Asset Allocation Bi-Weekly – The Inflation Adjustment for Social Security Benefits in 2023 (October 31, 2022)

by the Asset Allocation Committee | PDF

Even for dedicated, successful investors who have built up a substantial nest egg, Social Security retirement and disability investments can be an important part of one’s financial security. For many Americans, Social Security benefits may be the only significant source of income in old age. On average, Social Security benefits account for approximately 30% of elderly people’s income and more than 5% of all personal income in the U.S. One aspect of Social Security is especially important in the current period of galloping price inflation: by law, Social Security benefits are adjusted annually to account for changes in the cost of living. In this report, we discuss the Social Security cost-of-living adjustment (COLA) for 2023 and what it implies for the economy.

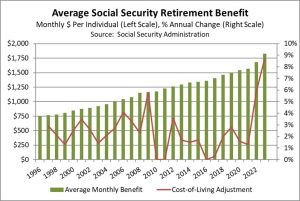

In mid-October, the Social Security Administration announced that Social Security retirement and disability benefits will jump 8.7% in 2023, bringing the average retirement benefit to an estimated $1,827 per month (see chart below). The increase, which will be the biggest since 1982, will boost the average recipient’s monthly benefit by approximately $145. The benefit’s raise was right in line with expectations, given that it is computed from a special version of the Consumer Price Index (CPI) that is widely available. The COLA process also affected some other aspects of Social Security, although not necessarily by the same 8.7% rate. For example, the maximum amount of earnings subject to the Social Security tax was hiked to $160,200, up 9.0% from the maximum of $147,000 in 2022.

Media commentators often fret that the Social Security COLA could be “eaten up” by rising prices in the following year, or that the benefit boost could provide a windfall if price increases slow down. In truth, the COLA merely aims to compensate beneficiaries for price increases over the past year. It’s designed to maintain the purchasing power of a recipient’s benefits given past price changes. Price changes in the coming year will be reflected in next year’s COLA.

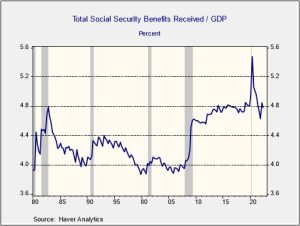

For the overall economy, the inflation-adjusted nature of Social Security benefits is particularly important. Since so many members of the huge baby boomer generation have now retired, and since more and more people are drawing disability benefits than in the past, Social Security income has become a bigger part of the economy (see chart below). In 2021, Social Security retirement and disability benefits accounted for 4.8% of the U.S. gross domestic product (GDP). Having such a large portion of the economy subject to automatic cost-of-living adjustments helps ensure that a sizeable part of demand is insulated from the ravages of inflation, albeit with some lag. In contrast, if Social Security income were fixed, a large part of the population would be seeing their purchasing power drop sharply, which could not only reduce demand but might also spark political instability. Of course, the additional benefits in 2023 will help buoy demand and keep inflation somewhat higher than it otherwise would be.

Finally, it’s important to remember that an individual’s own Social Security retirement benefit isn’t just determined by inflation. The formula for computing an individual’s starting benefit is driven, in part, by the person’s wage and salary history. Higher compensation will boost a retiree’s initial retirement benefit, which will then be adjusted via the COLA process over time. As average worker productivity increases, average wages and salaries have tended to grow faster than inflation, and as a result, the average Social Security benefit has grown much faster than the CPI. Over the last two decades, the average Social Security retirement benefit has grown at an average annual rate of 3.2%, while the CPI has risen at an average rate of just 2.3%. In summary, Social Security benefits provide an important source of growing purchasing power that helps buoy demand and corporate profits in the economy.