Asset Allocation Weekly (December 21, 2018)

by Asset Allocation Committee

(N.B. This is the last Asset Allocation Weekly for 2018. Have a Merry Christmas and Happy New Year. The next report will be published January 4, 2019.)

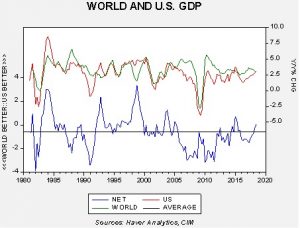

The U.S. economy is performing in line with the rest of the world.

This chart shows the yearly change in U.S. and world ex-U.S. GDP. The lower line on the chart shows the difference. On average, U.S. growth is usually 0.61% lower than world growth and the world exceeds U.S. growth 70% of the time (with data since 1981). This situation isn’t a huge surprise; the U.S. is the world’s largest economy and smaller economies can grow faster more easily. The lower line shows that U.S. growth has been gaining on world growth for the past two years.

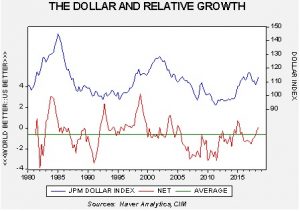

The net number does coincide with dollar cycles.

When the growth differential is below average (implying stronger world growth relative to the U.S.), the JPM dollar index averages 107.21. When growth exceeds average, the index averages 113.14. We are projecting slower growth in the U.S. next year, around 2.7%, which is essentially average growth. If world growth also holds near average, around 3.3%, it would be reasonable to expect the dollar to weaken from current levels. The U.S. growth surge in 2015 led to a strengthening dollar and this year’s rally was partly due to the lift in U.S. growth due to fiscal stimulus. As that wanes, relative growth should favor the world, which will support a softer greenback. In general, a weaker dollar will tend to support commodities and foreign equities, especially emerging markets. We expect those assets to perform better in 2019.