Daily Comment (July 9, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Happy Monday! It looks like a risk-on day so far, with Treasury prices lower and equities higher. The dollar is a bit soft which has lifted metals prices. The lack of comment from the White House about trade appears to be helping equity markets. Here is what we are watching:

BREAKING NEWS: Boris Johnson, the U.K. foreign minister, has resigned. Below we discuss the earlier resignation of David Davis. Johnson’s resignation is far more serious as he could mount a leadership challenge to PM May. The GBP is falling on the news.

North Korea disappointment: SoS Pompeo was in North Korea over the weekend and his visit didn’t go very well.[1] The U.S. wanted to begin talks on North Korea dismantling its nuclear program, but North Korea wanted “goodies” before even beginning to talk about denuclearization. North Korea called the U.S. “gangsters,” criticizing U.S. negotiating tactics.[2] For anyone who has watched North Korea since the fall of the Soviet Union, this behavior isn’t a surprise. North Korea’s negotiating stance has been mostly “Lucy with the football.”[3] The West thinks it has a promise from Pyongyang but finds out that either the promise was broken or that the North Koreans never intended to take such actions and the West’s disappointment is merely a misunderstanding.

North Korea isn’t going to give up its nukes. It may be willing to have the IAEA count some of them and it may be willing to split the U.S. alliance in the Far East by restricting its missiles to ones that cannot reach the U.S. But, complete denuclearization is a demand that is unlikely to be met. The real question is the reaction from the White House. If President Trump concludes he’s been “played” then we could move quickly from summits and handshakes to war. Although we haven’t seen any movement yet, we would not be shocked to see a rapid escalation in tensions. On the other hand, the White House will tend to react based on commentary from the right-leaning media. The fact that John Bolton is inside the government removes a prominent pundit voice that would have been harshly critical of the summit and would have likely pushed for a hard line after the Pompeo visit.[4] In addition, the potential negative impact of this news is lessened due to the expected announcement of the president’s selection for the Supreme Court, which will occur later tonight.

May moves to soft Brexit: PM May took her cabinet out to her summer place in Chequers last Friday and appeared to move her advisors to her vision of Brexit,[5] which is mostly a series of measures designed to limit the impact of leaving the EU on the U.K. economy. Initially, it appeared May had earned unanimous approval, winning over the hard Brexit members of her cabinet. However, last night David Davis,[6] the minister in charge of the EU exit, resigned. Dominic Raab has taken Davis’s ministry. Davis is hoping his sacrifice will prevent any further concessions to the EU, while May is hoping his departure from the cabinet will give her more freedom to act. We expect Davis to agitate for a hard Brexit now that he is out of the cabinet; our read is that support for Brexit has waned a bit and Davis may not have all that much sway. The GBP took the resignation well, suggesting the markets believe May will not only survive but negotiate a soft Brexit, which would be favorable for the pound.

Japan returning to nuclear power? After the Fukushima disaster, Japan pulled back from nuclear electric power. Public sentiment turned sharply against it. However, Japan faces another policy goal, energy security.[7] The Trump administration’s actions against Iran[8] have made it clear that the island nation is vulnerable to energy flow disruptions. If Japan returns to nuclear power, it could give a boost to a moribund uranium industry.

President Trump to Europe: As we noted last week, the president is traveling to the U.K., attending the NATO summit and visiting with Russian President Putin. We have been discussing this upcoming meeting for the past few reports. Fears among Europeans are elevated; President Trump has been critical of the alliance and has been pressing the EU to boost defense spending. We will be watching to see how the president deals with our EU allies this week.

Energy recap: As we noted last week, the DOE weekly energy data was delayed. As promised, we are publishing our recap in today’s comment due to the delay.

U.S. crude oil inventories rose 1.2 mb compared to market expectations of a 5.0 mb draw.

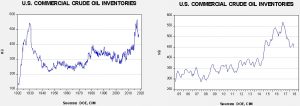

This chart shows current crude oil inventories, both over the long term and the last decade. We have added the estimated level of lease stocks to maintain the consistency of the data. As the chart shows, inventories remain historically high but have declined significantly since March 2017. We would consider the overhang closed if stocks fall under 400 mb.

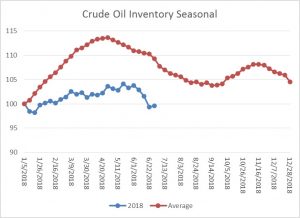

As the seasonal chart below shows, inventories are well into the seasonal withdrawal period. This week’s increase in stocks was unusual, but some adjustment was not a huge shock given last week’s rather large decline. If the usual seasonal pattern plays out, mid-September inventories will be 411 mb.

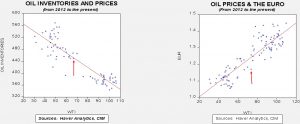

Based on inventories alone, oil prices are near the fair value price of $68.31. Meanwhile, the EUR/WTI model generates a fair value of $61.24. Together (which is a more sound methodology), fair value is $62.80, meaning that current prices are above fair value. Currently, the oil market is dealing with divergent fundamental factors. Falling oil inventories are fundamentally bullish but the stronger dollar is a bearish factor. The action to suppress Iranian oil exports has boosted oil prices, but the rapid decline in oil inventories over the past week is very supportive for prices. It should be noted that a 410 mb number by September would put the oil inventory/WTI model in the high $70s per barrel. Although dollar strength could dampen that price action, oil prices should remain elevated. At the same time, refinery utilization remains above 97.0%. We will be reaching a point in the near future where domestic oil consumption growth will peak for the summer season, although we expect the level to remain elevated.

[1] https://www.ft.com/content/721ba908-8286-11e8-96dd-fa565ec55929?emailId=5b42e658f885cc00043968c4&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[2] https://www.washingtonpost.com/world/pompeo-pushes-back-against-north-koreas-gangster-like-criticism/2018/07/08/a6261b3e-825e-11e8-9200-b4dee4fb4e28_story.html?utm_term=.db990966f032&wpisrc=nl_todayworld&wpmm=1 and https://www.theatlantic.com/international/archive/2018/07/america-north-korea-nuclear/564620/?wpmm=1&wpisrc=nl_todayworld and https://www.nytimes.com/2018/07/07/world/asia/mike-pompeo-north-korea-pyongyang.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=first-column-region®ion=top-news&WT.nav=top-news

[3] https://www.youtube.com/watch?v=055wFyO6gag

[4] http://quotes.yourdictionary.com/author/quote/570850

[5] https://www.ft.com/content/aeb53c82-82ac-11e8-96dd-fa565ec55929

[6] https://www.ft.com/content/fef0e51c-8300-11e8-96dd-fa565ec55929

[7] https://www.ft.com/content/66c37158-801a-11e8-bc55-50daf11b720d?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[8] https://www.reuters.com/article/us-iran-nuclear/iran-calls-for-eu-help-as-shipping-giant-pulls-out-for-fear-of-u-s-sanctions-idUSKBN1JX0NQ?feedType=RSS&feedName=worldNews