Daily Comment (April 10, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Risk-on is the order of the day. Here’s what’s driving it:

Xi talks: Chairman Xi spoke at the Boao Forum yesterday evening and made promises to open China’s market to foreign investment and lower export impediments. He indicated that auto tariffs will be lowered. The tone was conciliatory and would offer the Trump administration a path to de-escalate trade tensions. We have seen a steady escalation of tensions since January which has clearly spooked risk assets. Trade tensions are a major element of those concerns (the FOMC is the other). However, a word of caution is needed. Xi was rather vague in his comments. In fact, there isn’t much new here from his speech in Davos in 2017. Xi’s goal appears to be two-fold. First, he wants to lower the “temperature” on trade and offer President Trump a face-saving path to lower tensions. Offering to lower car tariffs is a clear but minor concession that Trump could take to declare victory and smooth relations. Since the Trump administration hasn’t really offered what it wants to accomplish with trade, he could declare the autos as sufficient. There was a second element to Xi’s speech. China’s view is that it wants to be considered a rival superpower to the U.S. and end America’s unipolar moment. Thus, he wants to offer China as an alternative to the U.S. and is portraying China as the defender of free trade. This is preposterous; China may be a rising superpower but it doesn’t engage in free trade at all. Not only does it interfere with exports, but its financial system is mostly closed and therefore its currency can’t be used for reserve purposes. If one runs a trade surplus with China and holds CNY as a result, it’s difficult to invest those CNY in the Chinese financial system in an asset like U.S. Treasuries. So, the bottom line is that the speech was mostly fluff but the fact that he at least tried to lower trade tensions is being well received by financial markets.

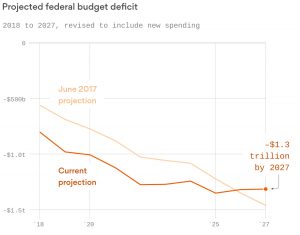

The deficit: Yesterday, the CBO released its new deficit estimates, taking into account the tax reform act and the recent spending package. The results:

Clearly, the deficit is going to rise. Here is the key point—either the deficit is going to expand growth beyond capacity and lead to higher inflation, or it is going to lead to a wider trade deficit, or some combination of the two. The deficit, all else held equal, will shift the aggregate demand curve outward from the origin. The intersection with aggregate supply determines the level of output and the price level. In a closed economy, this usually leads to higher levels of inflation and higher nominal interest rates. But, in an open economy, the excess consumption usually leads to increased imports and a wider trade deficit. The trade deficit outcome is dependent upon (a) global capacity—if it is insufficent then import prices will rise, leading to inflation, and (b) the exchange rate and the willingness of foreigners to hold the financial assets of the deficit nation. For example, when Venezuela runs a fiscal deficit, no one will hold its bonds and the result is higher inflation. The U.S., a the provider of the reserve currency, is uniquely able to run fiscal deficits and rely on foreign saving to partially fund it. However, if American policy is determined to reduce the trade deficit while simulateously expanding fiscally, the result will be higher inflation.