended without limit have led to partial reversals in the initial market reactions. In other words, in terms of forward guidance, the ECB is suggesting that there isn’t more to come, which dampens the market impact of the announcement.

Today’s WSJ “Heard on the Street” column introduces the notion of the “Yellen call” as a foil to the concept of the “Greenspan put.” The analogy doesn’t really work but the idea is that as the financial markets stabilize, the Fed will probably lean toward tightening policy again. Essentially, the Fed is acting as a cap on equity prices, using stability in the financial markets to move toward its preferred policy action, which is to lift rates.

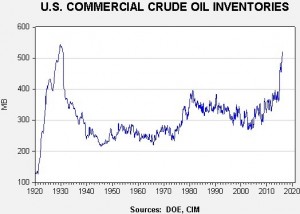

Yesterday, the DOE released its weekly inventory data. Oil prices have continued to rise, although inventory levels are very elevated.

Current stockpiles are 521.9 mb, the highest since August 1930. The seasonal build in inventories is on track to reach around 560 mb by late April.

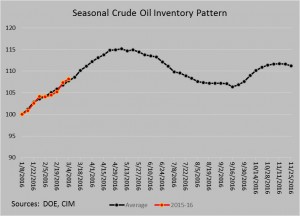

The crude oil inventory build season tends to run from early January into late April. On this chart, we have indexed the five-year average for crude oil against the current year. As the chart indicates, this rebuild season is closely tracking average; if that trend continues, commercial crude stocks will be near 560 mb by spring.

So, with this inventory overhang, why are prices so strong? There are probably two explanations. First, the market is beginning to look past the end of the rebuild season to the spring and summer driving season. Thus, traders holding short positions are covering before the rebuild season ends. Second, oil prices have become undervalued and have recovered to fair value.

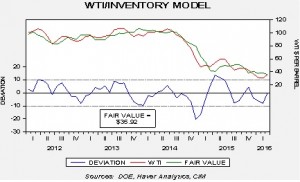

This model uses oil stockpiles and the EUR exchange rate. It is a monthly model that uses the average WTI price and the month-end inventory level. The fair value level for March, so far, is near $36 per barrel. On a nearby basis, we have moved above that level after being well below it a couple of weeks ago. Current prices are no longer cheap and further rallies may become difficult to sustain in the short run. However, we are becoming friendlier to oil after mid-year due to falling U.S. output, improving demand and a growing need for OPEC to boost prices (see below).

Some other news items of note:

- Chinese CPI came in stronger than expected, up +2.3% year-over-year in February. Although inflation does remain below the PBOC’s 3% target, China has a long, unpleasant history with high inflation and so, when it rises quickly, it does get the attention of the CPC’s leadership. Food prices were up 7.3% from last year, which is a major concern because higher food prices affect a large number of people and could cause civil unrest. However, it is important to remember that seasonal factors affected the data as the New Year holiday fell in February. Thus, the inflation rate may ease in the coming months.

- The Reserve Bank of New Zealand (RBNZ) surprised the markets by cutting its policy rate by 25 bps to 2.25%. The RBNZ cited weaker global growth as the reason for the rate cut.

- The WSJ reports that Saudi Arabia is looking to borrow up to $8 bn from international banks and may issue foreign bonds in an attempt to plug its widening fiscal deficit due to rising spending from wars and weak oil prices. There are also reports suggesting the kingdom is moving forward on a partial IPO of Saudi Aramco. All this suggests that Riyadh’s finances are deteriorating, which increases the odds that some action to support oil prices may become attractive in the coming months.