Daily Comment (October 24, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s mid-week and equity markets are trying to find their footing. Yesterday’s action almost qualified for what a former boss of mine would call a “Hollywood finish.” That’s one where the market takes a beating in the early part of the day only to recover to positive territory by the close. We didn’t get out of the red yesterday but we did see a solid recovery. Here is what we are watching this morning:

Earnings: Although there is much hand-wringing about earnings, the fact is that, overall, S&P 500 earnings appear to be coming in about as forecast. This is positive; however, the usual pattern is to somewhat understate earnings in the estimates and then celebrate beating the forecast. That may not happen this quarter. At the same time, S&P 500 earnings are running above 6% of GDP, which is a record. Earnings themselves look fine but sequential momentum is clearly fading.

Given where we are in the business cycle, this development shouldn’t be a shock. Wage pressures are rising. Interest costs are increasing, too. Although it’s difficult to see the impact of trade restrictions in the macro data, individual companies are reporting adverse effects.[1] Our margin model suggests that margins will remain elevated but growth will be flat; that would mean earnings growth may be limited to the growth of nominal GDP next year. That’s not bad, but significant market appreciation will require multiple expansion. Given how elevated confidence readings are now, it would take a major decline in interest rates to boost P/Es.

Fed bashing: In an interview with the WSJ,[2] President Trump lambasted the FOMC and Chair Powell. In a telling quote from the article, the president said, “He was supposed to be a low-interest-rate buy. It’s turned out he’s not.” We wondered at the time Powell was selected (to replace Chair Yellen, who was perceived as dovish) whether Powell got the job because he was seen as an easy money person. It should be noted that Treasury Secretary Mnuchin supported Powell’s nomination; Mnuchin is an establishment figure in the administration. In fact, all the appointees for Fed governor so far have been remarkably mainstream. It’s becoming obvious that Powell will be blamed for equity market volatility and any economic weakness. Interestingly enough, criticism from the White House will tend to make it more difficult for FOMC policymakers to pause the pace of hikes. There may be legitimate reasons for the Fed to pause—equity market turmoil is one.[3] However, FOMC members may feel the need to maintain hikes simply to enforce Fed independence.

Our position is that we are on a slow pace to reflate the economy as part of reversing four decades of rising inequality. Central bank independence was a key policy tool to bring down inflation. Although the actual impact of monetary policy on inflation isn’t all that strong, policy does clearly affect inflation expectations. But, when policymakers want to reflate, they can’t have the central bank undermining their policy actions. President Trump’s statements to undermine Fed independence, though a reversal of the early 1990s détente, does fit a reflation narrative.

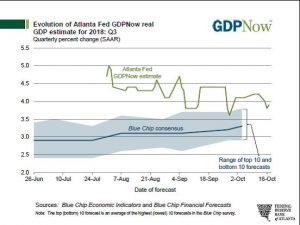

GDP: We get Q3 GDP tomorrow. Here is the most recent GDPNow estimate from the Atlanta FRB.

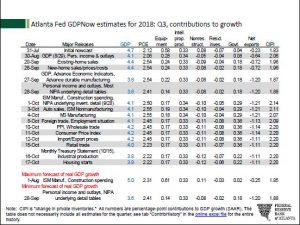

The current forecast is 3.9%. Here is the contribution table:

The two largest positive contributors to growth are consumption and inventory rebuilding. The largest offset is net exports. We would not expect as strong of a contribution from inventory in Q4, so there is a chance we will see GDP closer to 3% in Q4.

[1] https://www.reuters.com/article/us-usa-stocks-earnings-analysis/tariffs-begin-to-take-bite-out-of-us-corporate-earnings-growth-idUSKCN1MX2W0

[2] https://www.wsj.com/articles/trump-steps-up-attacks-on-fed-chairman-jerome-powell-1540338090

[3] https://www.reuters.com/article/us-usa-fed-selloff-analysis/for-fed-sell-off-could-point-to-fading-trump-stimulus-idUSKCN1MX32L