Asset Allocation Bi-Weekly – Our Take on the Initial Trump Tariffs (February 18, 2025)

by the Asset Allocation Committee | PDF

While investors broadly understood that the new Trump administration would impose import tariffs as a key part of its economic policy, concrete details weren’t available until the initial tariff announcements on February 1. Even though some of those tariffs were quickly “paused,” the announcements gave us our first chance to explore how the administration intends to wield this weapon against other countries. This report provides our first take on the initial Trump tariff policies. As we show below, we think it’s still too early to gauge the impact that trade policy will have on inflation. What we can say is that the policies are likely to be disruptive for many sectors of the global economy, potentially prompting safe-haven buying in US Treasury obligations and precious metals.

In its February 1 announcement, the administration imposed 25% tariffs on most goods from Canada and Mexico, 10% tariffs on Canadian energy imports, and additional 10% tariffs on imports from China. For legal basis, the White House cited emergency economic authority based on fentanyl trafficking from those countries. Within about 48 hours, however, the administration announced a one-month pause in the tariffs against Canada and Mexico after those countries agreed to minor concessions, such as deploying more troops to their borders with the US to clamp down on illegal crossings and drug shipments. As of this writing, Beijing has made no concessions, so the tariffs on Chinese imports remain in place. At some point, the administration is also expected to impose tariffs against the European Union and potentially against multiple individual countries in Asia and beyond.

Mainstream economists tend to believe that import tariffs are inflationary, at least in the short term, because they can restrict the supply of goods to the domestic market. However, we don’t think investors should blindly assume that’s the case. For many reasons, tariffs may not put much upward pressure on prices. After all, some importers may have little market power and be unable to pass the cost of the tariffs onto their customers. In those cases, the importer would simply suffer lower profit margins. The threat of higher input prices might also discourage firms from investing, reducing overall demand in the economy and potentially offsetting price pressures. The impact on prices would likely differ across industries, depending on how quickly each industry can adjust to the tariffs. Therefore, much depends on whether the tariffs are applied broadly against all imports or targeted against specific trade partners and/or products. Finally, retaliation by the targeted trade partner has to be considered. For instance, countries hit with US tariffs might slap tariffs against US goods, thereby slowing down export growth, increasing domestic supply, and weighing on price pressures. The targeted countries might also impose retaliatory tariffs or embargos on their exports to the US, pushing up inflation.

Nevertheless, although it’s difficult to gauge the impact of tariffs or related trade barriers, the discussion above shows they can certainly be disruptive. Even the modest additional tariffs of 10% against the Chinese, which are already in place, will likely prompt reactions from businesses and consumers, and the net impact of those reactions remains unknowable. Beijing has also already retaliated by imposing tariffs on some US goods, preparing to curb shipments of certain minerals to the US, and ratcheting up regulatory scrutiny of US firms operating in China. For now, we think the main market reaction to the tariffs relates to the potential for economic disruption and uncertainty. In particular, it appears the tariffs have prompted investors to bid up safe-haven assets such as gold, silver, and longer-term bonds.

