Asset Allocation Quarterly (Third Quarter 2024)

by the Asset Allocation Committee | PDF

- Domestic economic growth is expected to be solid on continued supply chain rearrangement, the resulting domestic industrial production, and supportive fiscal stimulus. There is no recession in our forecast.

- With the Fed remaining data-dependent regarding the fed funds rate, we believe the likelihood is diminishing for multiple rate cuts this year.

- Economic growth is likely to support credit conditions and domestic equities. Mid-cap equities offer attractive valuations and growth profiles. We have moved to an even weight in our growth/value style tilt.

- Volatility is likely to increase in economic readings as well as market movements as we head into the elections and beyond.

- We maintain the exposure to gold as a geopolitical hedge, and silver is also utilized where risk appropriate.

ECONOMIC VIEWPOINTS

Our three-year forecast period includes expectations for continued healthy economic growth, a constructive environment for risk markets, and support for all capitalizations of domestic equities. Lacking an external shock to the system, our expectations do not include a recession. Market participants have been surprised by the economic resilience despite the prolonged high level of the federal funds overnight rate. Conventional economic wisdom teaches us that rapidly tightening monetary policy should slow the credit cycle and dampen demand, pushing the economy into a contraction. Yet the economy has remained resilient.

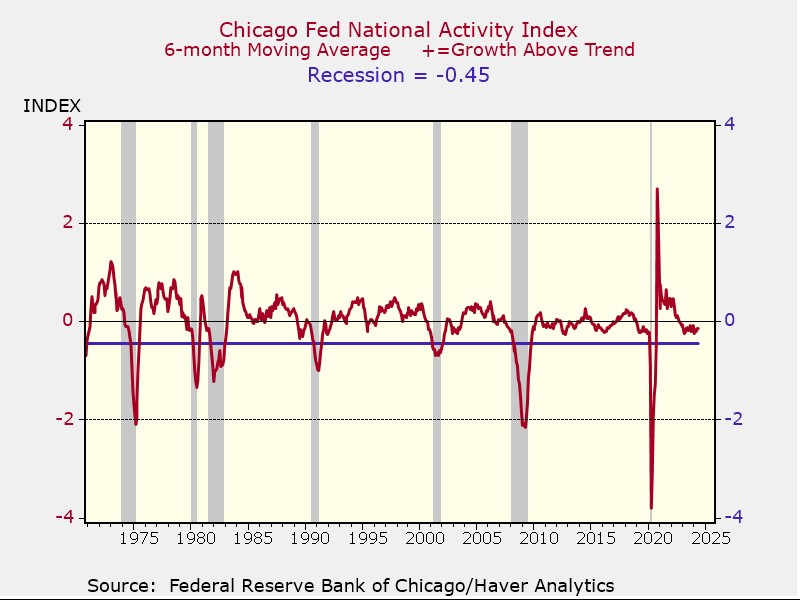

In our view, the economic resilience will persist on the back of structural changes driven by geopolitical shifts, private sector strength, and fiscal spending. Heightened geopolitical tensions and deglobalization will continue to foster a restructuring of supply chains, which is supportive for the domestic economy. At the same time, aging demographics and immigration uncertainty are likely to keep labor markets tight. These are longer-term trends which are not as sensitive to monetary policy and thus have boosted the economy. Despite the strength of aggregate economic activity, certain sectors are likely to experience pressures from high interest rates. For instance, we have already seen slowing residential construction, and higher borrowing costs are impacting smaller companies. This is confirmed by the Chicago Fed National Activity Index (shown in the first chart), which has fallen but is still well above recessionary levels.

We are expecting the private sector to remain strong in the current higher rate environment as many businesses took advantage of low rates over the past decade. Consequently, the impact of higher rates will be felt gradually as debt matures and is refinanced over the next several years. Meanwhile, the trend of reshoring continues to bolster investments in domestic capacity construction. Manufacturing capacity building is a multi-year process that will result in increased domestic manufacturing capability, buoying the economy when construction spending wanes.

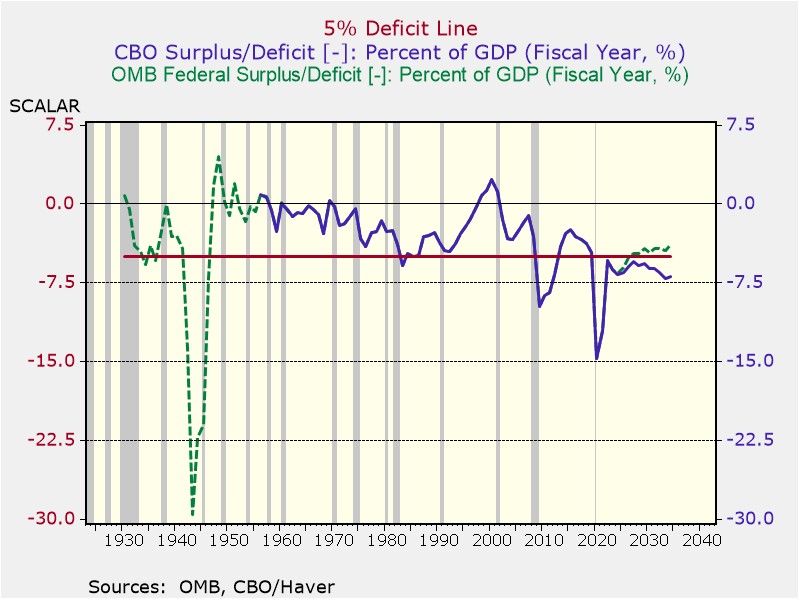

Fiscal spending is another key factor sustaining continued economic growth. This second chart shows the government deficit, which has largely expanded due to non-discretionary spending. Due to the non-discretionary nature of the increase and political gridlock, deficit spending is likely to continue in the near term which should support corporations as well as consumers. We note that, with the exception of the 1945 recession, the economy has never slipped into an official downturn when the fiscal deficit has been 5% or more of GDP.

