Daily Comment (October 18, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Good morning! Equities fell and Treasury yields rose due to the hawkish tone of the Fed minutes. There was not a lot of overnight news but below are the stories we are following today:

EU trade truce on the rocks: The truce between the U.S. and the EU appears to be in jeopardy as negotiators trade barbs in the press, accusing each other of stalling the negotiation process. At the heart of the dispute is the trade truce, also known as the Trump- Junker deal, which lacks any concrete parameters. The EU appears unwilling to begin negotiations without assurances that there will be no retaliation in the event of a stalemate. The U.S. seems reluctant to grant those assurances, likely due to fears that it could undermine its leverage. It appears that the Trump administration has been using a series of bilateral agreements with its allies to apply more pressure on China in trade negotiations, in much the same way TPP was intended. That being said, President Trump’s harsh criticism of allied nations, specifically, has created an environment of mistrust, which could explain why countries are hesitant to engage in trade negotiations. Nevertheless, we expect the impasse between the U.S. and Europe to end somewhat soon given that recent trade agreements with Korea, Canada and Mexico were relatively non-controversial; hence, the EU agreement will likely follow suit. We continue to monitor this situation.

FOMC minutes: The Fed minutes, released on Wednesday, support the case for future rate hikes. Although there were some concerns regarding rising trade tensions and strain in emerging market economies, the FOMC believes the U.S. economy is moving in the right direction. At the same time, members of the FOMC have expressed willingness to raise rates past the neutral rate, which is a rate that is neither accommodate nor constrains the economy, in order to address financial imbalances and to contain future inflation. This point of view runs counter to the views of the president, who believes the Fed should consider the impact that higher rates will have on the economy. The president responded to the minutes by calling Fed Chairman Jerome Powell a weak link. At this point, it is unclear how high the Fed is willing to raise rates but current projections suggest a neutral rate around 3.0%. The president’s pugnacious response could be a concern as it seems he is starting to view the Fed as an adversary. Although Powell seems unbothered by the criticism, that position could change if the president releases the bully pulpit.

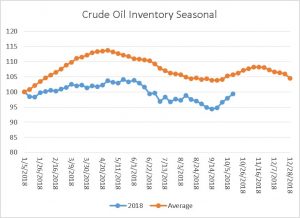

Energy recap: U.S. crude oil inventories rose 6.5 mb compared to market expectations of a 1.6 mb build. Refinery utilization was unchanged at 88.8% and oil production fell by 0.3 mbpd to 10.9 mbpd. Exports rose 0.1 mbpd, while imports fell by 0.2 mbpd. The rise in stockpiles was mostly due to slower refining activity. As the seasonal chart below shows, inventories have begun their seasonal build period. We should see inventories continue to rise in the coming weeks as refinery operations decline for autumn maintenance.

The build up in inventories led to a drop in the price of Brent and WTI crude oil. Rising tensions between the U.S. and Saudi Arabia, as well as the impending U.S. sanctions on Iran, have led to supply pessimism. As a result, rising shale production is becoming important in maintaining oil price stability.