Asset Allocation Weekly (April 8, 2016)

by Asset Allocation Committee

One of our key investment decisions in terms of asset allocation has been to avoid emerging markets. There are primarily two reasons for this call.

First, as the U.S. pulls back from its superpower position, the emerging world, which tends to be more dependent on exports for economic development, faces two significant risks.

- Their geopolitical position becomes more tenuous because the U.S. is less likely to “keep the peace” in the world.

- The American role of providing the reserve currency and acting as a consumer of last resort for emerging economy exports is at risk. Since the end of WWII, export promotion has been the most successful economic development model. This model only works if there is an importer of last resort. By providing the reserve currency, the U.S. has played that role. If America stops acting as the primary purchaser of exports, the export promotion model collapses.

Second, a stronger dollar weighs on the relative performance of emerging markets to a dollar-based investor. Again, there are two reasons for this outcome.

- Many emerging market economies are commodity producers and a strong dollar tends to dampen demand for commodities because they are priced in dollars. A stronger dollar raises the price of commodities for all non-dollar consumers, thus lowering total demand.

- Emerging economies often borrow in dollars because the interest rate is lower. As long as the dollar doesn’t appreciate, the debt service cost on these dollar loans is lower. However, a stronger dollar will tend to lift debt service costs which hurt emerging economy growth and raise the risk of financial problems.

The dollar has been strengthening since 2014 due to the divergence of monetary policy between the Federal Reserve (Fed) and other central banks. The Fed was very aggressive in easing after the 2008-09 recession, not only keeping rates at zero but implementing three rounds of quantitative easing. The other major central banks tended to lag U.S. efforts. However, in late 2013, the Fed began to taper its additions to the balance sheet and last December the FOMC raised rates for the first time since 2006. This change in policy, coincident with other central banks becoming more aggressive in their policy accommodation, led to a stronger dollar.

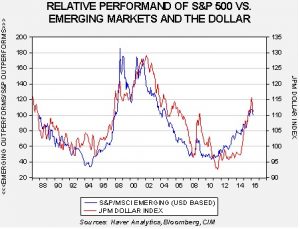

This chart shows the relative index performance of the S&P and the MSCI Emerging Market Index. When the blue line on the chart is rising, the S&P 500 is outperforming emerging markets and vice versa. The JPM dollar index is directly correlated with the relative performance of these equity indices at the 86% level. As we noted above, a stronger dollar tends to weigh on emerging market equity performance.

Interestingly, the dollar fell sharply last month. There is growing evidence that Fed Chairwoman Yellen is keeping policy easier than the Phillips Curve would justify; one of the factors she seems to be targeting is the dollar. It is clear that the strong dollar has weighed on net exports and the industrial sector, pressuring U.S. economic growth lower. If the Fed decides to guide the dollar lower, emerging markets will look more attractive.

The key issue for our investment committee is whether these trends are durable enough for a cyclical allocation. The longer term outlook for emerging markets is still problematic if America’s foreign policy trends remain in place. That will be part of our decision process in upcoming allocation meetings.