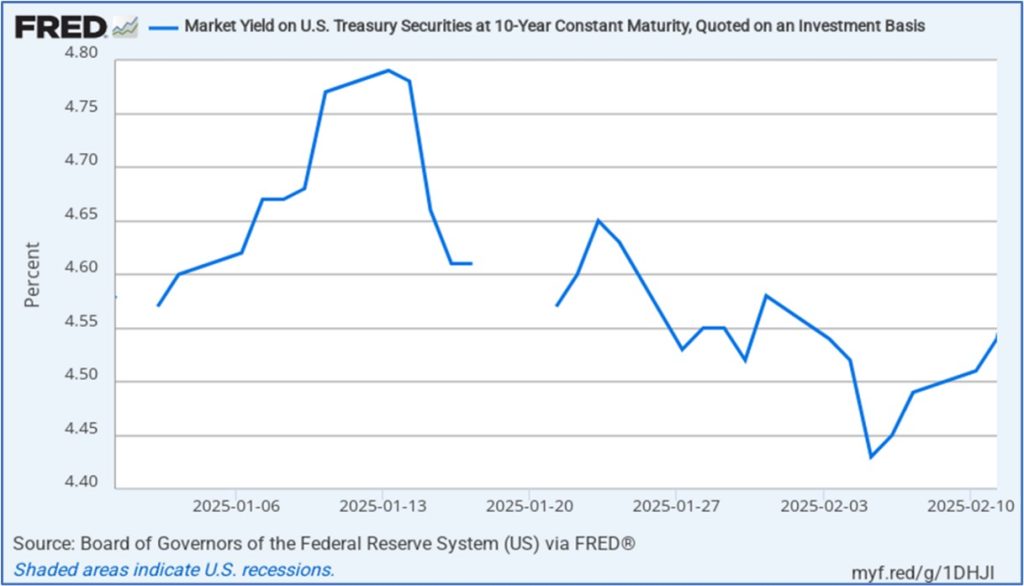

As shown in the chart below, the yield on 10-year US Treasury notes rose sharply to 4.65% over the first two days after President Trump was inaugurated, when investors were pleasantly surprised by the lack of any immediate tariff action despite the president’s earlier promises. Over the following two weeks, however, as the administration put more of its policies into place and investors could sense the possibility of economic disruptions, they bid up Treasurys, driving down yields. Once the Canadian, Mexican, and Chinese tariffs were announced at the start of February, the flight to safety intensified, pushing Treasury yields even lower to below 4.45%, although they have rebounded somewhat since then.

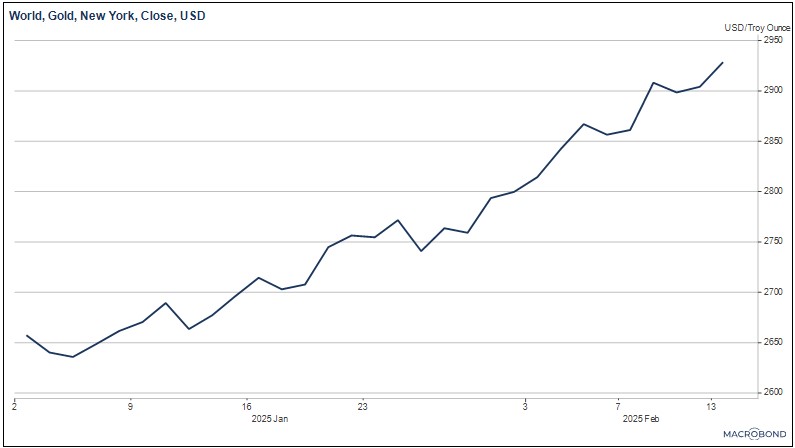

In the next chart, we show the progression of gold prices over the same period. Here, we see a pullback in gold prices in the period immediately after Trump’s inauguration, when his earliest executive orders and other policy announcements still seemed relatively tame to many investors, reducing the demand for safe-have assets. By early February, once the tariffs were announced, the general uptrend in gold prices re-accelerated, driving prices for the yellow metal to record highs above $2,900 per ounce.

As mentioned, it’s still too early to know whether Trump’s apparently neo-mercantilist economic policy and its associated tariff program will be inflationary. However, it does seem clear that investors are focused on the risk that the tariffs will drive prices higher and the potential for them to create economic disruptions. Investors are therefore bidding up traditional safe-haven assets, including longer-term Treasury obligations and gold. If and when the administration applies tariffs to the EU or other economies, we suspect longer-term Treasurys and gold could see another round of safe-haven buying. Based on technical analysis, we think the yield on the 10-year Treasury could be pushed down to its next major support level at about 4.17%, while gold could be pushed higher to its next expected resistance levels of $3,000 or $3,100 per ounce. Treasurys and gold could continue to be well bid until investors sense that the international trade environment has stabilized.