Asset Allocation Bi-Weekly – Activist vs. Accommodative Treasury Issuance (August 26, 2024)

by the Asset Allocation Committee | PDF

The Federal Reserve and the US Treasury are independent government agencies with the shared objective of economic prosperity. While the Treasury manages government finances and executes fiscal policy, the Fed focuses on monetary policy as it aims to maintain price stability and full employment. Despite the Fed and the Treasury having distinct roles, there is an ongoing debate over whether they should coordinate their policies or whether it’s appropriate for one to work at cross-purposes with the other, particularly in the context of the big US budget deficit and growing debt load.

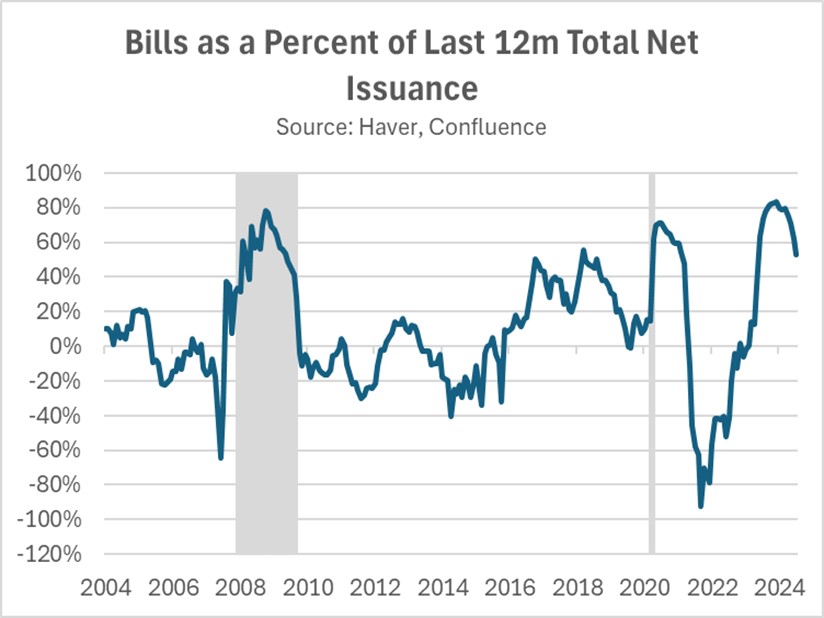

A recent report has accused the Treasury of intentionally shifting its debt issuance strategy to favor shorter-term bills over longer-term notes to the detriment of the country. Economists Nouriel Roubini and Stephen Miran, both Treasury veterans, contend in their paper, “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy,” that this strategy is a deliberate attempt to counteract the Fed’s tightening measures and artificially stimulate the economy.

The Roubini and Miran paper argues that the Treasury’s strategy effectively amounts to a covert form of quantitative easing (QE). When the Fed employs QE to stimulate the economy, it purchases long-term bonds, thereby suppressing interest rates. The Treasury can achieve a similar outcome by shifting toward shorter-term debt issuance. By reducing the supply of longer-term bonds, the Treasury can indirectly push up their prices and lower their yields, effectively loosening financial conditions.

Roubini and Miran contend that the Treasury’s shift toward more bill issuance has counteracted the Fed’s effort to tighten monetary policy, contributing to the robust economic growth and elevated inflation seen in Q1 2024. According to Roubini and Miran, Treasury bills serve as a near-cash asset, enabling financial institutions, institutional investors, and corporations to secure loans by using them as collateral. In essence, the issuance of new Treasury bills can amplify the money supply through the money multiplier effect, which increases market liquidity.

While they acknowledge the typical shift toward shorter-term Treasury issuance in economic downturns, Roubini and Miran argue that the current pronounced bias for bills over notes is exceptional and may be politically motivated. By prioritizing bill issuance, the Treasury may have sought to avert a surge in long-term interest rates typically associated with bond sales. This strategy is credited with contributing to a decline in 10-year yields, which, in turn, has fueled risk appetites and inflated stock valuations in the lead-up to the election.

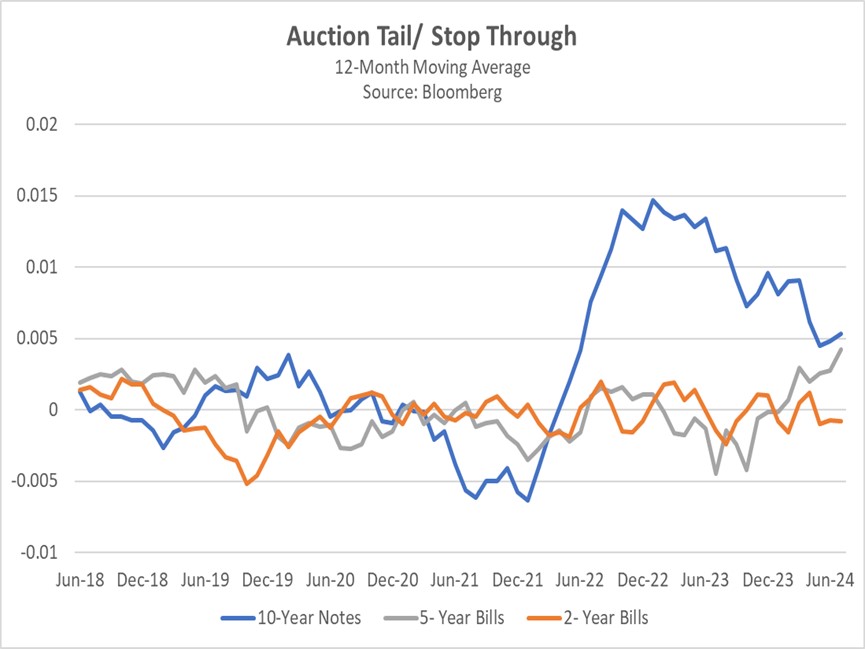

However, an alternative explanation for the Treasury’s issuance reallocation lies in the market’s response to rising interest rates. When the Fed initiated rate hikes in 2022, demand for longer-term bonds weakened due to increased interest rate risk. Conversely, demand for shorter-term Treasury bills surged, primarily driven by money market funds and institutional investors seeking higher yields on short-term assets. This market dynamic is reflected in the results of Treasury auctions, with 10-year bonds consistently undersubscribed and two-year bills frequently oversubscribed.

Moreover, the Treasury’s issuance strategy may not be as counterproductive as Roubini and Miran imply, since the sale of bills has mitigated the need for extraordinary Fed intervention in the economy. Prior to the change, the banking sector faced severe liquidity challenges following the collapse of Silicon Valley Bank in 2023 due to heavy investments in low-yielding, long-duration bonds. As interest rates rose, bond values fell and hindered banks’ ability to use them as collateral to meet short-term cash needs. In response, the Fed established new lending facilities, which helped address the immediate crisis but hampered its balance sheet reduction efforts.

By significantly increasing bill issuance, the Treasury provided the banking system with high-quality collateral, therefore mitigating the risk of a liquidity crunch within the repo market. This buffer has made it easier for the Fed to maintain its policy tightening without hurting the financial system. As interest rates begin to decline, the urgency of this allocation strategy will lessen, leading to a gradual reduction in Treasury bill issuance as a share of total issuance.

Contrary to Roubini and Miran’s assertion, the Treasury’s allocation strategy has actually seemed to support the Fed’s objectives. It has enabled the Fed to prolong quantitative tightening and maintain higher interest rates for an extended period and has increased the likelihood of a soft landing. However, this cooperative stance could potentially embolden the Fed to adopt a more gradual easing path, which would benefit short to intermediate bond yields.