Daily Comment (March 3, 2016)

by Bill O’Grady and Kaisa Stucke

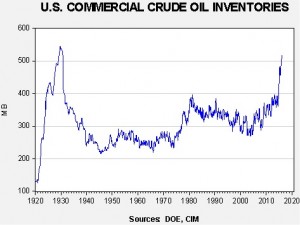

[Posted: 9:30 AM EST] U.S. commercial crude oil inventories jumped 10.4 mb for the week ending 2/26, well above forecast. Current stockpiles remain at 80+ year highs. We are only 21 mb below the all-time high and there is a very good chance we will make a new high in the coming weeks.

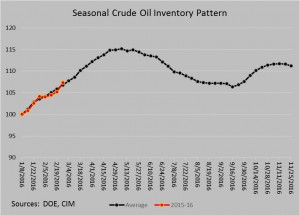

The below chart shows the current build compared to the five-year average on an indexed basis. As the chart indicates, the current build is running close to normal. If we continue to track the average, we will see stockpiles peak at 555.8 mb, a new high.

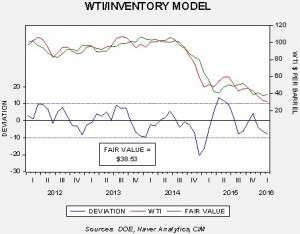

Oil prices rose yesterday despite the massive inventory overhang. This is probably because current prices are below where the combination of the dollar and inventories suggest they should be.

Our oil price model, which uses commercial crude oil inventories and the EUR exchange rate, puts fair value at $38.53. Thus, the market is a bit cheap here. Assuming we do reach the expected seasonal peak, fair value would be $31.62, so we are not necessarily out of the woods yet on oil. If the European Central Bank presses the EUR lower at next week’s meeting, oil could come under further pressure.

Market action is clearly supportive; rallying in the face of such bearish data is at least a short-term signal that oil has bottomed. Nevertheless, we still have to make it through the rest of the injection season. The good news is that we probably have seen the lows in oil.

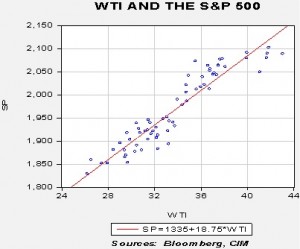

The relationship between oil and U.S. equities has been rather tight. Looking at the relationship since the last OPEC meeting, the two series are correlated at the 93.9% level.

Although one cannot necessarily derive causality from correlation, market behavior seems to suggest that oil prices drive equity values. The relationship is currently quite strong; the regression suggests that every dollar change in oil prices leads to a change in the S&P 500 of 18.75 points. Thus, if we get to our current fair value price, the S&P 500 would be 2,057, assuming the above relationship holds. Of course, as noted above, we still have eight weeks of storage accumulation in front of us, which will likely pressure oil prices. The fact that we are currently below fair value is likely due to expectations of rising storage. If we reach the expected level of storage, the fair value level for the S&P 500 would be 1,928, based on the oil price/equity relationship.

The wild card in all this rests with the ECB. If the ECB expands monetary stimulus and leads the EUR lower, the fair value for oil will decline as well. The other critically important caveat is that short-term relationships in markets come and go; this one will as well. If the FOMC returns to hawkishness (as intimated yesterday by San Francisco FRB President Williams) the oil/equity relationship could break down. However, for now, it appears that any equity rallies depend on rising oil prices.