Asset Allocation Bi-Weekly – The Immigration Paradox (May 13, 2024)

by the Asset Allocation Committee | PDF

Throughout history, immigration has been a politically charged issue, creating a rift between capital and labor. Employers have advocated for looser immigration policies to fill job vacancies, particularly for positions that don’t offer high pay. Conversely, labor unions often push for stricter policies to prevent an influx of workers that could suppress wages. This long-standing divide presents a complex challenge for policymakers seeking a middle ground that satisfies both sides.

The recent surge in immigration has reignited tensions between populists and technocrats. While populists often worry about immigration’s impact on national security, technocrats highlight its potential economic benefits. Research by the nonpartisan Congressional Budget Office estimates that immigrants could contribute $7 trillion to the economy over the next decade. At the same time, there is hope that immigration could help the Federal Reserve achieve its dual mandate of price stability and full employment. According to Fed Chair Powell, the influx of new workers has allowed the country to add new jobs without triggering significant wage pressures.

The argument for allowing increased immigration has gained momentum due to the country’s ongoing shortage of relatively low-skilled workers. Household employment data reveals there has been a decline of 1.1 million workers without a college degree since March 2020. Demographics are also unfavorable. The US fertility rate has hit a record low of 1.62, significantly below the replacement rate of 2.1 children per woman. Falling birth rates have held back the supply of US-born workers. As a result, foreign workers may have accounted for most of the job growth going back to February 2020.

Nevertheless, there is a growing push for stricter immigration policies, even as additional workers are needed for the economy. A Harris Poll survey indicates that more than half of Americans favor tighter controls on illegal immigration. Interestingly, 42% of Democrats — a demographic typically associated with looser immigration restrictions — endorse such measures. This shift in public opinion briefly spurred bipartisan support for the most restrictive immigration bill in recent history. However, the legislation ultimately crumbled as politicians pushed for even stricter measures.

Despite public opposition, rising immigration has demonstrably helped the Fed limit price inflation while keeping employment high. Over the past four years, the influx of foreign workers has helped firms keep a lid on wage rates, thereby reducing cost-push inflation. The hiring of non-natives has also expanded the labor supply without boosting the unemployment rate. For example, the recent surge of foreign workers into the labor force coincided with a fall in the non-seasonally adjusted unemployment rate, from 4.2% in February to 3.9% in March.

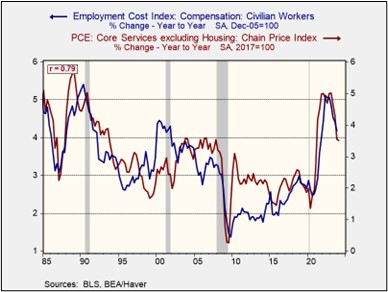

Going forward, the rising pushback against immigration may complicate the Fed’s efforts to do its job. Since one of the Fed’s preferred inflation gauges, the Core PCE index for services, is closely linked to wages, a decrease in wage growth is likely necessary in order for the Fed to achieve its inflation target in a reasonable time frame. However, strict measures to limit foreign workers could support wage growth and constrain the Fed’s ability to cut interest rates. A tighter labor market due to fewer foreign workers could put upward pressure on wages, making it harder to control inflation.

Although immigration has helped temper inflation recently, political resistance makes it an unreliable long-term solution for the Fed. Absent significant productivity gains, a more limited labor force could exacerbate inflationary pressures, which could then necessitate restrictive monetary policy to keep price pressures contained. This could lead to a period of underperformance for long-term Treasurys as investors seek higher returns to offset inflation. Of course, the labor market has historically adjusted slowly to immigration changes, so the disinflationary effects of today’s immigration will probably continue for the foreseeable future. Nevertheless, a crackdown on immigration would likely contribute to a less positive environment for bonds in the longer term.