Daily Comment (June 26, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] After a rough day yesterday, financial markets are attempting to stabilize this morning. Here is what we are watching:

Trouble in Iran: Protests are escalating in Iran. Comments on Twitter suggest there is widespread dissatisfaction with the government. Unconfirmed reports of crowds chanting “Leave Syria, think of us” and “Death to Palestine” suggest that Iranians are getting tired of their country’s foreign adventures while the economy languishes. Adding to trouble, the unofficial Iranian rial rate has dropped to 90k/USD, down from 43k/USD at the beginning of the year. The return of sanctions is undermining the economy but there is also growing discontent with the current government. We haven’t seen much of a crackdown yet, which makes us wonder if the hardliners are allowing the protests to expand in order to remove President Rouhani from office and put a hardliner into power. This is a risky strategy because without elections any new president will struggle with legitimacy and simply being appointed by the Grand Ayatollah may not be enough to quell unrest. It is always difficult for outsiders to discern what is going on in Iran; it should be noted there was genuine surprise by the Shah’s fall in 1978. Since the theocracy was established in the late 1970s, it has been very effective in containing unrest. However, that doesn’t mean it will always be true.

Although regime change has been a goal of the U.S. since the revolution in 1978, it is unclear who would govern Iran if the government falls. Nevertheless, any new government would likely sue for peace with the Trump administration in a bid for sanctions relief. And, we suspect they would get it. So, it could be bullish for oil in the short run but long-term bearish if a new government leads to increased exports.

Trade: The EU applied tariffs on items it views as politically sensitive. Harley-Davidson (HOG, 41.57), the maker of iconic American motorcycles, was an obvious target for the EU. In response, the company announced it would move production outside the U.S. to prevent the tariffs from being applied to U.S. exports.[1] The president accused the company of “waving the white flag”[2] on this issue. Here is an important point. The president and his followers[3] are economic nationalists; they view trade through the viewpoint of nation against nation. Major companies, for the most part, are run by members of the establishment who view the world from a global perspective. Thus, in light of trade actions, they tend to think in terms of supply chains,[4] not national employment.

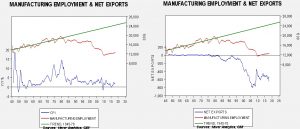

There charts show what we think is the president’s worldview:

The upper line on both charts is the level of U.S. manufacturing payrolls. We have regressed a trend through the data from 1945 to 1978 and extended that trend past 1978. Note that actual manufacturing employment began to fall below trend in the late 1970s and has continued on that path into the present. The lower line on the left-hand chart shows the yearly change in CPI. When manufacturing employment began to fall below trend, so did inflation and inflation volatility. The lower line on the right-hand chart shows net exports along with the aforementioned trend data on manufacturing employment. The impact of globalization is abundantly clear—the widening trade deficit has pushed manufacturing employment well below trend but has also been instrumental in reducing inflation. We believe one of President Trump’s core beliefs is that manufacturing employment is the key to middle class prosperity and he wants to move the red line on the above charts back to trend. To do so, he needs to reduce globalization by ending the trade deficit. If he does that, we anticipate a return of inflation. Harley-Davidson’s reaction to tariffs is perfectly rational if a company is a profit-maximizing firm as it is trying to keep its costs under control and its products competitive, thus moving production makes sense. But, if one’s goal is to bolster nationalism through an increase in manufacturing employment, Harley-Davidson’s behavior is inappropriate. Instead, the company should keep production in the U.S. and assume (hope?) that Europeans will be willing to pay more for the brand.

This divergence of goals is a key element in the current debate between the political establishment and insurgent populism, not just in the U.S. but in Europe as well. What makes this issue tricky is that each side of the debate sees its own position as a self-evident truth and accordingly perceives the other side’s viewpoint as untenable.

Is China blinking? Bloomberg[5] is reporting there is growing opposition to a trade war in China. Important voices in China appear to be arguing that Chairman Xi doesn’t really have the country ready for a trade war and therefore making peace with the U.S. is a better course of action. We have our doubts that Chairman Xi can back down as the leader of China has also stoked nationalism to solidify his political power, so caving to the U.S. will look like a surrender. We may be too pessimistic, but our read on Xi is that he won’t give in to President Trump on China 2025 or any other Chinese policy goal.

Is Trump’s political capital exhausted?One of our positions is that new presidents have about 18 months of political capital; from inauguration into the summer of the second year, a president sees a steady diminishment of power. Usually, when presidents realize they cannot pass any major legislation as Congress’s attention shifts to the midterms, they focus their attention on foreign policy, where they are less reliant on Congress to accomplish their goals. This may also explain why the president is focusing on trade.[6]

[1] https://www.ft.com/content/54a6cc82-7867-11e8-8e67-1e1a0846c475

[2]https://twitter.com/realDonaldTrump/status/1011360410648416258?utm_source=POLITICO.EU&utm_campaign=90fa10452d-EMAIL_CAMPAIGN_2018_06_25_08_13&utm_medium=email&utm_term=0_10959edeb5-90fa10452d-190334489 ; https://www.reuters.com/article/us-harley-davidson-tariffs/trump-blasts-harley-plan-to-shift-u-s-production-to-avoid-eu-tariffs-idUSKBN1JL185

[3] https://www.ft.com/content/29f24644-78f1-11e8-bc55-50daf11b720d

[4] https://www.reuters.com/article/us-usa-trade-supplychains/trump-tariffs-force-companies-to-rework-supply-chains-idUSKBN1JL2LR ; https://www.wsj.com/articles/trump-rides-a-harleyto-europe-1529968178

[5] https://www.bloomberg.com/news/articles/2018-06-25/as-trade-war-looms-china-wonders-whether-it-s-up-for-the-fight

[6] https://www.axios.com/donald-trump-administration-gridlock-congress-legislation-house-midterms-14ee0143-6f8e-4228-b7b5-653e6e6ea027.html