Daily Comment (October 15, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] The equity sell-off has returned as U.S. tensions with Saudi Arabia and China escalated over the weekend. Growing concerns of market uncertainty have led to a rise in oil prices, gold and Treasuries, as well as a drop in the dollar. Below are the stories we will be following throughout the day:

Saudi Arabia hits back: Saudi Arabia responded to threats from President Trump by vowing to strike back if any actions are taken against the kingdom. Over the weekend, the president suggested there will be consequences for Saudi Arabia if it was responsible for the suspected killing of Washington Post journalist Jamal Khashoggi. In response to the allegations, businesses have begun to distance themselves from the kingdom by withdrawing from the Saudi conference nicknamed “Davos in the Desert,” with the most notable withdrawals being Ford Motor (F, $8.64) Chairman Bill Ford and JP Morgan (JPM, $106.95) Chief Executive Jamie Dimon. Equity markets in Saudi Arabia also took a hit. As mentioned last week, in the event of escalating tensions between the U.S. and Saudi Arabia we expect the kingdom to reduce oil production in an attempt to raise oil prices. Although the U.S. could use some of its strategic supplies to offset some of the reduction in production, it will likely do little to change the world price of oil. Therefore, we expect global equities to suffer as a result of tit-for-tat responses between the U.S. and Saudi Arabia.

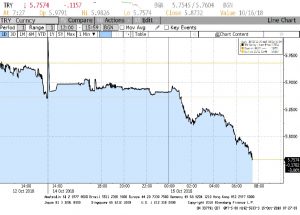

Pastor Brunson’s return: On Friday, Turkey released Pastor Andrew Brunson who was detained on terrorism charges following the failed coup in 2016. Pastor Brunson’s release will likely lead to a de-escalation of tensions between Turkey and the U.S. Earlier this year, the Trump administration imposed sanctions on Turkey to pressure the country to release Pastor Brunson with no conditions attached. Although there have been rumors of Pastor Brunson’s release being linked to President Trump’s decision to take a tougher stance against Saudi Arabia, the Trump administration has denied any such deal. As a result of Pastor Brunson’s release the Turkish lira strengthened against the dollar due to the possibility of a lift in U.S. sanctions.

Another round of tariffs: On Sunday, President Trump threatened to impose another round of tariffs on Chinese goods on the grounds that it has interfered with American elections. The president appears to be alluding to a newspaper ad in Iowa designed to sway voters in the midterm elections. Although this does seem like an unorthodox reason for implementing new tariffs, the president may have broad protections under the “Trading with the Enemy Act of 1917” if he decides to follow through on this threat. This law is meant to be enacted during times of war, but the U.S. involvement in Syria may be enough justification. China’s decision to aid Iran in avoiding U.S. sanctions could be interpreted as an act to aid an enemy of the state. While there isn’t direct conflict between the U.S. and Iran within Syria, the two are strategic foes in the region. That being said, if the president were to proceed down this route he will likely meet stiff opposition from Congress, especially from congressmen whose states will be impacted in the event of retaliation. We do not expect there to be much criticism from members of the Republican Party until after the midterm elections as tariffs appear to be popular with their base.

Brexit deal in trouble: The prospect of an imminent Brexit deal seems to have hit a snag after UK Prime Minister Theresa May stated she is not ready to agree to the deal in its currents state. This shift comes two days after a report suggesting PM May told her inner cabinet that a potential deal was close. It appears that backlash from members of the Tory party and coalition partners DUP could have swayed her position over the weekend. On Friday, the DUP categorically ruled out supporting the deal in its current state after reports suggested Northern Ireland would be treated differently from other members of the United Kingdom. It is becoming increasingly clear that the UK parliament in its current form will not be able to agree to a Brexit deal prior to the March deadline. The possibility of a UK exit from the EU without a deal will spark more uncertainty throughout the region; therefore, we wouldn’t be surprised if there is a push for snap elections before the end of the year. Following the report, the pound weakened against the dollar. We will continue to monitor this situation.