We are likely to see inflation volatility in the near and medium term. In the medium to long term, due to structural reasons, inflation is likely to remain higher than we have generally experienced over the past decade. We expect the monetary policy response to be well-telegraphed and data-dependent. If inflation moves closer to the 2% target, the Fed could ease before year-end. Although we are now in the midst of the US election season, our expectation is that Fed policymakers will continue to be agnostic regarding the party in power among the branches of government and rely on economic data to guide them in their monetary policy decisions regarding the target fed funds rate and changes to the balance sheet.

STOCK MARKET OUTLOOK

Our outlook calls for solid domestic economic growth during the forecast period. Economic growth leads to demand and healthy margins, which benefit earnings, and also bolsters investor sentiment and valuations. This environment is typically supportive of risk assets and will generally be positive for all capitalizations. The mid-cap space, in particular, offers attractive valuations and therefore we continue to overweight US mid-cap equities. However, current higher interest rates do not equally affect all capitalizations. Small capitalization equities hold a larger proportion of floating rate debt, thus higher rates affect them disproportionately. Although we reduced our exposure to small caps slightly this quarter, we still find valuations attractive. To mitigate concerns about high interest rates affecting some small caps, we introduced a quality factor position, which screens for indicators such as profitability, leverage, and free cash flow.

While we remain cautious about the concentration risk in a handful of prominent growth equities, we believe economic conditions will support growth stocks, in general. Furthermore, the shift to passive investing should continue to spur growth stocks as long as the economy remains healthy. As a result, we shifted our growth/value style bias to even-weight.

We maintain an overweight position in the Energy sector and Uranium Miners due to geopolitical tensions in the Middle East and sustainable energy transition policies. Additionally, we maintain our exposure to the military-industrial complex through investments in military hardware and cyber-defense.

International developed equities remain attractive due to valuation discounts. Many large global market leaders in the developed world ETF are trading at lower valuations relative to domestic large cap companies. We maintain our country-specific exposure to Japan due to ongoing shareholder-friendly reforms and continued capital inflows, which could potentially lead to multiple expansion.

BOND MARKET OUTLOOK

According to a 2018 report by the San Francisco Fed, since 1955 the two-to-10-year segment inverted six to 36 months before the onset of each of the last six recessions. Though the bond market recently marked 24 months since the two-to-10-year portion of the Treasury curve inverted (the longest streak on record), many are now questioning the validity of whether it still serves as a harbinger for recession. With the Fed remaining data-dependent regarding the fed funds rate, the likelihood is diminishing for multiple rate cuts this year. As a result, the yield curve has the potential to remain inverted for an extended period. Underscoring this potential is our expectation regarding heightened inflation volatility throughout the forecast period. Note that we are not expecting the absolute level of inflation to necessarily remain elevated, rather the volatility of the measure from one period to the next. Finally, the net issuance of Treasurys to finance the federal deficit, and notable declines in the proportion of Treasurys held by foreign central banks, indicates growing risk on the long end of the curve, which we find to be uncompensated. Consequently, our positioning is geared to intermediate-term maturities, which we find hold the most allure due to modest stability of rates and resultant limits to market risk.

Among sectors, mortgage-backed securities (MBS) are attractive. Most fixed-rate MBS prices are now well below par, which help address prepayment risk; at the same time, refinancing trends are low enough to limit incremental extension risk. In addition, the Fed’s intentions to dampen its MBS runoff from its $7.3 trillion balance sheet should also help limit spread widening.

Investment-grade corporate bonds are currently trading at relatively tight spreads of +93 basis points to Treasurys, lessening their appeal. Therefore, we find little reason to overweight investment-grade corporates in the strategies with an income component. Speculative grade corporates, however, still offer an attractive spread of +325 basis points. The backstop programs put in place over the past few years by the Fed and US Treasury, notably during COVID and the Silicon Valley Bank run, provide an implied element of support for lesser-rated bonds during crises. Nevertheless, caution dictates our preference for the higher BB-rated bonds in this asset class.

OTHER MARKETS

The position of gold within the commodities asset class is retained as a hedge against elevated geopolitical risks. Gold also presents an opportunity given increased price-insensitive purchasing by international central banks. As in quarters past, we note that international central banks are increasingly positioning gold as a reserve asset in fear of continued weaponization of the US dollar. In the more risk-tolerant portfolios, silver is maintained as an additional precious metal holding. As has been the case for over three years, real estate remains absent in all strategies as demand remains in flux and REITs continue to face a difficult financing environment.